Global oil and gas contract activity boosted with Petrobras' key upstream contracts. The industry witnessed a significant 47% increase in total disclosed value, rising from $37.3bn in Q1 2024 to $54.91bn in Q2 2024. However, the number of contracts saw a decline of 7%, from 1,473 in Q1 2024 to 1,377 in Q2 2024.

Some of the notable contracts awarded by Petrobras include Seatrium’s $8.15bn contract for the P-84 and P-85 FPSOs for the Atapu and Sepia fields, offshore Brazil; Seagem's, Sapura subsidiaries' and Seabras Sapura Participacoes’ $1.8bn contract for the subsea engineering, installation, and other services utilising the of six multi-purpose pipe-laying support vessels (PLSV); and Subsea 7’s five contracts, including $1.25bn four pipelay support vessels contracts; and another $1.25bn engineering, procurement, fabrication, installation, and pre-commissioning contract of 102km of rigid risers and flowlines for the steel lazy wave production system for Petrobras’ Buzios 9 field development, offshore Brazil.

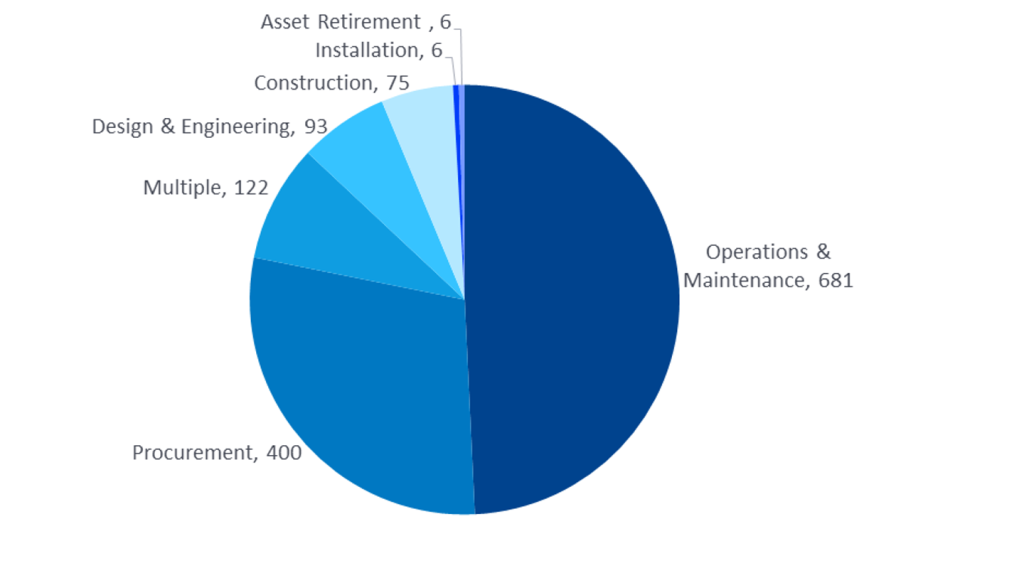

Oil and gas industry contracts by scope, Q2 2024

The upstream sector reported 901 contracts during Q2 2024, followed by the downstream/petrochemical and midstream sectors with 306 and 191 contracts, respectively during the quarter.

Asia recorded most of the contracts, with 464 contracts, in Q2 2024, followed by Europe and North America with 368 and 343 contracts, respectively.

Operation and maintenance (O&M) represented 49% of the total contracts in Q2 2024, followed by procurement scope with 29%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 9%.

Further details can be found in GlobalData’s new report, 'Oil and Gas Industry Contracts Review by Sector, Region, Terrain and Top Contractors and Issuers, Q2 2024'.