The Moratti family has signed an agreement to sell a 35% stake in Italian oil refining company Saras to global commodity trading company Vitol.

The deal, which values Saras at €1.7bn ($1.83bn), is set for €1.75 per share, representing a 10% premium over the share price as of 6 February 2023.

As per the deal, there is also an option for Vitol to purchase an additional stake of up to 5% in Saras.

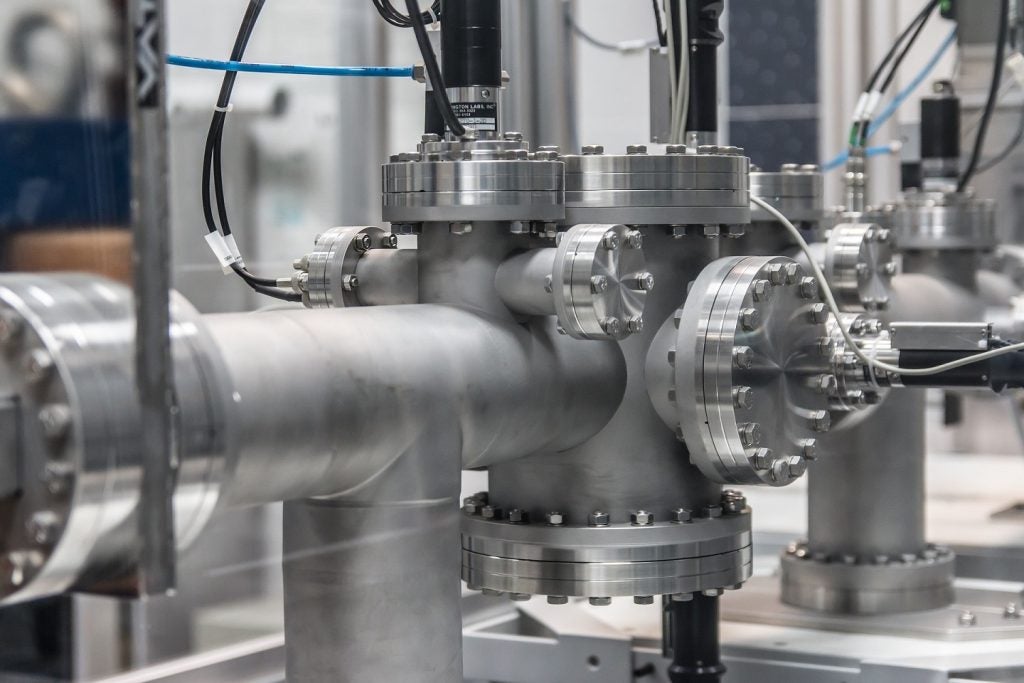

Saras, a key player in the energy sector, operates a Sardinia-based single-site refinery, with a capacity of 300,000 barrels per day (bpd).

The refinery is a key supplier of oil products to Italy and other European markets.

Upon the transaction's completion, Vitol will assume the Moratti family's entire stake in Saras, which will trigger a mandatory tender offer for the remaining shares of the company.

The tender offer will be launched at the same price of €1.75 per share, although this may be subject to adjustments should a dividend distribution occur before the deal is finalised.

As per the announcement, the primary objective of this mandatory tender offer is to facilitate the delisting of Saras from the Milan Stock Exchange.

This could be achieved either through the tender offer or via a delisting merger, provided certain conditions are met.

If Vitol's acquisition is successful, it will expand its refining capacity, taking it to over 800,000bpd across seven refineries to its portfolio.

The completion of this transaction is dependent solely on the receipt of the necessary regulatory approvals.

Vitol CEO Russell Hardy said: “We appreciate the significance of Saras within Sardinia, and the country more broadly, and are committed to continuing the Moratti family’s legacy of diligent stewardship, safe operations and support for the local community and employees.

“Saras’s business is highly complementary to Vitol’s core operations and this transaction will strengthen European energy security and enhance supply for a key European energy asset.”