Three major Greek shipping companies have now completely ceased transporting Russian oil in a bid to avoid US sanctions that are now being imposed.

Greek shippers Minerva Marine, Thenamaris and TMS Tankers have all stopped moving Russian oil from Europe to other continents. Until October, all three companies were actively shipping Russian crude oil and oil products. Since then, they have been gradually scaling-down their involvement, shipping data shows.

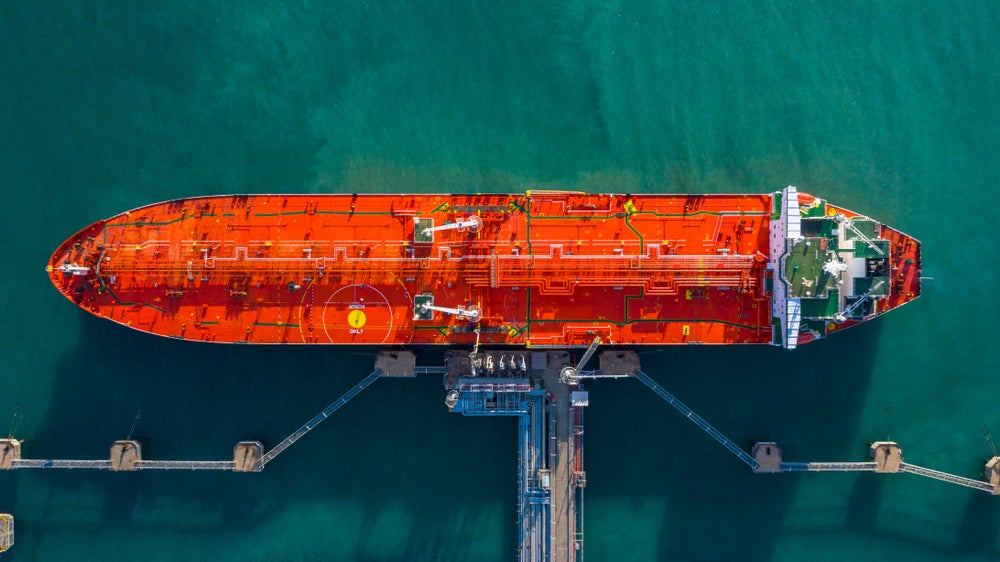

The three companies operate more than 100 oil tankers with the capacity to move almost all of the exports from Russia’s European ports of Primorsk, Ust-Luga and Novorossiisk. This amounts to approximately ten million tonnes of oil per month or 2.4 million barrels per day.

The move limits the number of shipping companies ready to transport Russian oil to consumers across Asia, Africa and South America, although traders told Reuters that Moscow still has enough companies willing to ship its products.

In the middle of October, the US imposed its first sanctions on two companies, one Turkish and the other from the United Arab Emirates (UAE), for buying Russian oil above the $60 per barrel-imposed price cap. UAE-based Lumber Marine transported oil priced above $75 per barrel, while Turkey’s Ice Pearl Navigation carried oil sold at more than $80 per barrel. The price cap, originally imposed by G7 countries last year, is an attempt to limit Russian profits from its oil business amid its ongoing invasion of Ukraine. Last week, the US imposed further sanctions on three more companies based in the UAE.

Russian oil has been trading above the $60 cap since July as the OPEC+ group of exporters continue to cut production.

Profits have soared for shipping companies that have continued to transport Russia’s oil. Freight rates for transportation routes have sometimes leapt as high as $15m per tanker, principally because shippers are charging more for the increased capital risk brought by sanctions.

Russia is now relying on its own shipping company, Sovcomflot, to carry much of its supply. Moscow also works with many smaller companies registered in the UAE, India, Hong Kong, Seychelles, Ghana and other locations, according to traders and shipping data.