Recent contract activity around FSRUs is signalling that the terminals, which witnessed a boom during the 2022 energy crisis in Europe, continue to be a popular option for countries looking to expand their import infrastructure for LNG regasification.

The number of FSRU projects increased by 30% in 2022, reflecting the West’s pivot away from Russian gas and towards LNG. FSRUs sit just off a nation’s shore and regasify LNG delivered by cargo. In the wake of the energy crisis caused by the Russia-Ukraine war, they have seen increased interest due to their implicit flexibility and the relatively short time it takes to bring them online.

French energy giant TotalEnergies says it takes half the time to build an FSRU compared with onshore regasification units, and, according to Wärtsilä, for installation with a deployment period of up to three years, the capital investment required is smaller.

As a flexible component of LNG import infrastructure, FSRUs can help meet the energy security needs for countries, both in the developed world and emerging economies. Some countries use FSRUs as a backup energy source in the transition to renewables, while others rely on them to meet seasonal spikes in demand, such as increased power use for air conditioning in the summer.

Russian gas disruption boosts demand for FSRUs

Contract activity for FSRUs in the past two years indicates they were sought after following Russia’s full-scale invasion of Ukraine. The number of new projects globally jumped by 30% in 2022 compared with 2021, with 16 out of the 17 projects announced being in Europe, according to data collated by GlobalData, Offshore Technology’s parent company.

“The recent surge in FSRU requirement in Europe, a significant natural gas demand region, was driven by a geopolitical conflict involving a gas-rich country [Russia] and a gas-consuming region,” says Raj Shekhar, oil and gas analyst at GlobalData.

“This required a readjustment of gas supplies, from piped gas from Russia to LNG, which forced European countries to develop import infrastructure for LNG regasification. FSRUs were favoured so that Europe could import LNG from the US and Qatar. This led to a surge in FSRU projects in 2022, both in terms of number and capacity.”

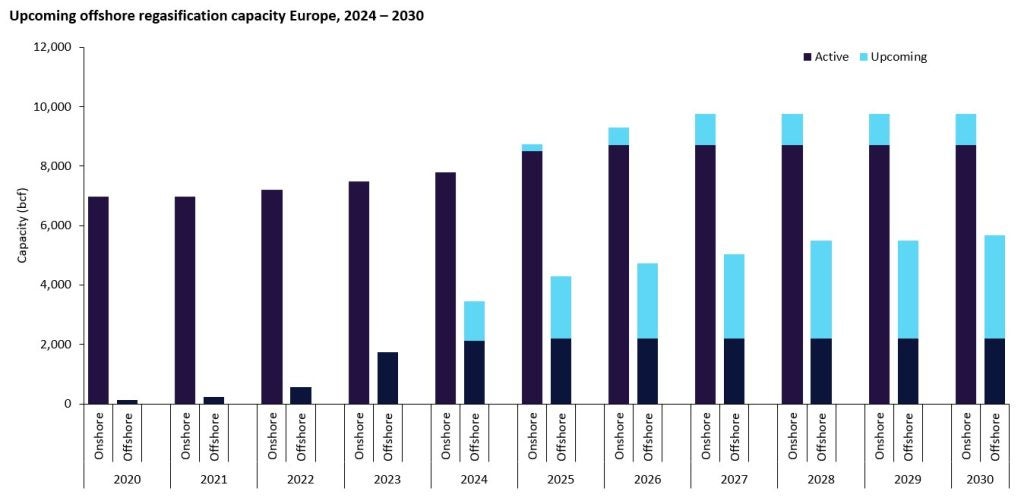

Despite the uptick, there were only six new FSRU projects announced in 2023, with only one of them in Europe. However, GlobalData is tracking a significant increase in offshore regasification terminals coming online by 2028. Markets in the Global South are also looking to FSRUs as a cost-effective option to improve regional energy security and transition away from more polluting fuels such as coal.

“In the medium to long term,” Shekhar says, “an overall reasonable growth can be expected in this sector aligned with natural gas growth as a whole, especially in the developing parts of the world like South and South East Asia and Latin America.”

