The global oil and gas industry is now refocusing on fossil fuels and away from the energy transition as heightened energy concerns amid the Ukraine war place more emphasis on security, according to a new GlobalData report.

As such, many companies have scaled back their focus on technologies and investments that would help them decarbonise their operations.

The report, produced by Offshore Technology’s parent company, said the trend would likely continue in 2024, although the switch towards low-carbon energy is expected to proceed, albeit at a slower pace.

The thematic report, Energy Transition in Oil and Gas, highlights the energy transition-related developments in the oil and gas industry.

Companies are switching towards renewable power and other low-carbon options in their energy transition efforts. Most leading industry companies have adopted 2050 as the long-term goal for net-zero carbon emissions.

A lot of promises made by them hinge on the successful implementation of their respective interim targets for 2030, said the report.

Ravindra Puranik, oil and gas analyst at GlobalData, said: “Energy security has been a concern for most countries following the outbreak of the Russia-Ukraine war. The resultant supply chain disruption drove countries towards the readily available fossil fuels, thereby boosting oil and gas demand.”

He added that on the other hand, “the push for energy self-reliance and high inflation have somewhat derailed the clean energy adoption”.

Leading oil and gas companies have set themselves decarbonisation targets for both the medium and long term, relying on existing and emerging technologies.

Companies are increasingly investing in renewable power generation, with wind and solar power being a particular area of focus.

Puranik continues: “In 2020, several oil and gas companies announced ambitious energy transition targets. However, the hype around energy transition has somewhat subsided going into 2024. Profitability issues and inflation, along with high interest rates, are causing uncertainties in undertaking renewable projects.”

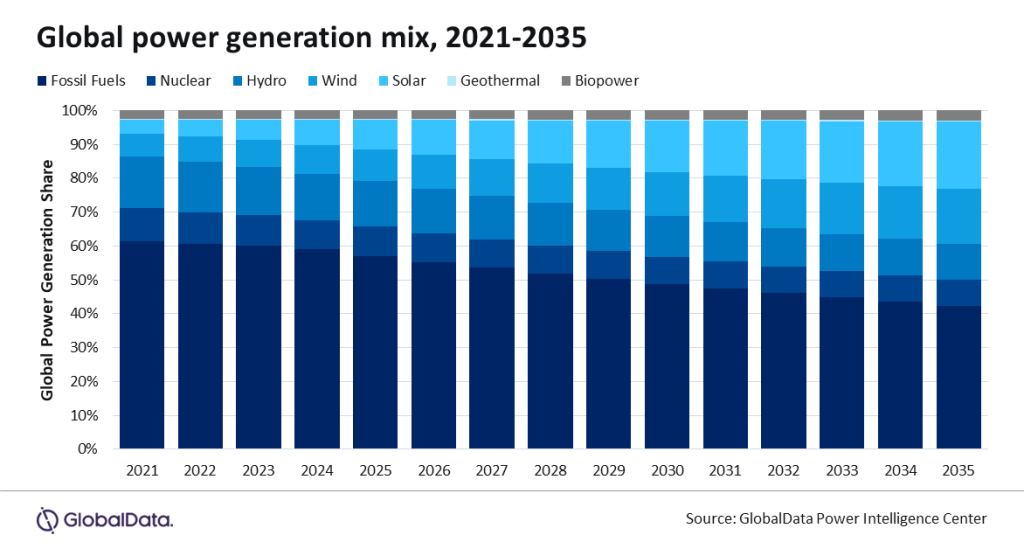

The share of fossil fuels in the global power generation mix is dwindling by the year. This space is increasingly being occupied by renewable energy sources, especially solar and wind energy.

Efforts such as carbon capture predominantly work to mitigate emissions, while hydrogen production, renewable power and low-carbon fuels offer end-consumers alternatives to fossil fuels. Energy storage, mostly in the form of batteries, is another transition avenue being explored by the oil and gas industry.

Puranik concludes: “The oil and gas industry’s energy transition requires long-term planning to reduce or eliminate carbon emissions. In the short to medium-term, companies must incorporate transition fuels as well as low-carbon and zero-carbon energy sources in their portfolios.”

He added that despite “periodic slowdowns, energy transition in [the] oil and gas industry will take place and pave [the] way for [a] new global energy mix in the future”.