Australia-based oil and gas company Woodside Energy is looking to sell its stake in mature offshore assets, reported The Australian Financial Review.

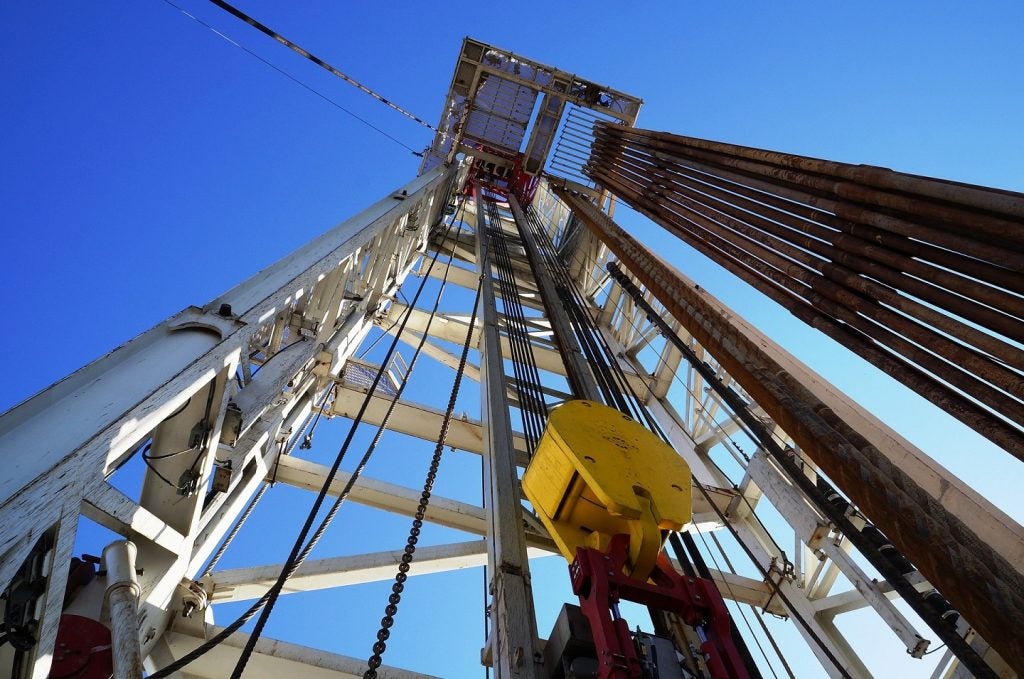

Specifically, the energy company is looking to sell Macedon and Pyrenees oil and gas assets offshore Western Australia.

The assets up for sale have 75 million barrels of oil equivalent in reserve and are located in the rich Carnarvon Basin.

They produce 29,000 barrels per day net to Woodside, the report said.

With gas making up 82% of the portfolio's balance reserves and liquids forming the remaining 18%, production is anticipated to continue into the mid-2030s.

As per the report, Woodside has appointed Morgan Stanley to divest its stake as part of efforts to streamline its portfolio following the acquisition of BHP’s petroleum unit.

The Morgan Stanley flyer estimates that during the five years from 2023 to 2027, cash flows from the portfolio will average A$232.2m ($150m) a year.

The portfolio consists of the Macedon local gas venture and the Pyrenees oil operations.

Santos and Japanese company Inpex are Woodside's partners in the ventures.

“Woodside continuously reviews its portfolio of assets to ensure ongoing alignment with strategy and value for our shareholders,” a Woodside representative told the publication without elaborating.

The assets up for sale, which include offshore licences, related pipeline and production infrastructure, and an onshore gas plant, are described as a "portfolio of stable cash flow generating assets" in the Morgan Stanley flyer.

According to the flyer, the assets have been in operation for more than ten years and include "attractive end markets and strategically located infrastructure."

Earlier this week, Woodside reported a 6% rise in its first-half net profit after tax and a 66% surge in production.