Europe’s growing demand for regasification capacity

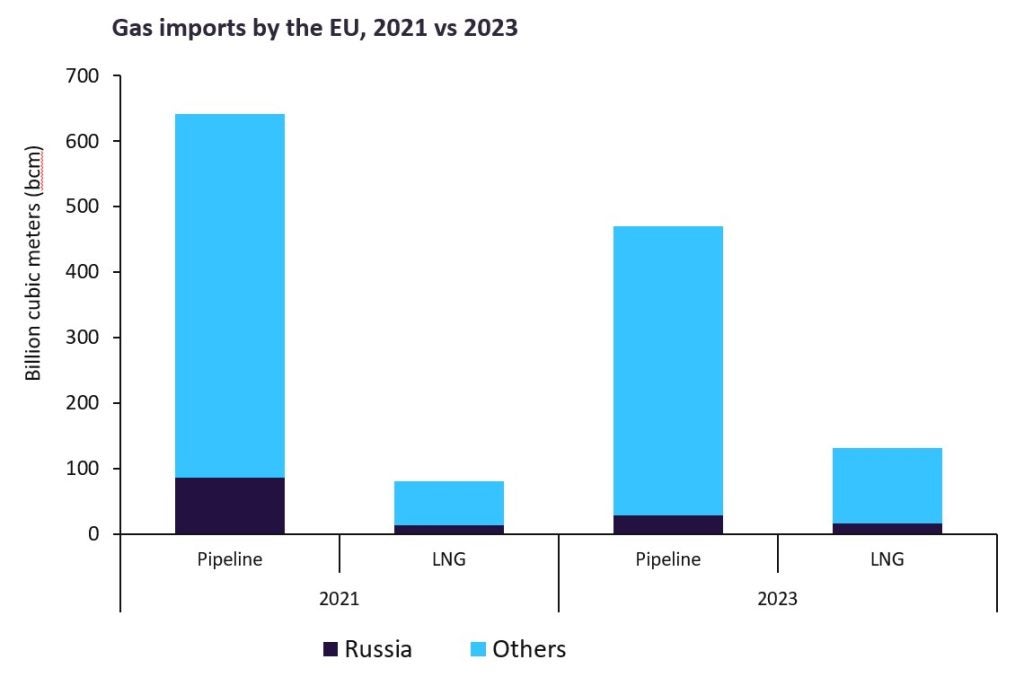

Before Russia’s invasion of Ukraine, many European countries, especially highly industrialised ones like Germany, relied on cheap Russian natural gas imports to fuel their industrial and power plants. In 2020 alone, the region imported around 40% of its pipeline gas from Russia. This dependency was even higher for Germany at nearly 70%.

The war in Ukraine forced the region to seek alternative sources of gas – that is, LNG. Imports of LNG, particularly from the US and Qatar, increased significantly to offset the pipeline gas deficit.

One of the factors that impeded LNG imports in the EU was a lack of infrastructure. This has led to a new wave of LNG regasification terminals across Europe, with some 30 new terminals likely to come online by 2028 – most of them floating ones, according to GlobalData’s analysis.

While total offshore regasification capacity in Europe stood at 1.73 trillion cubic feet (tcf) in 2023, GlobalData expects it to grow to 2.13tcf in 2024, a 23% increase. GlobalData is tracking five offshore terminals set to come online in Germany in 2024, and one each in Cyprus and Greece. In contrast, onshore capacity is only set to increase by 4% in 2023, indicating a growing trend towards offshore regasification.

“FSRUs are favoured due to several reasons,” says Shekhar. “They have a 0.5–0.7-times lower capex per MMBTU (million British thermal units), a lower deploying period of one to three years, compared with three to five years for onshore terminals, and higher flexibility.”

Germany, which had no LNG regasification capacity until 2021, is expected to overtake the current leader, Spain, by 2030. Germany initiated LNG imports in 2023 with the start-up of three new regasification terminals – all based on offshore platforms. Spain and the UK, the traditional LNG regasification leaders in Europe, rely on onshore terminals.

The market for FSRUs remains active

US-listed Excelerate Energy has been among the companies responding to the surge in demand for floating regasification capacity. The company, which was the top player by FSRU capacity in 2023, according to GlobalData’s research, is focusing on FSRU operations, terminal ownership and LNG supply with recent partnerships and investments.

In February, Steven Kobos, Excelerate’s president and chief executive, said the company is considering buying existing LNG vessels and newbuilds under a new growth strategy that would expand its core ten-vessel, fully contracted FSRU fleet.

Excelerate has a series of projects in progress. In January, its FSRU Sequoia started a 20-year charter with Brazil’s Petrobas. During the first quarter, it signed a long-term contract to buy 0.85–1 million tonnes per annum (mtpa) of LNG from Qatar Energy, Qatar’s national gas and LNG company, on a delivered ex-ship basis in Bangladesh for 15 years, starting from January 2026.

Qatar Energy has played an important role in expanding LNG supplies globally. In May, the company said it was on track to double its LNG production capacity in the next few years, with domestic LNG production capacity increasing from the current 77mtpa to 142mtpa.

Meanwhile, in Poland, national gas transmission system operator Gaz System, the operator of the country’s future LNG terminal, signed a long-term time charter party agreement for an FSRU with a subsidiary of Japan’s shipping major Mitsui O.S.K. Lines (MOL). MOL’s FSRU has an estimated regasification capacity of 6.1 billion cubic metres of gaseous fuel per year, which has already been booked. The FSRU, Poland’s first, will be built 3km off the port of Gdansk.

So far, Poland’s policy of switching away from Russian supplies has been successful. In 2023, it managed to meet domestic natural gas demand without any Russian imports. LNG has played a vital role in this manoeuvre, with the Swinoujscie LNG terminal on the shore of the Baltic Sea, currently Poland’s sole import facility, receiving 4.73 million tonnes (mt) of super-chilled fuel last year, up from 4.47mt in 2022.

Germany is also working to expand its LNG import capacity through the addition of FSRUs. In March, state-owned LNG terminal operator Deutsche Energy Terminals announced that the FSRU Energos Force, owned by Marine LNG infrastructure company Energos Infrastructure, arrived at the port of Stade. According to the company, the unit will have a capacity of 174,000 cubic metres, enabling Germany to continue to enhance its energy security.

With global demand for natural gas set to rise by 34% to 2050, and LNG expected to overtake long-distance pipeline trade by 2026, demand for LNG regasification infrastructure will continue to grow. FSRUs are likely to play a key role in this trend as they offer a flexible and cost-effective option for connecting global LNG supplies to markets with a growing demand for natural gas.