GlobalData has revealed top 10 financial advisers in oil and gas sector by value and volume for 2021 in its report.

GlobalData, a leading data and analytics company, has revealed its global league tables for top 10 financial advisers in oil and gas sector by value and volume for 2021 in its report, ‘Global and Oil & Gas M&A Report Financial Adviser League Tables 2021’.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to GlobalData’s M&A report, a total of 1,799 merger and acquisition (M&A) deals were announced in the sector during 2021, while deal value for the sector increased by 16.4% from $287.9bn in 2020 to $335bn in 2021.

Top advisers by value and volume

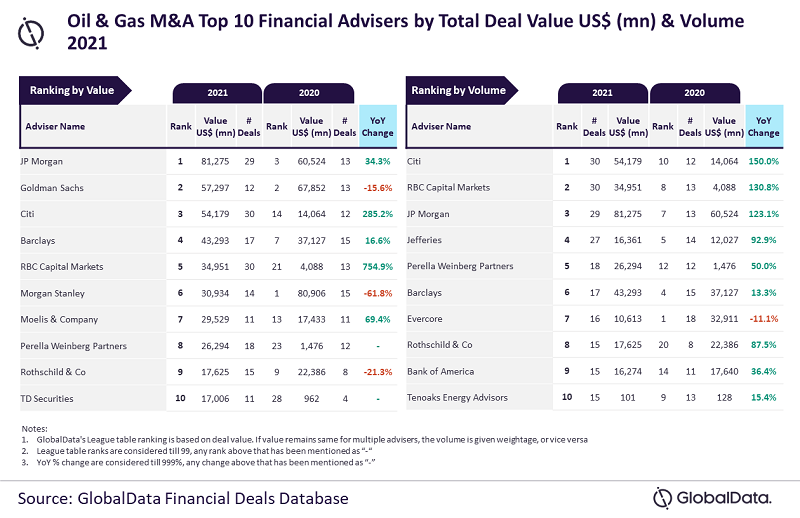

JP Morgan and Citi were the top M&A financial advisers in the oil & gas sector for 2021 by value and volume, respectively.

JP Morgan advised on 29 deals worth $81.3bn, while Citi advised on 30 deals worth $54.2bn.

GlobalData lead analyst Aurojyoti Bose said: “JP Morgan was the only adviser to surpass $80 billion in deal value during 2021, thereby outpacing its peers by a significant margin in terms of value. It also gave strong competition in terms of volume and was just short of one deal for the top spot by this metric.

“Meanwhile, Citi and RBC Capital Markets were the only two firms to touch the 30 deal volume mark during 2021. Citi advised on fewer big ticket deals due to which it also secured the third position by value. Interestingly, JP Morgan also occupied the third position by volume.”

Goldman Sachs took the second position in terms of value, with 12 deals worth $57.3bn, followed by Citi. Barclays occupied the fourth position by value, with 17 deals worth $43.3bn, followed by RBC Capital Markets, with 30 deals worth $35bn.

RBC Capital Markets secured the second position in terms of volume, followed by JP Morgan. Jefferies got the fourth position by volume, with 27 deals worth $16.4bn, followed by Perella Weinberg Partners, with 18 deals worth $26.3bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.