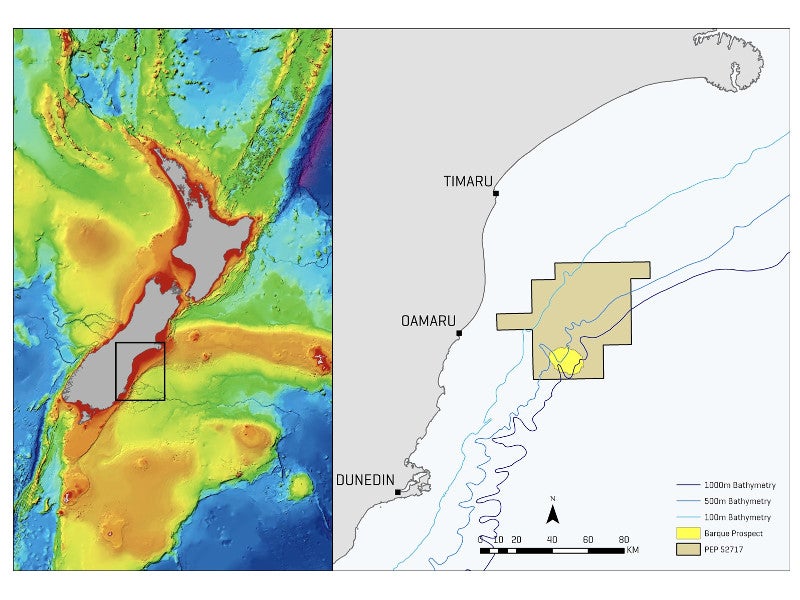

Barque is an undrilled offshore oil and gas prospect located in the Clipper permit (PEP 52717) within the Canterbury Basin, approximately 60km east of Oamaru, offshore New Zealand.

New Zealand Oil & Gas (NZOG) is the operator, holding a 50% stake in the Clipper permit, while Beach Energy holds the remaining interest.

The joint venture completed an economic impact study (EIS) for the prospect in 2017, with co-funding from the New Zealand Trade & Enterprise. The EIS predicted that the Barque prospect has a resource base of more than five trillion cubic feet (tcf) of gas and light oil.

NZOG is currently in discussions with potential farm-in partners for the development of the field. The Energy and Resources Minister of New Zealand has allowed the JV to determine a well commitment for the prospect by April 2022, from an earlier deadline of April 2019.

Barque prospect location and geology

The Barque prospect is located in 800m of water, approximately 60km from the Galleon-1 well, which was drilled in 1985. The Clipper permit extends over an area of 2,601km².

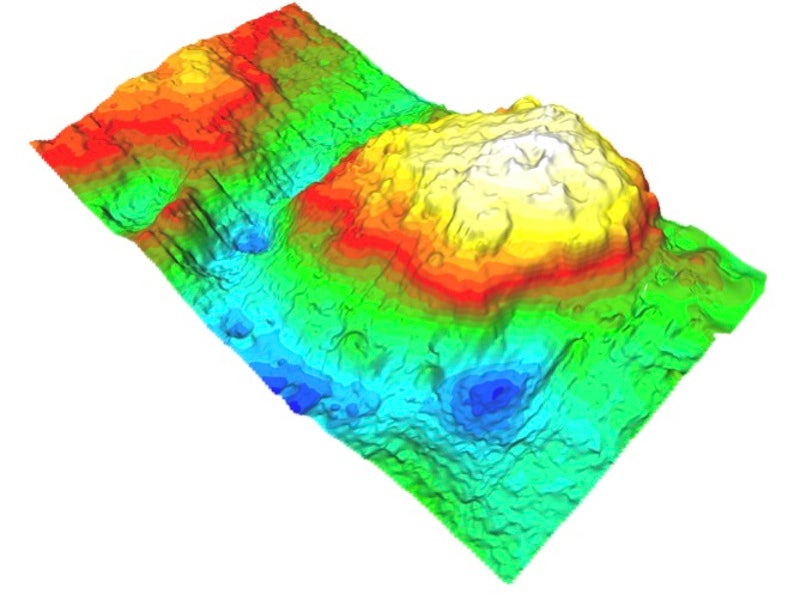

The prospect is identified as a large cretaceous structural trap of approximately 150km², with target formations located between 2,500m and 3,000m below mean sea level.

