Woodside Energy has secured field development plan (FDP) approval from Mexican regulator Comision Nacional de Hidrocarburos for the proposed $7.2bn (A$11bn) Trion ultra-deepwater oil project in the Gulf of Mexico.

Woodside owns a 60% stake and Mexican state-owned oil company Pemex Exploración y Producción holds the remaining stake.

The partners made the final investment decision on the offshore oil project in June 2023.

Production from the project is scheduled to commence in 2028. It aims to develop estimated oil and gas resources of 479 million barrels of oil equivalent (mboe).

Woodside CEO Meg O’Neill said: “This milestone allows us to fully progress into execution-phase activities with our contractors.

“We look forward to working with Pemex and our other stakeholders in Mexico to deliver this important project.”

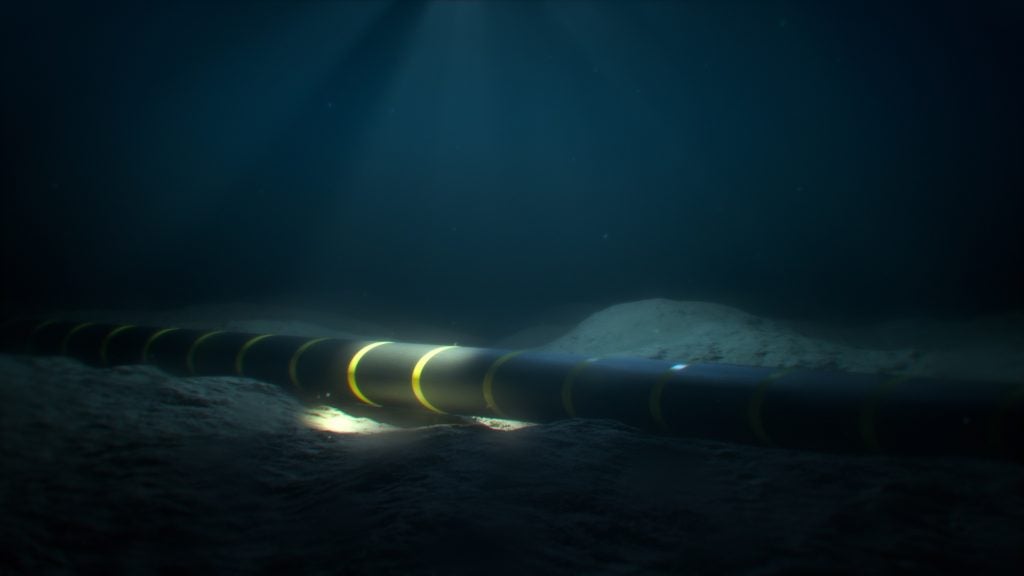

The Trion oil field is due to be developed with an in-field floating production unit (FPU) with an oil production capacity of 100,000 barrels per day.

The FPU will be connected to a floating storage and offloading vessel, which will have 950,000 barrels of oil capacity.

In a press statement, Woodside said: “Following the approval of the FDP, Woodside has booked proved undeveloped reserves of 324.7mboe gross (194.8mboe Woodside share) and proved plus probable undeveloped reserves of 478.7mboe gross (287.2mboe Woodside share).”

Initially, the project involves drilling 18 wells, of which nine will serve as producers, seven as water injectors and two as gas injectors.

A total of 24 wells are due to be drilled at the field throughout its operational life.

However, environmental organisations and activist investors have been opposing Woodside over climate ambitions.

Activist-investor group Market Forces acting CEO Will van de Pol was quoted by Reuters as saying: "Woodside is failing to feel enough pressure from financiers and investors, developing a new deep water oil field while it enjoys the financial backing of (major banks) and almost every major Australian superannuation fund.”