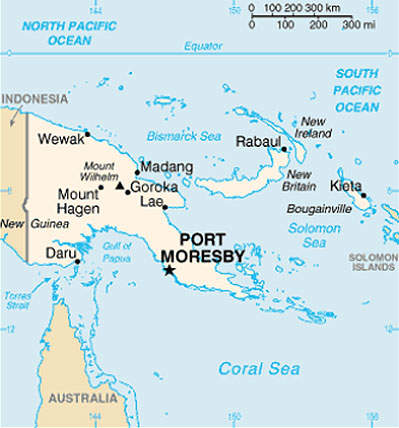

The Papua New Guinea liquefied natural gas (PNG LNG) project is a new gas project championed by ExxonMobil, to realise the potential of three large gas discoveries in the southern and western highlands of the country. The integrated project includes gas production, processing and liquefaction facilities, as well as offshore and onshore pipelines.

The new gas discoveries are the Hides, Angore and Juha gas fields, which are likely to have reserves approaching three to four trillion cubic feet. The three fields supply gas for the Asian market via a pipeline to a two-train LNG facility constructed at Napa Napa, near Port Moresby.

The project was underpinned by InterOil’s Elk / Antelope field infrastructure (not yet fully proven). The facility is supplied using a 36in (910mm) natural gas pipeline.

It is believed there could be a further two trillion cubic feet of gas, or 400 million barrels of oil equivalent, waiting to be discovered in Papua New Guinea (PNG), which could require a phase two development of a third LNG train in the future.

LNG cargoes started in April 2014. The PNG LNG project has a lifespan of approximately 30 years (until 2043). It is estimated to produce nine trillion cubic feet of gas.

In October 2009, the environmental impact assessment report on the LNG project submitted by ExxonMobil was approved by the PNG Government. The approval paved way for the clearance of final environmental management plan required to begin construction. Construction of the plant began in April 2011 and the plant became operational in April 2014.

The construction of online and offshore pipelines was temporarily suspended in January 2012, due to a massive landslide near the project site.

PNG liquefied natural gas (LNG) facilities

The project is based around a two-train LNG liquefaction facility based near Port Moresby and capable of producing 6.6 million tons (Mt) of LNG a year.

ACIL Tasman was contracted to prepare reports on the environmental impact and also the economic impact of the project for PNG.

InterOil completed the pre-front-end engineering and design (FEED) preliminary engineering and evaluation design work for the project in April 2007. The dual-train facility was constructed adjacent to the InterOil refinery at Port Moresby in the Gulf of Papua, to share infrastructure. The FEED work for the project was awarded to Bechtel in March 2008, with an option to continue the project into the EPC phase.

The plant uses ConocoPhillips technology (used by more than 50% of LNG plants worldwide). Their proprietary natural gas liquefaction technology, which is based on the optimised cascade (SM) process are central to the two trains. FEED was started in early 2009 (establishing environmental considerations to meet the equator principles, equipment required, cost estimates and preliminary long-lead time equipment enquiries).

The LNG facility has a 2.3km trestle for loading tankers, two 125,000m³ LNG storage tanks, LPG recovery systems and two 50,000-barrel condensate storage tanks.

It is supplied by a 716km gas pipeline, 417km of which is subsea and 36in (Kopi on the coast is 450km from Port Moresby), while the onshore 265km section is 32in.

The pipeline links to the Hides gas conditioning plant (906 million cubic feet a day) and the Juha production facility (250 million cubic feet a day). Between the Juha and Hides facility there is a 14in gas pipeline and an 8in liquids pipeline for condensate.

Condensate is being handled at the existing Kutubu and Agogo processing plant and exported from the existing Kumul platform on the coast (the gas produced as a by-product from these facilities is returned to the LNG pipeline).

The LNG project is led by Liquid Niugini Gas, who are a group of experts assembled by project partners InterOil, Merrill Lynch Global Commodities (Europe) and Pacific LNG.

The project partners signed an agreement, in November 2009, for the supply of 2MT of LNG annually to Unipec Asia, a subsidiary of Sinopec. The Tokyo Electric Power Company, Osaka Gas Company and Chinese Petroleum Corporation are the other customers.

Contractors involved with Papua New Guinea’s gas project

ExxonMobil subsidiary Esso Highlands awarded a contract to build the liquefaction plant to engineering and construction company Clough Curtain JV (CCJV) in June 2009.

In September 2010, CCJV received work orders for the upstream infrastructure of the project. In February 2011, CCJV received another work contract worth A$209m for the upstream infrastructure.

In December 2009, the Chiyoda-JGC joint venture (CJJV) between JGC Corporation and Chiyoda Corporation was awarded the engineering, procurement and construction contract for the PNG LNG Project. Daewoo E&C was the sub-contractor to CJJV and responsible for the construction of the process facilities.

In August 2010, BAM Clough joint venture was awarded a A$314m contract for building the condensate and LNG offloading jetty in the Gulf of Papua for the PNG LNG project.

Finances and shareholdings of ExxonMobil’s PNG LNG project

The project initially required an estimated investment of $9.5bn over the 30-year lifetime of the project. The project cost was reassessed and declared in late 2009. The development of the Hides, Juha and Angore gas fields, together with a pipeline to the coast, may cost $5bn, while the LNG plant could cost $4.5bn.

Financial closure for the project was achieved in 2010 and the sovereign funds were not affected by the US subprime financial crisis. The initial phase of the project was expected to involve an investment of $100m.

In October 2009, the project cost for phase one of construction of facilities was announced to be around $19bn. The cost escalation occurred due to increased provision for contingency and $600m as pre-start-up capitalised operating cost, along with other revised expenses. The final investment decision along with FEED was announced at the end of 2009.

The project’s main shareholder is ExxonMobil (Esso Highlands is the operator) at 33.2%. The project’s other shareholders include: Australian oil and gas producer Oil Search (29%), Santos (13.5%), Nippon Oil (4.7%), National Petroleum Company PNG (PNG Government – 16.6%), Mineral Resource Development Corporation / State (MRDC) (2.8%) – the land owners and Petromin PNG Holdings (0.2%).

PNG’s Government retained the right to take a 22.5% stake in the Hides, Angore and Juha gas fields.

A joint operating agreement was signed between the government and the project consortium in March 2008 prior to the FEED work of the project starting. PNG’s Parliament investigated the due diligence of the project since opposition MPs expressed doubts that PNG would benefit significantly from the project if it ties into protected price contracts.

Liquid Niugini Gas worked closely with the government on the project since March 2006. The deal closed in late 2008 and construction work began in 2009.

Exxon Mobil Corporation subsidiary Esso Highlands raised funds and worked towards a final investment decision in Q4 2009, with a corresponding first LNG cargo in 2014.

By the fiscal stability agreement the country guaranteed the fiscal stability of the project. Executed in April 2009, the fiscal stability agreement is between PNG and project co-venturers. It includes applicability and rates of taxes, duties, fees and other fiscal imposts payable by the project.

Construction involving newly discovered Hides, Angore and Juha gas fields

The preparation works at the plant site and development of road and other infrastructure had started in 2009. The plant structure required 2,000kg of steel. The workforce at the site included more than 1,100 people.

The construction of a 292km-long onshore pipeline was commenced by August 2011. The laying of offshore pipeline began in October 2011. The 407km-long pipeline from Omati in the Gulf Province to the LNG Plant was laid by two pipe laying vessels, Semac 1 and Castoro 10.