Global oil and gas contracts activity witnessed a decline of 15% in the number of contracts, from 1,346 in Q4 2023 to 1,142 in Q1 2024. Likewise, the total disclosed value decreased by 37%, from $50.2bn in Q4 2023 to $31.4bn in Q1 2024. Some of the notable contracts during the quarter include Samsung Heavy Industries’ $3.44bn construction contract for 15 LNG carriers each with a 174,000m³ capacity, Tecnicas Reunidas and Sinopec Engineering Group’s two lumpsum contracts worth approximately $3.3bn from Saudi Aramco for the EPC of the Riyas Natural Gas Liquids (NGL) fractionation facility in Saudi Arabia, and Tecnimont’s approximately $1.1bn contract from Sonatrach for the engineering, procurement, construction, and commissioning (EPCC) of a new linear alkyl benzene (LAB) plant with a capacity of 100,000 tons per annum (tpa) and utility infrastructure in east Algeria.

The upstream sector reported 842 contracts during Q1 2024, followed by the midstream and downstream/petrochemical sectors with 162 and 155 contracts, respectively during the quarter.

Europe recorded most of the contracts, with 381 contracts in Q1 2024, followed by North America and Asia with 345 and 229 contracts, respectively during the quarter.

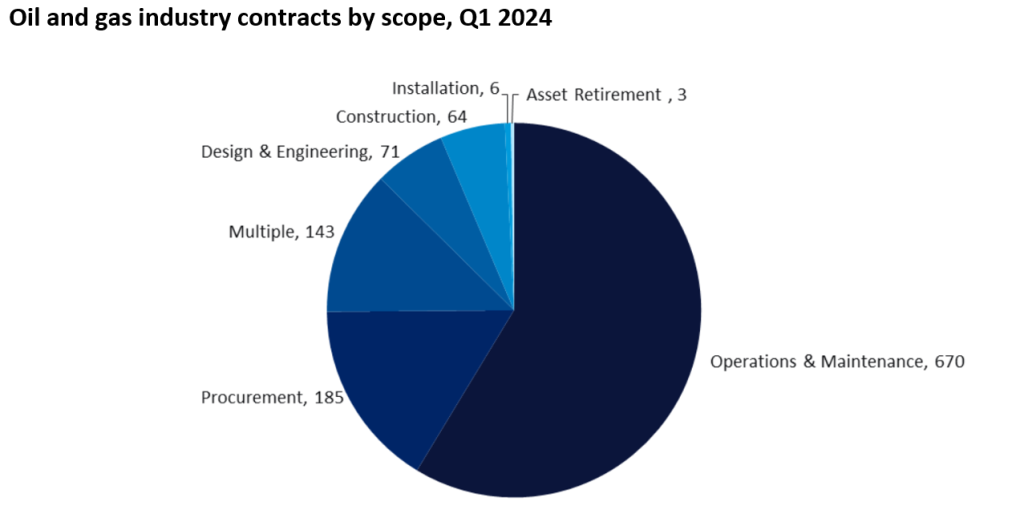

Operation and maintenance (O&M) represented 59% of the total contracts in Q1 2024, followed by procurement scope with 16%, and contracts with multiple scopes such as construction, design and engineering, installation, O&M, and procurement, which accounted for 13%.

Further details can be found in GlobalData’s new report, Oil and Gas Industry Contracts Review by Sector, Region, Terrain, Planned and Awarded Contracts and Top Contractors and Issuers, Q1 2024.