The Buffalo oil field redevelopment project will tap recoverable oil reserves of Buffalo field, offshore Timor-Leste in the Bonaparte Basin in Western Australia’s sector of Timor Sea.

The redevelopment project will be operated by Carnarvon Petroleum, which will hold 50%-75% of the equity interest in the field. The remaining equity interest will be acquired by Advance Energy, according to an agreement signed with Carnarvon in December 2020.

The project will be implemented by the partners through a joint venture, under the TL-SOT 19-14 production sharing contract (PSC).

Geology and reserves of Buffalo oil field

The Buffalo oil field has the world-class Buffalo reservoir, which contains light premium oil with an API of 53°. The reservoir is present below the shallow region of the Big Bank that is surrounded by a deeper water region of approximately 255m to 350m.

The state-of-the-art seismic survey of the field has determined the presence of unproduced oil, particularly in the undrilled attic of the reservoir immediately south and east of the previous production area.

The Buffalo oil field has been estimated to contain a recoverable resource of 31.1 million barrels of light premium oil and 3C resource of 47.8 million barrels of oil. The presence of highly productive reservoir in shallow water region makes the project advantageous with low drilling and development costs and rapid payback.

Buffalo oil field redevelopment project background

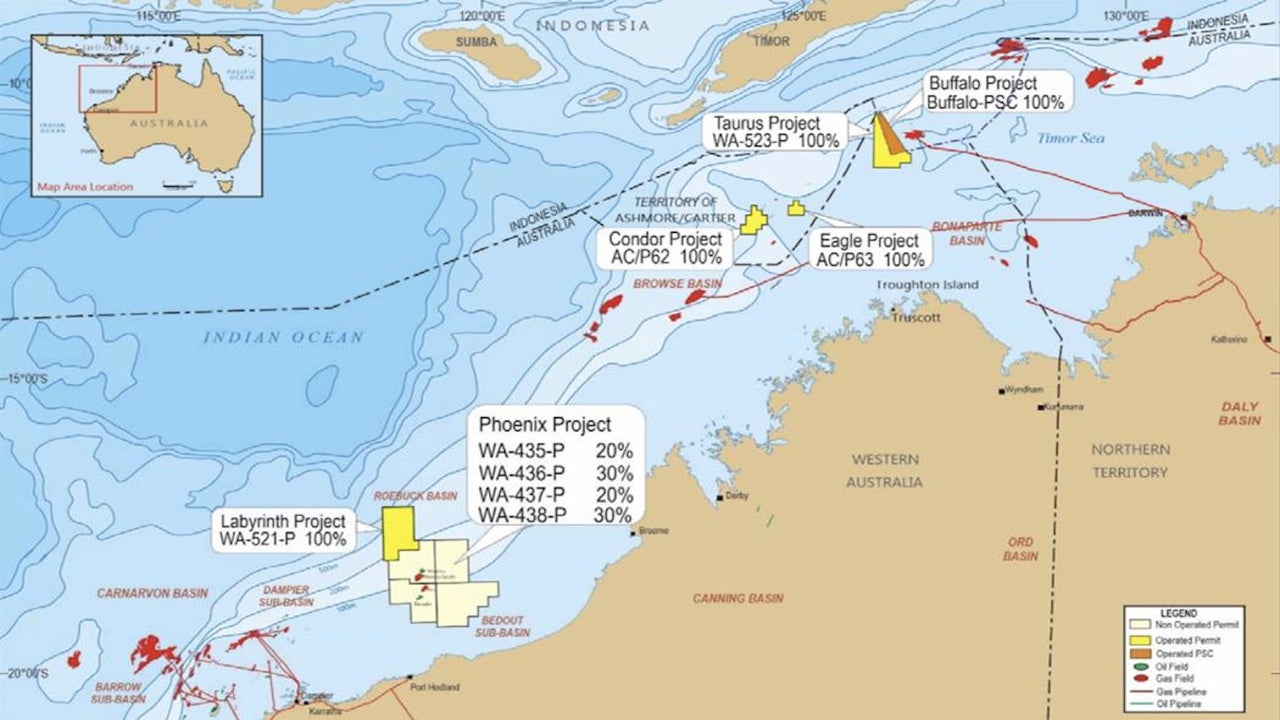

Carnarvon acquired the WA-523-P exploration permit, containing the previously developed Buffalo field in May 2016, covering an area of 4,246.4km².

The Buffalo field was discovered by BHP with the drilling of the Buffalo-1 well in 1996 and was developed with four wells (Buffalo-3, Buffalo-5, Buffalo-7, and Buffalo-9) drilled from a small, unmanned wellhead platform installed in 25m deep water. The platform was tied back to floating production storage and offloading (FPSO).

In December 1999, first oil from the field came onstream at a production rate of approximately 50,000stb/d. The field produced 20.5MMstb of highly undersaturated, light oil from the Jurassic-age Elang Formation before its termination in November 2004.

In 2005, the field was decommissioned due to low oil prices and limited capability of seismic processing to optimise well locations.

All the developed facilities and wells were decommissioned and removed before the WA-523-P permit was awarded to Carnarvon.

The seismic data of the field were reprocessed with the DUG supercomputer, using the advanced full-waveform inversion technology that identified the presence of unproduced oil in 2017.

Carnarvon signed the PSC over the Buffalo field and adjoining areas in September 2019 as a maritime boundary treaty (MBT) signed by the governments of Australia and Timor-Leste in March 2018 affected the WA-523-P permit. The PSC cleared the path towards the drilling and redevelopment project.

Buffalo oil field redevelopment details

The Buffalo oil field will be redeveloped with the drilling of Buffalo-10 well, which is expected to have a 60m-long oil column.

The Buffalo-10 well will be completed as a production well, which will be developed either with a wellhead platform connected to the FPSO vessel or with a mobile operating production unit (MOPU) connected to FPSO.

Carnarvon also plans to drill up to two additional production wells optionally as part of the redevelopment project.

The requisite environmental approvals for drilling Buffalo-10 well have been obtained by the operator. The operating systems and procedures for the development have been prepared. A Dili office has been established in Timor-Leste, and staffs have been recruited in Timor-Leste for the project.

The drilling of the Buffalo-10 well is expected to begin in the second half of 2021 with first oil targeted for 2023. Further development of the well with front end engineering and design (FEED) work and final investment decision (FID) is expected in 2022.

Financing

The drilling of Buffalo-10 well will require an estimated investment of approximately $20m, which will be funded by Advance Energy.

Carnarvon and Advance aim to source development funding from third-party lenders.

Advance will also provide an interest-free loan to meet the additional funding requirements.

Contractors involved

Petrofac finalised the operating systems and processes for the project.

Carnarvon plans to award the drilling contract for the Buffalo-10 well to Drilling Management Services Company (DMSC).