In addition to other key elections this year, the UK is preparing for a general election on 4 July, allowing citizens to choose their prime minister.

Any change in administration is likely to heavily influence the energy sector, as well as the revenues and tax requirements of companies operating within it.

A recent YouGov survey predicted that Labour, currently the official opposition, will likely win a majority of 200 seats, while the Conservative party are expected to see their number of MPs drop to their lowest-ever figure, possibly below 100, after having won 365 seats under Boris Johnson in 2019.

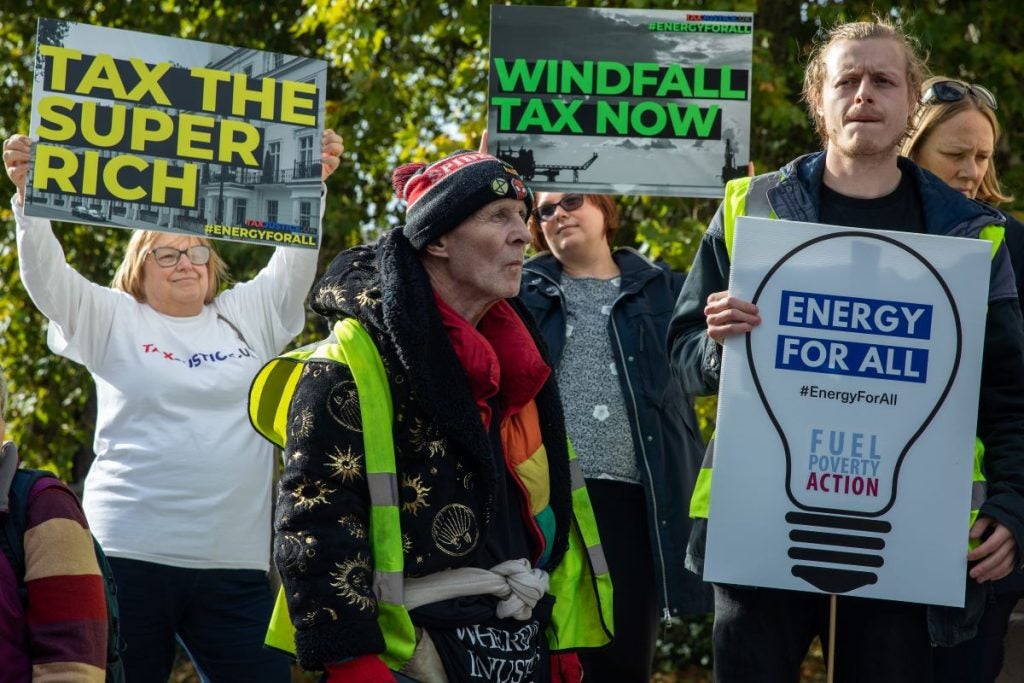

What is a windfall tax?

A windfall tax is money taken by a government from firms that have profited from a windfall, such as a sudden or unexpected rise in earnings, but based on something for which they were not wholly responsible.

For example, energy companies saw a significant rise in profits due to higher demand following the lifting of Covid restrictions. And energy prices, particularly for natural gas, jumped after Russia’s invasion of Ukraine in 2022.

Offshore Technology asked Will Richardson, the founder of environmental management consultancy Green Element, why these companies are not switching more quickly to renewables, and continue to profit from oil and gas.

His answer was that companies “can make so many profitable subsidies.”

Richardson, speaking at London’s climate action conference Reset Connect in late June, added that while the government needs to implement regulations and policies, companies should do an “awful lot more” to make things happen in the fight against climate change, and help ensure lower prices for consumers.

According to Richardson, when it comes to keeping big energy firms accountable, the current government has “left it on to the next government, and then the next government” to make decisions.

The parties’ manifestos and windfall tax pledges

Conservatives: The UK government introduced the ‘Energy Profits Levy’ policy in May 2022 to address the soaring energy prices caused by Russia’s war on Ukraine, which resulted in oil and gas companies making “extraordinary” profits.

The UK raised the levy rate from 25% to 35%, bringing the sector's headline tax to 75% and extending the duration of the levy to ensure energy firms “pay their fair share of tax.”

If re-elected, the government plans to keep this policy in place until 2028-29 unless energy prices fall back to “normal sooner”.

The manifesto provided no more specific details on windfall taxes but said that the party would maintain the investment allowances that provide incentives for companies to invest in the North Sea – which Labour has said they would remove.

Labour: The manifesto promises £7.4bn of tax rises for more public spending, including a pledge to levy VAT to widen the windfall tax on oil and gas companies.

Labour promise to extend the Energy Profits Levy until the end of the next parliament, increasing the levy rate by three percentage points and removing investment allowances, as well as retaining the Energy Security Investment Mechanism (a promise to remove the tax if oil prices fall significantly).

However, Labour's intention to "end loopholes" to raise an extra £5 billion a year has caused concern among energy companies, as they fear that the party might revoke essential allowances supporting long-term domestic production investments.

The party has also mentioned a ‘Green Prosperity Plan’ that will be funded in part by a time-limited windfall tax on the oil and gas giants making record profits, with the rest of the funding coming from responsible borrowing to invest within Labour’s fiscal rules – which the party hopes will leverage higher private investment and boost economic growth.

Additionally, the party revealed that if elected, it would increase a windfall tax on North Sea oil and gas profits to 78% and remove “the unjustifiably generous investment allowances” that companies can use to reduce their tax take.

Greens: The Green Party said they will not increase the main corporation tax rates further.

Rather, they advocate for windfall taxes where there is evidence that market distortions create risk-free additional profits.

Initially, the levy on energy companies’ windfall profits will be retained, and another will be applied to banks following interest rate rises. The party claims this could raise £9bn a year by the end of parliament.

Liberal Democrats: The party promises to help people with the cost-of-living issues and their energy bills by implementing a “proper, one-off” windfall tax on the super-profits of oil and gas producers and traders.

Likely election outcomes and state of the industry

According to YouGov's predictions, Labour are expected to comfortably win the 2024 vote next week.

A fresh MRP poll published towards the end of June forecasted Labour winning a record-breaking majority, with a total collapse for the Conservatives.

Labour will take over 500 seats, with the Conservatives taking 53, said the MRP poll. MRP is a statistical modelling technique combining a large poll with other sources of information.

The oil and gas sector is still a significant part of the UK economy, valued at £20bn annually and supporting 200,000 jobs throughout its supply chain, including 90,000 jobs in Scotland.

This industry fulfils nearly half of the UK's fossil fuel requirements, with over 70% of the domestic energy usage still coming from fossil fuels, primarily oil and gas. This a fall from over 80% in 2012.

The ability to balance environmental goals with support for oil and gas employees demonstrates the difficulties the party will face should it take office.

However, according to sources within the Labour Party, it also indicates that the current opposition has managed to present its energy plans as a key component of a broader economic proposal to gain voter support.