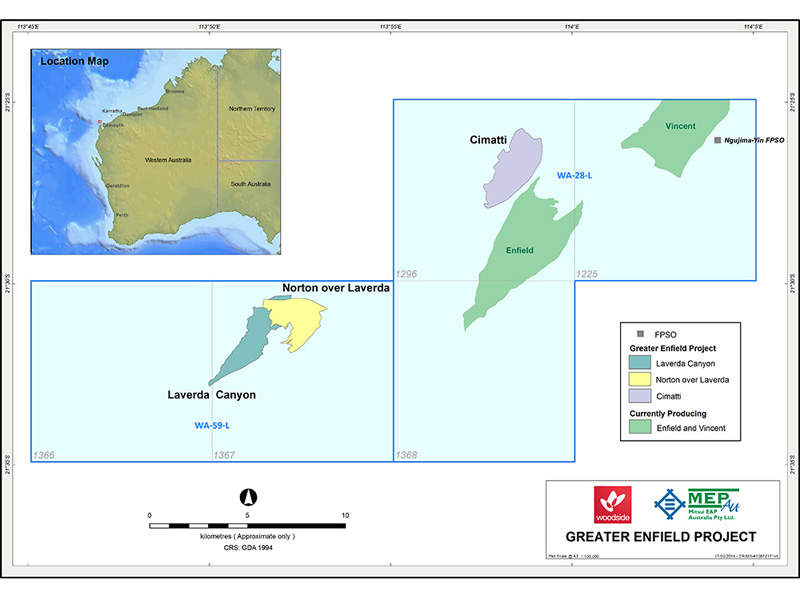

The Greater Enfield Development (GED) Project involves the development of the Laverda Canyon, Norton over Laverda, and Cimatti (WA-28-L) oil accumulations in Australia. The former two accumulations are situated within the production licence WA-59-L, whereas the latter is situated within the production licence WA-28-L.

The fields are located within the offshore Carnarvon Basin, approximately 60km north-west of Exmouth, Western Australia. The Laverda accumulations are situated at a water depth of 550m, whereas the Cimatti accumulation is situated at a water depth of 850m.

The project is owned by the joint venture of Woodside Energy (60%) and Mitsui E&P Australia (40%). Woodside Energy is the operator for the project.

The final investment decision (FID) for the project was made in June 2016 and the first production is anticipated in mid-2019. The overall investment in the project is estimated to be $1.9bn.

Discovery and appraisal of the Greater Enfield fields

The Laverda field was discovered in 2000, whereas the Cimatti field was discovered in 2010. The Laverda field was first appraised in 2011 by drilling the Laverda North-1 well at a water depth of 809m and to a total depth of 2,282m. It was further successfully appraised by drilling the Laverda North-2 well to a total depth of 2,300m, which discovered a gross interval of 18m of new oil-bearing sands.

Another appraisal well, the Norton-1, was drilled in February 2012 at a water depth of 782m and to a total depth of 1,718m. It encountered oil and gas and confirmed the easterly extension of the oil-bearing sands discovered by the Laverda North-2 appraisal well.

The Cimatti field was discovered in November 2010 by drilling the Cimatti-1 well at a water depth of 547m and to a total depth of 2,424m. It intersected a gross oil column of 15m.

The field was appraised in the same month through the drilling of the Cimatti-2 well at a water depth of 547m, and to a total depth of 2,460m. The well intersected 7m-thick oil-bearing sand.

Reserves of the Western Australian oil field

The project is estimated to hold proven and probable (2P) reserves of 69 million barrels oil equivalent (MMboe).

The oil produced from the project is expected to be marketed through Mitsui’s wholly-owned subsidiary, Mitsui & Co. Energy Trading Singapore.

Greater Enfield development details

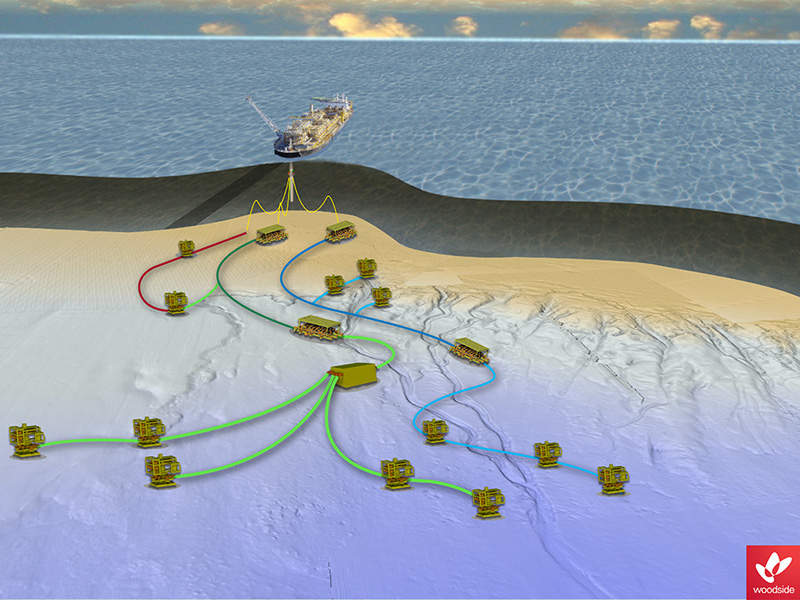

The project will involve the development of six subsea production wells and six water injection wells integrating subsea multi-phase booster pumps. The wells will be tied back to the Ngujima-Yin floating production storage and offloading (FPSO) vessel, which is located within the neighbouring Vincent Field in Production Licence WA-28-L, via a 31km-long subsea pipeline.

The FPSO’s topsides, hull and turret will also be modified to accommodate the capacity from the new fields.

Details of the Ngujima-Yin FPSO

The Ngujima-Yin FPSO is connected to the seabed, at a water depth of approximately 340m, using a disconnectable turret mooring system.

Commissioned in 2008, the FPSO has an oil processing capacity of 120,000 barrels per day (bpd) and is equipped with accommodation, water treatment facilities and a helipad.

Contractors involved with Woodside’s oil field development project

The front end engineering and design (FEED) study for the project’s subsea production system and the subsea multiphase booster pumps was performed by OneSubsea, whereas the FEED study for the subsea tie-back system was performed by Aibel Singapore.

The Norton-1 well was drilled deploying the Ocean America semi-submersible drilling rig, with support provided by the Lady Caroline and Far Strait supply vessels.