The Mexican Government has reportedly announced plans to transfer 136 billion pesos ($6.69bn) to state oil producer Pemex in 2025 to assist with its debt and loan repayments, reported Reuters.

This move is part of a budget proposal aimed at addressing the company's financial liabilities, which include nearly $9bn in bond payments due next year.

Pemex's total financial liabilities amount to $97.3bn, and the company has frequently been criticised by ratings agencies for its dependence on government support, the report stated.

This year, Pemex has already received around 150 billion pesos to meet its debt obligations.

Under former President Andres Manuel Lopez Obrador, Pemex received substantial financial support to reduce its debt, increase oil output and build a refinery, which has recently commenced fuel production.

President Claudia Sheinbaum, who assumed office in October, has committed to continuing support for Pemex and the state-owned electric utility CFE, recognising their significant roles.

The proposed transfer to Pemex is contingent upon the company improving its balance sheet by an equivalent amount, as outlined in the budget proposal. According to the report, the proposal will now be subject to debate and voting in Congress.

Under President Sheinbaum, Pemex aims to increase hydrocarbon reserves and ensure their restitution.

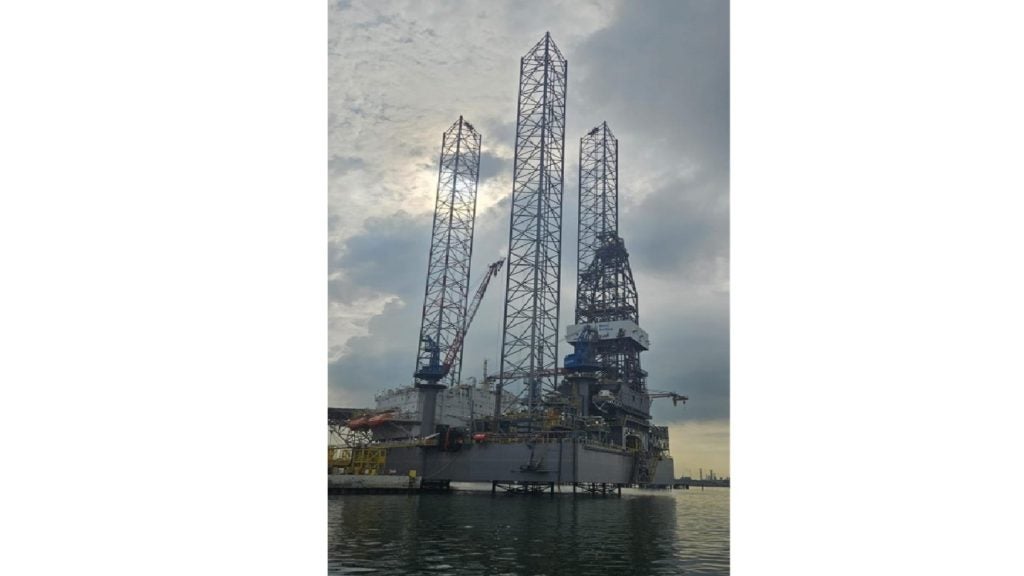

The company recently announced plans to intensify deep-water exploration and develop new business models to attract investment.

This represents a strategic shift from the approach of former President López Obrador, who avoided partnering with private companies for exploration and extraction projects.

Under the new direction, Pemex will concentrate on onshore exploration, shallow-water operations and areas adjacent to existing production fields.

The company will also prioritise projects with high success rates and strong profitability potential, aiming to offset the decline of ageing oilfields and support the development of new reserves.