Leading data and analytics company GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the oil and gas sector during the first, second and third quarters of 2024 (Q1–Q3 2024).

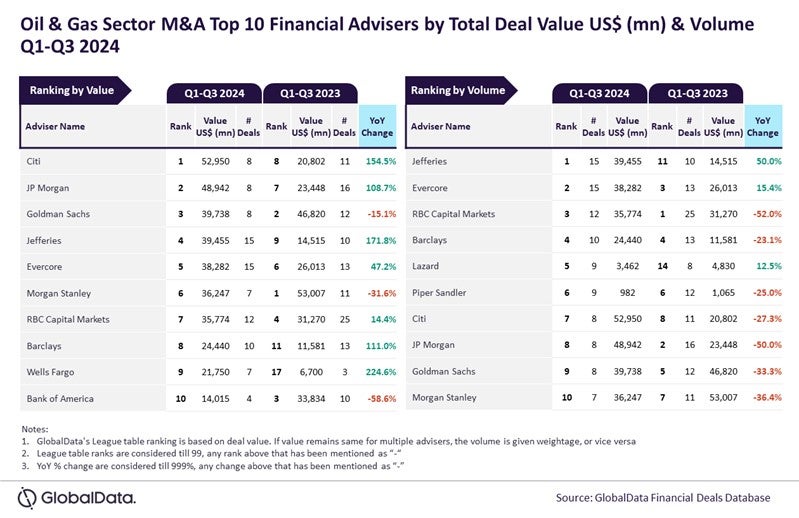

Citi and Jefferies were the top M&A financial advisers in the oil and gas sector during Q1-Q3 2024 by value and volume, respectively.

An analysis of GlobalData’s Deals Database reveals that Citi achieved the top position in terms of value by advising on $53bn worth of deals.

Meanwhile, Jefferies led in terms of volume by advising on a total of 15 deals.

Aurojyoti Bose, lead analyst at GlobalData, said: “Both Citi and Jefferies registered improvement in the volume and value of deals advised by them, respectively, as well as their ranking during Q1–Q3 2024 compared with Q1–Q3 2023.”

They added that Jefferies’ “ranking by volume improved from 11th during Q1–Q3 2023 to the top position during Q1–Q3 2024. Meanwhile, Citi went ahead from occupying the eighth position by value during Q1–Q3 2023 to top the chart by this metric during Q1–Q3 2024.”

The data also revealed that JP Morgan occupied the second position in terms of value by advising on $48.9bn worth of deals, followed by Goldman Sachs with $39.7bn, Jefferies with $39.5bn and Evercore with $38.3bn.

Meanwhile, Evercore occupied the second position in terms of volume with 15 deals, followed by RBC Capital Markets with 12 deals, Barclays with ten deals and Lazard with nine deals.

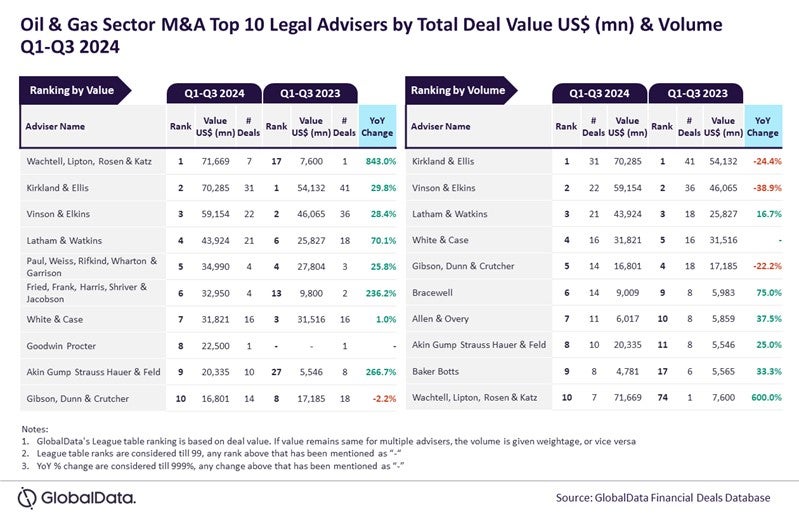

Wachtell, Lipton, Rosen & Katz and Kirkland & Ellis were the top M&A legal advisers in the oil and gas sector during Q1–Q3 2024 by value and volume, respectively, according to GlobalData.

The firm achieved the top position in terms of value by advising on $71.7bn worth of deals. Meanwhile, Kirkland & Ellis led in terms of volume by advising on a total of 31 deals.

Bose added that: “Kirkland & Ellis was the top adviser by both value and volume during Q1–Q3 2023. While it managed to retain the top position by volume during Q1–Q3 2024, it lost the top position in terms of value by a whisker to Wachtell, Lipton, Rosen & Katz.”