Oil and gas pipeline operator Enbridge has announced plans to expand the capacity of its Gray Oak oil pipeline by 80,000 barrels per day (bpd) this year, reported Reuters.

The company is also considering a further expansion of 40,000bpd in 2025.

This development comes after Enbridge revised its initial plans to add 200,000bpd to the Texas pipeline, now targeting an increase of between 100,000bpd and 200,000bpd.

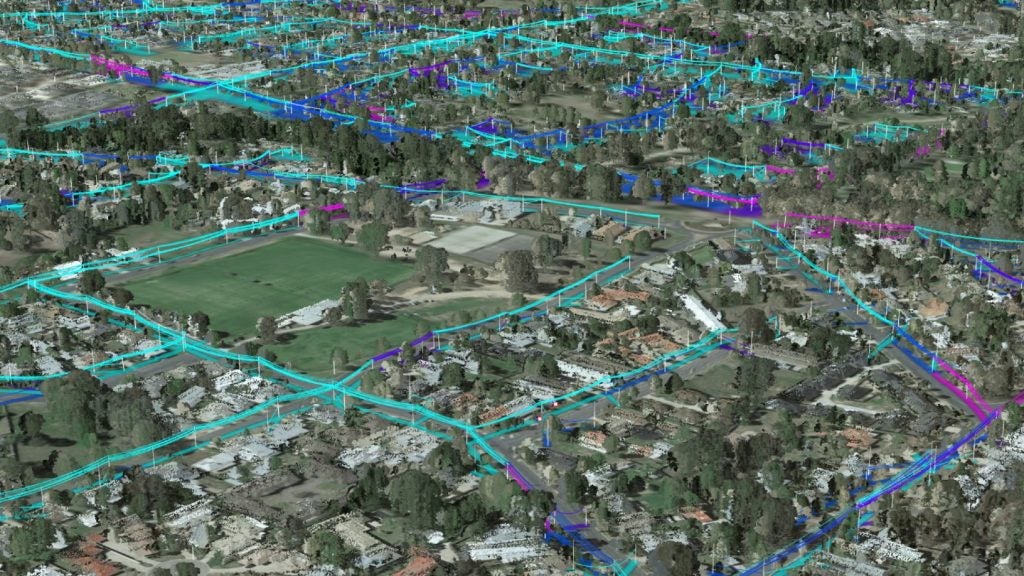

The Gray Oak pipeline facilitates the transport of oil from the Permian basin in West Texas to Corpus Christi on the Gulf Coast, and is a critical piece of infrastructure in Enbridge's portfolio.

Enbridge-operated Ingleside Energy Centre, located in Ingleside, Texas, is reputed to be the largest crude oil storage and export terminal by volume in the US.

Despite potential competition at the Corpus Christi hub, where Enterprise Products Partners is seeking licensing for its Sea Port Oil Terminal (SPOT) export project, Enbridge remains confident in its strategic position.

Speaking to the publication, Enbridge executive vice-president Colin Gruending said: “It is certainly a competitor for Corpus, but given the advantages of our terminal at Corpus, we are confident Ingleside can compete well against SPOT.”

Earlier this month, as reported by Reuters, the company raised its short-term profit growth forecast and announced a $500m investment to expand its pipeline and storage assets, enhancing its presence on the US Gulf Coast.

The Calgary, Alberta-based company has increased its core profit growth forecast to between 7% and 9% through 2026, up from the previous 4–6% through 2025.

This upward revision is primarily attributed to the acquisition of Dominion Energy’s US gas utility companies.

In September 2023, Enbridge reached an agreement to purchase three natural gas distribution companies from Dominion Energy in a transaction valued at $14bn (C$19.1bn).

The deal included East Ohio Gas, Questar Gas and its affiliate Wexpro companies, and the Public Service Company of North Carolina.