Appraisal and development plans for the Barque prospect

The joint venture of NZOG and Beach completed reprocessing of 1,250km of vintage 2D seismic data in 2013 and acquired approximately 650km² of high-quality 3D seismic data.

The seismic data identified three target reservoirs in the prospect, namely Barque Fm (primary), Herbert Sandstone and Intra Paleogene 3.

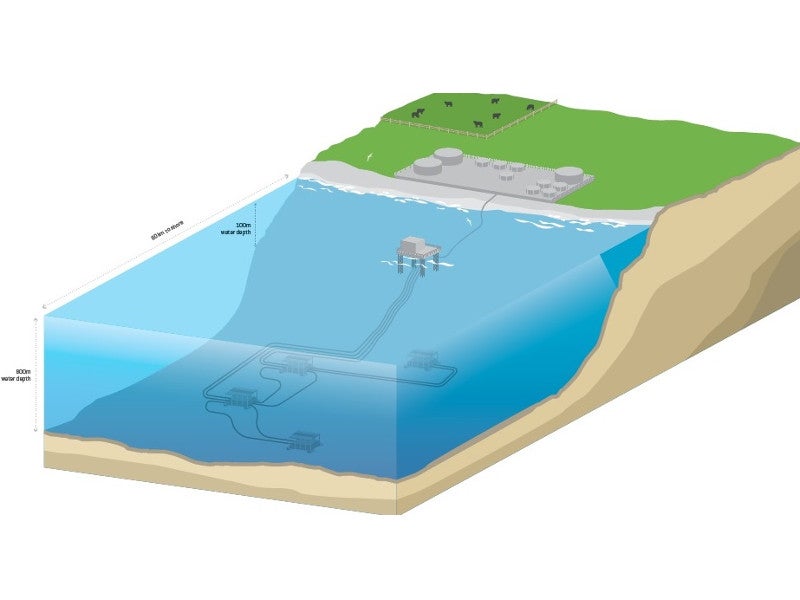

Two scenarios have been identified for the development of the field, offshore and gas-to-shore. The development plans will be finalised upon drilling the discovery well.

Barque prospect’s offshore development scenario

The offshore scenario calls for the extraction of fluids through ten production wells, as well as processing on an offshore vessel for direct export to markets. Condensate from the fluids will be separated, while the gas is proposed to be re-injected into the reservoir.

Offshore operations, expected to be started in 2025, would extract approximately 460 million metric barrels of oil (Mmbo) through the field’s life of 35 years. Onshore activities are limited to servicing and maintenance under the scenario, which also proposes to extract the recycled gas in future.

Barque prospect gas-to-shore development scenario

The gas-to-shore scenario proposes the extraction of gas, oil and liquefied petroleum gas (LPG) from 14 production wells, as well as transport to the shore through pipes. The scenario involves the conversion of gas to methanol, fertiliser (urea), LNG and industrial thermal/electricity, starting from 2025.

Extracted oil will be exported directly, while LPG will either be exported or sold domestically. The absence of an established gas market in the South Island means the local industry would develop and transform the South Canterbury/Otago region under the gas-to-shore scenario.

Supply of gas produced at Barque prospect

Gas from the prospect will be supplied to two proposed methanol plants, each with a capacity of approximately 1.7 million metric tonnes per annum (Mmtpa), and a 650,000tpa capacity fertiliser plant.

Methanex and Coogee Energy will own the methanol plants, while Ravensdown will develop the fertiliser plant.

Fonterra, a dairy company, also expressed interest to off-take gas from the project, with the intention of switching its operations from coal to gas.

Contractors involved

MartinJenkins was awarded the contract to prepare the economic impact analysis for the Barque prospect, while Aoraki Development was engaged as the lead local agent of the project on behalf of the stakeholders.