Magellan Midstream Partners’ unit-holders voted in favour of its sale to larger rival Oneok for $18.8bn, establishing one of the largest US energy pipeline companies. In June, one of the top stakeholders in Magellan, Energy Income Partners, scrutinised the deal due to its difficult tax structure. However, independent proxy advisors Glass Lewis & Co and ISS recommended the sale, and it has now been voted in favour of.

ONEOK, a midstream oil and gas company, offers midstream services to the states of Montana, Wyoming, North Dakota, Kansas and Oklahoma. The company has a market capitalisation of $29.5bn and the transaction will make it one of the largest of its kind in the US. About 96% of votes were cast in favour of the transaction, according to preliminary results. Nevertheless, the unit-holders voted against compensation to be paid to top executives related to the deal.

The merger is not conditioned on the compensation vote and if the acquisition is approved then the compensation is therefore payable. Aaron Milford, chief executive of Magellan, would receive $28m in stock, cash and benefits after the merger, while Michael Mears, the previous chief executive officer, would receive around $26.5m in equity.

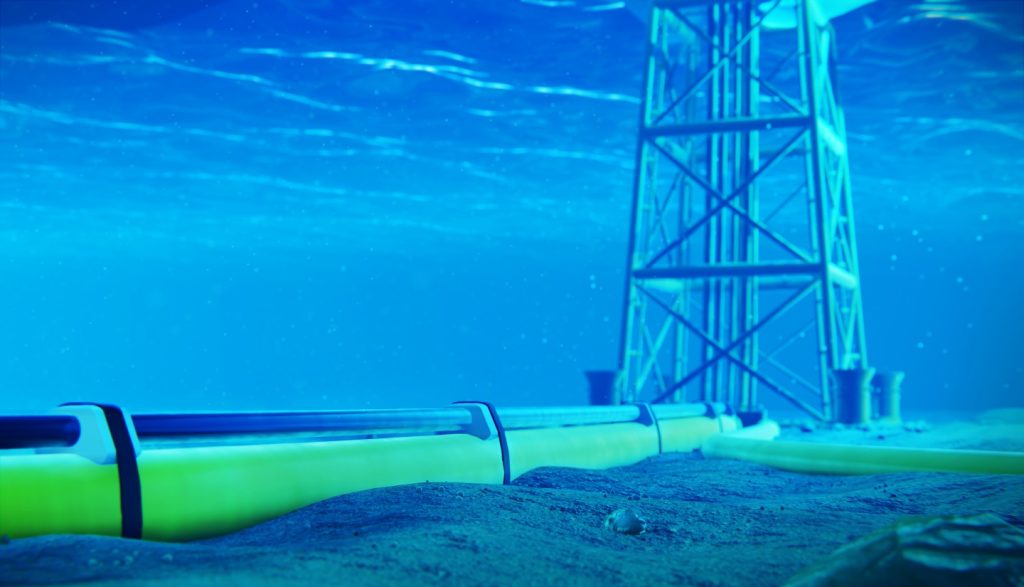

Pierce H Norton II, president and CEO of ONEOK, said: “The combination of ONEOK and Magellan will create a diversified North American midstream infrastructure company with predominately fee-based earnings, a strong balance sheet and significant financial flexibility focused on delivery of essential energy products.”

In 2022, US natural gas production was around 35.81 trillion cubic feet, allowing the country to produce nearly all of the natural gas that it uses. Five of the 34 natural gas-producing states account for 70.4% of total US dry natural gas production, with Texas having the largest output of 24.6% of total US natural gas production.