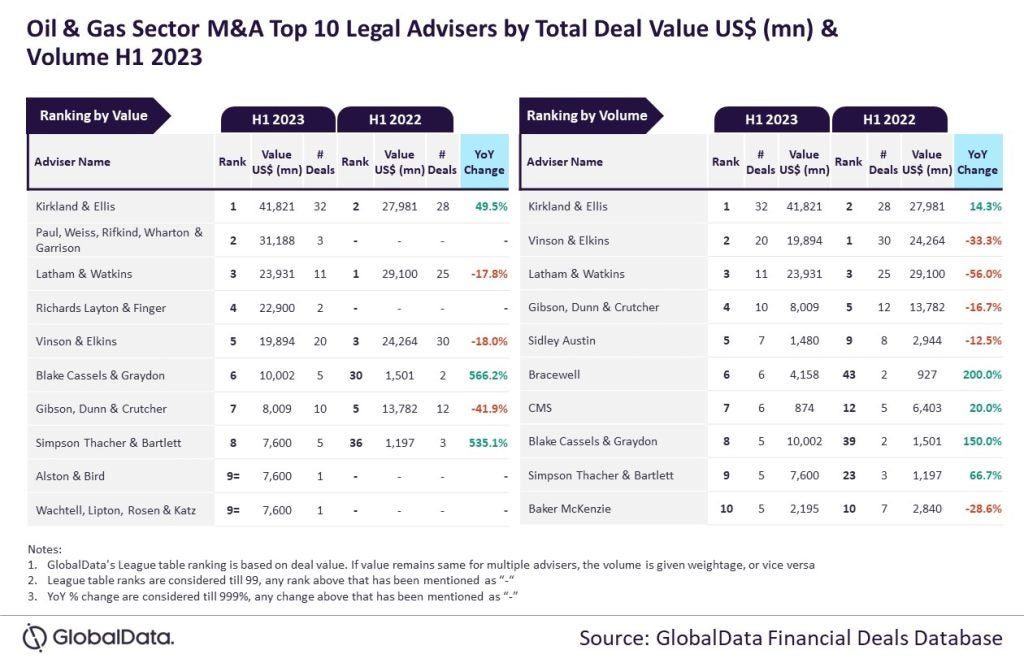

Analytics company GlobalData, the parent company of Offshore Technology, has found that US multinational law firm Kirkland & Ellis was the top legal adviser in the oil and gas sector during the first half of 2023.

Looking at data for mergers and acquisitions (M&A) legal advisers for H1 2023, the statistics showed that Kirkland & Ellis ranked first in both the quantity of and cumulative value of M&A advised during this period.

Kirkland & Ellis advised on 32 deals in H1 2023, marking a 14% increase in quantity over H1 2023. These deals were worth a total of $41.8bn; no other company managed more than $40bn of deals and only one exceeded $30bn. Kirkland and Ellis placed second in both categories in H1 2022.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the clear winner in the oil and gas sector’s legal advisers league table, outpacing its peers by a significant margin. It was the only firm with more than 30 deals in H1 2023, while it was also way ahead in terms of deal value as well. Kirkland & Ellis was the only adviser that managed to surpass $40bn in total deal value in H1 2023.”

Paul, Weiss, Rifkind, Wharton & Garrison held second place in the ranking by value, advising on $31.18bn. This represented a 300% increase on H1 2022, the largest year-on-year gain in the top ten. Lathan & Watkins came in third with $23.93bn of M&A advised, followed in fourth place by Richards, Layton & Finger with $22.9bn.

Vinson & Elkins fell from the top spot for quantity it held in H1 2022, down to second place. This was owing to a -33.3% fall in the number of deals it advised on, from 30 down to 20. It also fell in the ranking by value, from third in H1 2022 to fifth in H1 2023. Latham & Watkins came third in volume, with 11 deals, followed in fourth by Gibson, Dunn & Crutcher with ten.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks submissions of deals from leading advisers.