Fatih Birol, the IEA’s executive director, has stated that China’s gradually weakening oil demand and an increase in electric vehicle sales will negatively impact the world’s oil demand growth over the next few years.

The IEA’s head also reiterated what his organisation sees as a coming market surplus moving into next year, as outlined in the body’s recently published monthly outlook.

Birol, speaking to a US media outlet, said that for rest of this year, oil demand is “very weak, much weaker than previous years” and we expect “this will continue because of China”.

According to the body’s October market report, worldwide oil demand is set to increase by just 862,000bpd this year – lower than the 903,000bpd reported the month before – as China’s economy slows.

Chinese crude consumption fell by 500,000bpd annually in August, the latest IEA figures have revealed.

However, China’s recently announced economic stimulus package prompted the head of Saudi Aramco to say over the weekend that he remains "bullish" on the Asian nation’s oil demand for the rest of this year, and into the next.

Saudi Aramco CEO Amin Nasser added that the company is aiming to boost daily oil production, with China “a huge market and we are investing with our partners”.

Speaking at the International Energy Week conference in Singapore, he also said that the demand for aviation fuel is a “bright spot” in the Chinese market.

In June, the energy agency stated that global oil demand is expected to reach its highest point by 2030 and decrease the following year. Oil supply capacity will also significantly exceed demand by the end of this decade.

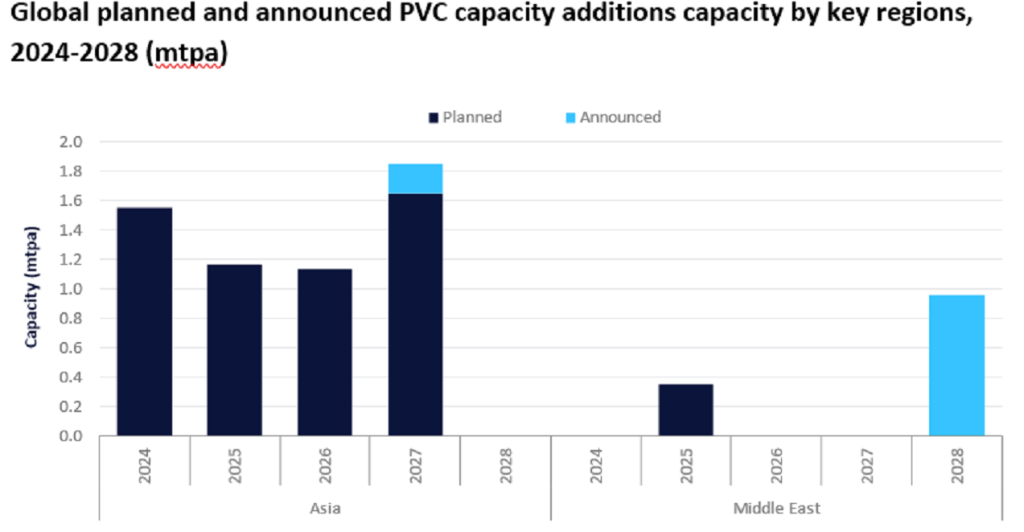

However, growing global demand for energy and petrochemicals, coupled with ongoing energy security concerns, could prompt rising demand for oil into 2030, despite the rapid deployment of green energy, according to a GlobalData response to the IEA data released earlier this year.