Britain's incoming Labour government has pledged bold climate targets but is set to display pragmatism in how it achieves them.

The Labour Party has secured an unprecedented majority after 14 years in opposition, reflecting a strong national desire for change. However, the new government is likely to prioritise fiscal responsibility, with MPs, the new cabinet and the public keen to avoid a scenario similar to the market reactions experienced during Liz Truss's 49-day tenure as Prime Minister in 2022. GlobalData Strategic Intelligence’s UK Elections briefing therefore expects a middle way between "shock therapy" and mere "elite rotation’.

Impact on the oil and gas industry

Labour has various policy tools to advance its climate goals and increase tax revenues, although not all have been fully discussed during the election campaign or explicitly outlined in the party's manifesto. Key policies affecting supply include halting new North Sea exploration and production licences, and increasing windfall tax rates. While Starmer has pledged to end new licences for North Sea exploration, the stance on existing production licences remains ambiguous. The windfall tax rate is set to increase by 3 percentage points to 38%, with significant changes expected in the energy profits levy, including amendments to investment allowances and potential ring-fencing.

On the demand side, the government might target fossil fuel consumption tax benefits, such as those for home heating and VAT on diesel, though these measures could face political backlash. Labour may also reverse the outgoing Tory government’s delay in banning internal combustion engine cars and accelerate the phase-out of gas boilers. These measures would be immediately noticeable to the public but could cost political capital.

Energy Independence Act

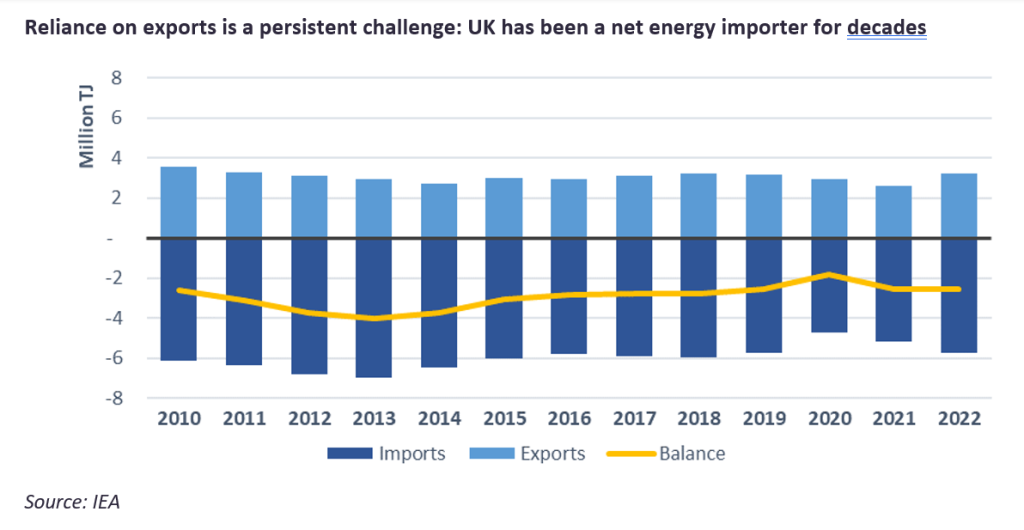

The most prominent piece of proposed legislation is the Energy Independence Act, which includes the establishment of GB Energy and a commitment to decarbonise the UK’s power grid by 2030. Ed Miliband, as Shadow Energy Secretary, promised that GB Energy will reduce high-cost bills for citizens and cut the UK's dependence on Russian oil.

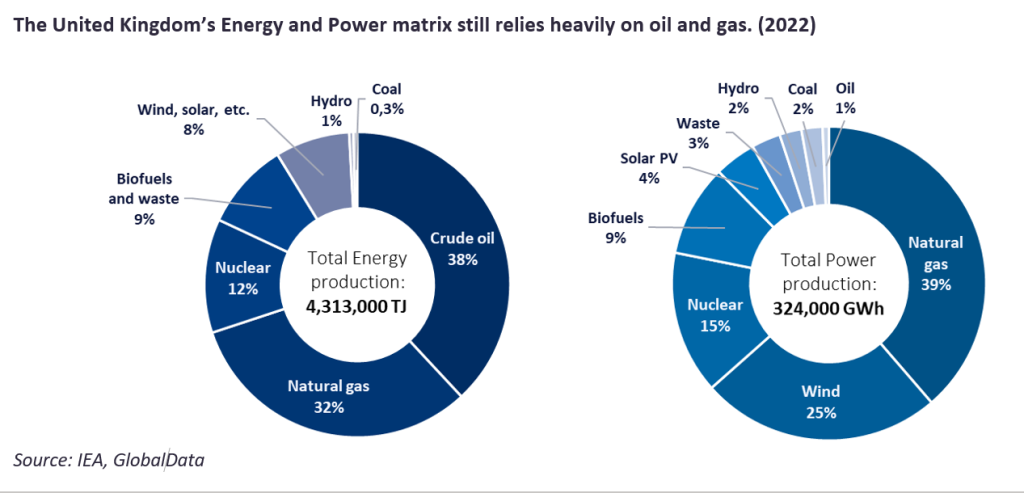

Achieving these objectives will be challenging. Oil and natural gas currently account for 70% of the UK’s total primary energy production, with natural gas power plants providing almost 40% of all electricity. Overly ambitious changes could face significant pushback.

The energy independence pledge would inevitably contradict the decarbonisation promise within a 5-year time frame, even at an accelerated pace of renewables and electric vehicle deployment. Competing priorities arise as the incoming government seeks decarbonisation and energy independence, while having an energy system that still relies on fossil fuels. This brings about both political and spending trade-offs, which the upcoming government will have to balance.

Political challenges and fiscal constraints

The oil and gas industry employs an estimated 150,000 to 200,000 workers who are particularly concentrated in the east and northeast of the UK, along the North Sea coast. Northeast England, a historical Labour stronghold, could be particularly sensitive to rapid changes. Additionally, dwindling Tory strongholds in Norfolk and Suffolk, and constituencies in Aberdeenshire, where Labour has gained seats from the Scottish National Party in the 2024 General Election, have interests aligned with the oil and gas industry and will hold Labour MPs accountable.

Labour faces a tight fiscal space due to a combination of low growth, tax breaks and spending pressures from the pandemic and the energy crisis. This has led to a rollback of their £28 billion green investment pledge, which was partly intended to support communities affected by reduced oil and gas economic activity.

Can Labour really force out fossil fuels?

It is therefore difficult to imagine a Labour government that will be willing - or able - to force out investment in fossil fuels, given the competing priorities.

The effect of the July 2024 change in government kicked in before votes were cast, however. The widely expected Labour victory prompted UK carbon prices to rebound from a January 2024 low, rising by £14 to £45 at the beginning of July. Oil and gas companies have also delayed final investment decisions in the North Sea, due to uncertainty or expected tougher fiscal terms. As speculation builds up, the market outlook would benefit from prompt clarity on policy from the new Prime Minister, Keir Starmer.