UK oil and gas company Tullow Oil (Tullow) has signed an agreement to sell its assets in Guyana to Eco Guyana Oil and Gas (Barbados) (Eco Guyana).

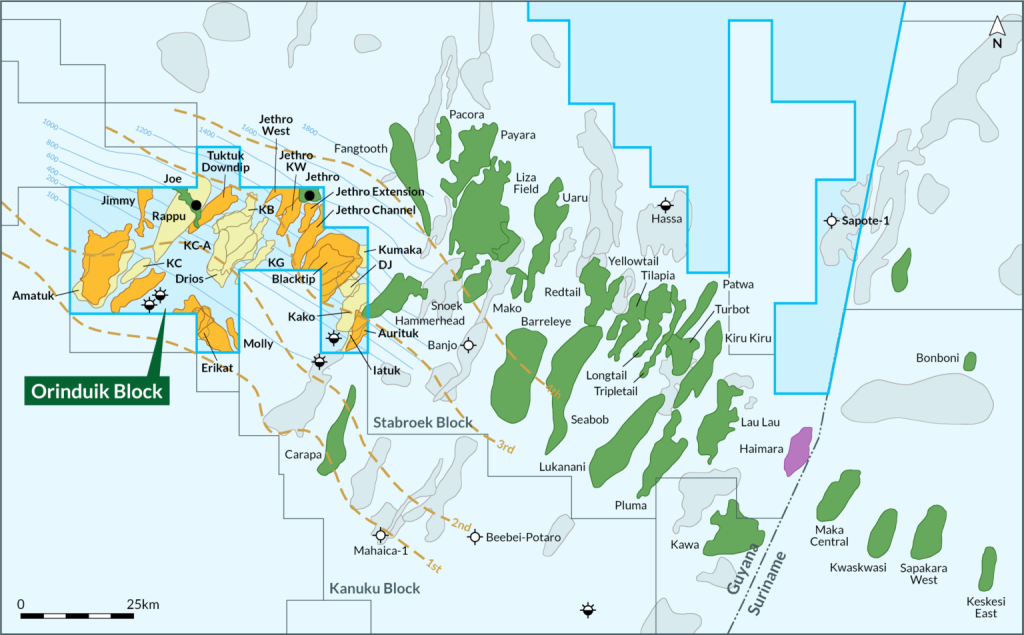

As per the deal, Eco Guyana, a subsidiary of Eco (Atlantic) Oil & Gas (Eco Atlantic), will buy the entire stake in Tullow Guyana, which owns Tullow’s 60% operating stake in the Orinduik Block, offshore Guyana.

Tullow said the divesture is part of its strategy to focus on its high-return production assets in Africa and infrastructure-driven exploration near producing centres.

Tullow drilled two exploration wells at the Orinduik licence in 2019 but failed to discover a commercially viable amount of oil there.

As per the terms of the agreement, the transaction includes an upfront payment of $700,000 (£551,187) in cash to Tullow.

Contingent considerations include $4m in case of a commercial discovery, $10m once the Guyanan Government issues a production licence and royalties on upcoming productions.

Tullow Oil director exploration, non-operated assets and decommissioning Jean-Medard Madama said: "This transaction is in line with our strategy to optimise our portfolio through opportunities to unlock value from our emerging basin licences, whilst focusing our capital expenditure on our high return producing assets and growth opportunities around existing infrastructure."

For Eco Atlantic, the agreement will enable it to explore hydrocarbons in some of the world's most productive petroleum basins.

Currently, Eco Guyana holds a 15% stake in the Orinduik licence, and upon completion of the deal will become the operator of the block with a 75% stake.

The remaining 25% stake in the block is held by TQAP Guyana.

Now, Eco Atlantic aims to take charge of the exploration effort and focus on its plan to onboard new partners to join the licence and actively participate in drilling.

The transaction is expected to close in the second half of this year.

Eco Atlantic president and CEO Gil Holzman said: "We will proactively engage in a farm-out process for this highly prospective licence and begin preparations to drill a well testing the cretaceous, where all light oil discoveries have been made in the adjacent Stabroek Block."