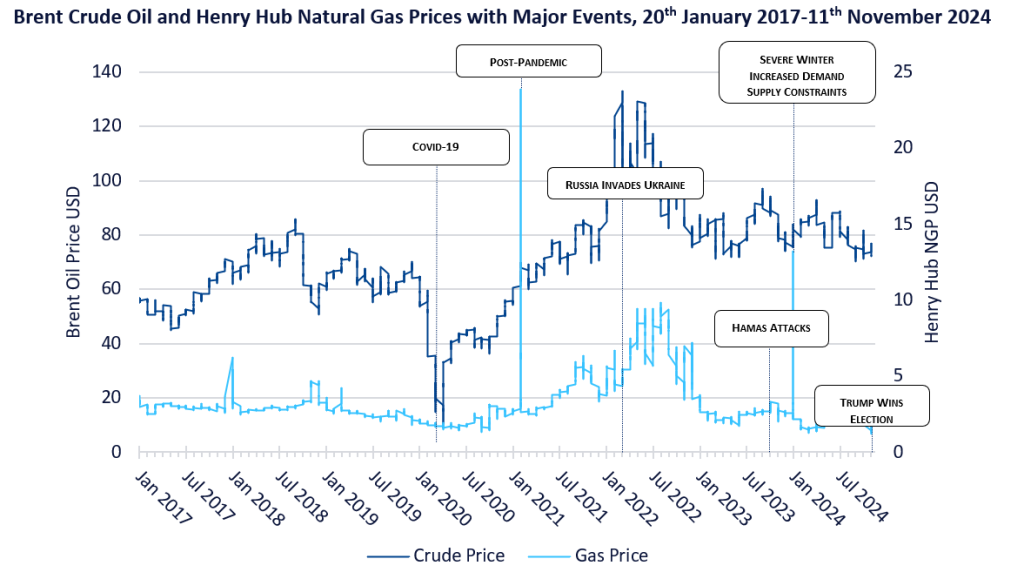

In just over 60 days, President Trump will once again occupy the White House. The US, OPEC, and Russia are leading the world into suspense and cliff-hanging anticipation of market volatility. With oil prices prone to geopolitical headwinds, it may become a more turbulent ride as Trump’s policies pass through both chambers of the federal legislature in early 2025.

America First, Again

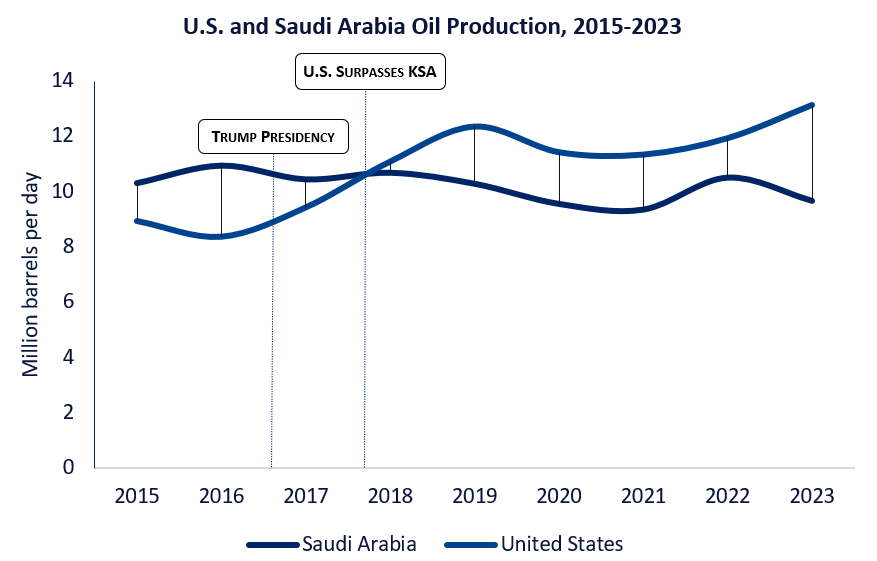

As Trump entered office for his first term as President in 2017, the US pipped Saudi Arabia as the world’s largest crude oil producer, with outputs peaking at 13 million barrels per day. He tore down environmental regulations, opened federal lands to drilling and promoted US shale and LNG exports as a priority during his first term in office. And his position has not changed.

Come January, he will prioritise domestic fossil fuel production, this time intensifying even further. There is much anticipation for renewed support to the oil and gas industry and a cold shoulder for renewables from within his administration. Still, Trump’s unilateralism on energy matters may heighten geopolitical difficulties, especially with Russia and OPEC.

Russian Roulette

Trump claims he and Putin have an understanding, and that Putin takes him much more seriously than those who have challenged him for office. Although Trump placed sanctions on Nord Stream 2 construction, pushing back against Russian ambitions in Europe, he openly admitted to developing a personal diplomatic relationship with the Kremlin boss. Whilst diplomacy can be beneficial, his views on Russia have often muddied the waters on the stance of the US.

