Global Polycarbonate capacity is poised to see considerable growth over the next five years, potentially increasing from 6.10Mtpa in 2020 to 9.28Mtpa in 2025, registering total growth of 52%.

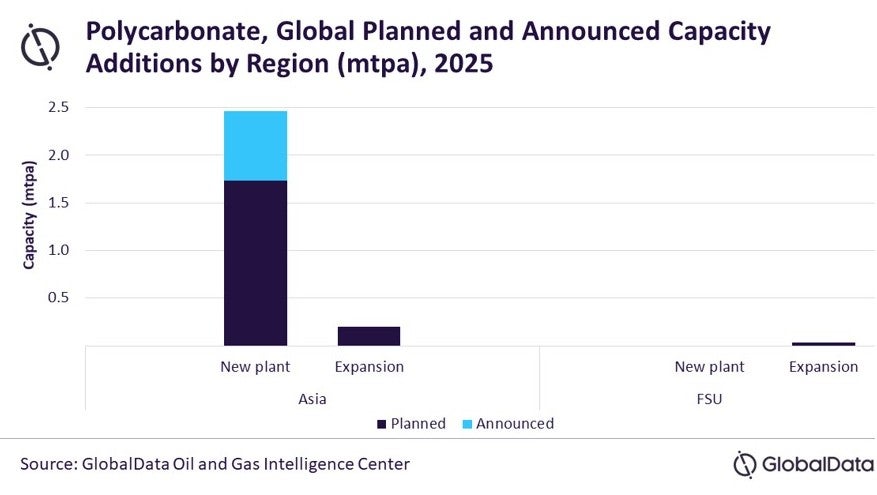

GlobalData’s latest report, ‘Global Polycarbonate Industry Outlook to 2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants,’ states that around 13 planned and announced plants are slated to come online primarily in Asia, followed by the Former Soviet Union.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWithin Asia, China has 11 planned and announced polycarbonate capacity additions, with a total capacity of about 1.93Mtpa by 2025. The country is expected to spend a capital expenditure (CAPEX) of $1.64bn. The majority of capacity additions are from the Shenma Industrial Company Kaifeng Polycarbonate Plant and the Shenma Industrial Company Pingdingshan Polycarbonate Plant, with a capacity of 0.40Mtpa each. They are expected to commence production of Polycarbonate in 2022. The former Soviet Union has two planned and announced projects and major capacity additions will be from the Kazanorgsintez Kazan Polycarbonate Plant. The CAPEX for the plant is $0.06bn by 2025.

Shenma Industrial Co Ltd, Reliance Industries Ltd and Covestro AG will be the top three companies globally in terms of planned and announced capacity additions over the upcoming years.

Related Company Profiles

Covestro AG

Reliance Industries Ltd

Shenma Industrial Co Ltd