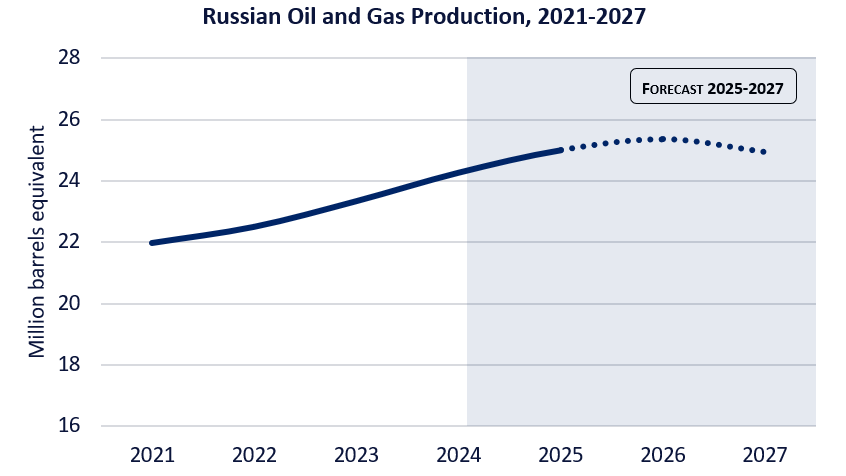

Trump likely also knows tightening sanctions on Moscow will only lead to reduced global supply and higher energy prices. Though leniency toward Russia risks alienating allies in Europe and seeing a resurgence of Russia’s energy dominance. Regardless, uncertainty creates volatile markets which is evident in current conditions.

Since Russia’s invasion of Ukraine, the G7 and EU set a price cap on Russian energy at $60 per barrel. The cap's main aim is to limit Russia’s earnings from oil exports and maintain market stability, however, reports suggest Russian oil has been trading above this price. This has led to a reduction of Russian revenue from oil exports, but exports to countries that are not participating in sanctions, and shadow fleet tankers, cause challenges for the West. Production rates largely stabilised, with the demand for cheap energy extending across many markets. Openly, India and Hungary have admitted to buying Russian energy, and investigations revealed that Turkish refineries are acting as middlemen to re-export Russia’s energy to others, including Western allies.

Trump’s proposed solution to the conflict prompts many questions. Should Trump be able to broker a quick peace deal between Russia and Ukraine, would he quickly loosen the sanctions on Russia? And what will that mean for EU-US relations, and for European gas supply?

OPEC: ally or adversary?

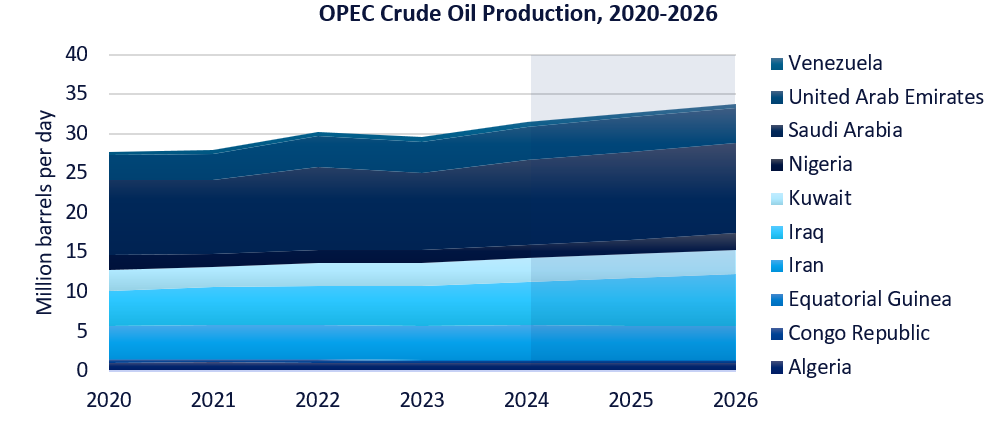

At the height of Covid in 2020, both Russia and Saudi Arabia engaged in a price war, and Trump intervened and brokered an agreement to cut production by 9.7 million barrels per day, and threatened import tariffs on both Russia and Saudi Arabia to protect domestic US producers. His own desire for cheaper fuel prices for US consumers often puts him at odds with OPEC’s market strategy for stabilisation through production cuts.

In response to Trump’s policies and actions, OPEC+ kept supply tight, pushing up prices. It also did not help that the de facto leader of Saudi Arabia, Mohammed bin Salman refused to take calls from Biden to loosen up supply and increase production. Trump will see this as an opportunity to apply pressure on Saudi Arabia to increase production in January 2025 and beyond.

While OPEC has gradually increased its production, it is nowhere near levels that significantly reduce the cost of oil globally. So, while Trump may be willing to play hardball with OPEC if talks break down regarding production agreements, it may be counterproductive and have unwanted effects.

The next four winters

Brent crude prices are already sensitive to supply dynamics, and sanctions on Russia and price caps so far, have curbed oil revenues with limited impact on supply. This is subject to change, should Trump pursue a settlement to the Ukraine conflict. If Trump then decides to lift sanctions, a large volume of Russian crude oil and natural gas into Western markets would put downward pressure on prices. On the other hand, continued sanctions would heighten supply shortages and drive peak winter prices for energy.

Cold winters globally may further cause supply issues of natural gas and oil, pushing demand up for gas, and maintaining fluctuating prices in energy markets. At the same time, mild winters could increase the prospect of oversupply, particularly if U.S. shale production is increased in response to Trump’s energy ambitions.

Starting at around $20 during the Covid-19 pandemic in 2020, to more than $100 in 2021 after economies started opening post-pandemic, Brent crude prices have been decreasing, and JP Morgan has indicated they expect prices to start stabilising in 2025.

As Trump prepares for this second term in the oval office, his policies and choices will indicate what is to come next for the global energy market.