The Church of England (C of E) will no longer invest in fossil fuel companies with its endowment and pension funds amid concerns that the industry is backtracking on climate pledges, it announced in a statement on Thursday.

The church said that its £10.3bn ($13.1bn) Church Commissioners for England investment fund and its C of E Pensions Board will independently divest from fossil fuels this year. The move comes after the church’s National Investing Bodies' (NIBs) 2018 recommendation of a five-year strategy to remove investment from fossil fuel companies whose climate pledges and net-zero targets do not align with the Paris Agreement.

The 2018 strategy developed a series of hurdles that required companies to meet progressively more ambitious climate targets and performance criteria. The results of this would then be used to inform future investment decisions. A report published this month from the NIBs for the General Synod, titled 'Approach to Climate Change', sets out that “no fossil fuel company has met the 2023 hurdles”.

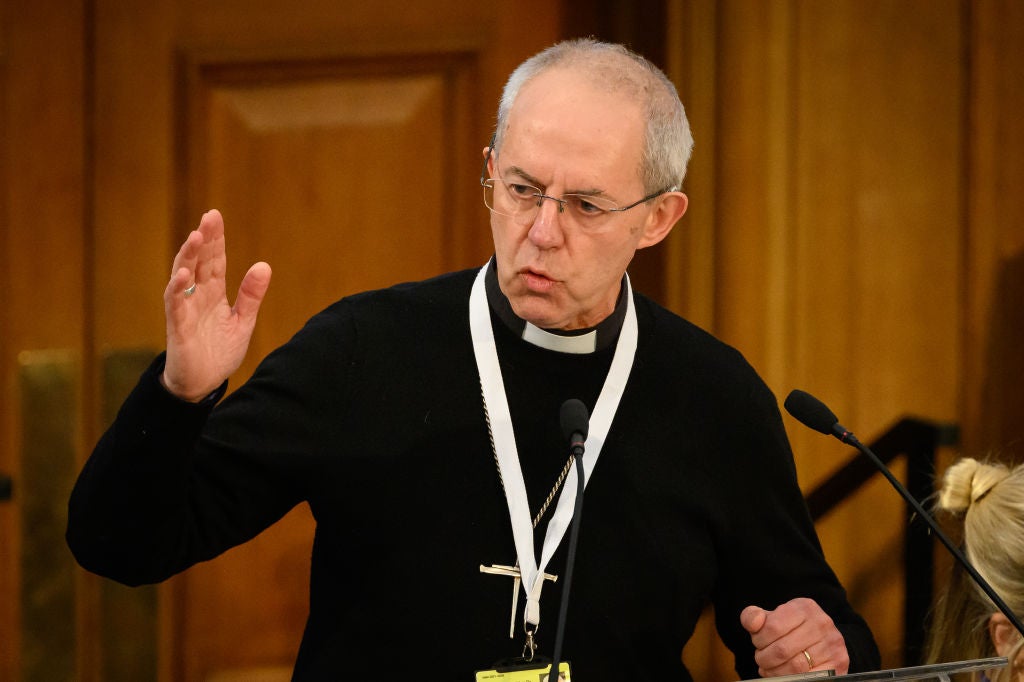

Justin Welby, the archbishop of Canterbury and chair of the Church Commissioners, said in the statement: “The climate crisis threatens the planet we live on, and people around the world who Jesus Christ calls us to love as our neighbours. It is our duty to protect God’s creation, and energy companies have a special responsibility to help us achieve the just transition to the low-carbon economy we need.

“We have long urged companies to take climate change seriously, and specifically to align with the goals of the Paris Climate Agreement and pursue efforts to limit the rise in temperature to 1.5°C above pre-industrial levels. In practical terms that means phasing out fossil fuels, investing in renewables, and plotting a credible path to a net-zero world. Some progress has been made, but not nearly enough. The Church will follow not just the science, but our faith – both of which call us to work for climate justice.”

Oil and gas giants have faced a barrage of shareholder rebellions this year as pressure to align with global climate targets intensifies. This year, BP faced several rebellions from pension funds after it diluted its climate pledges. In 2019, BP set a target to reduce its emissions by 40% from 2019 levels by 2030. In February this was weakened to just 25%, after the company reported record profits from its oil and gas portfolio. Other giants including TotalEnergies, Shell and ExxonMobil faced similar revolts.

According to the Guardian, chief executive of the C of E pensions board John Ball said the decision to divest from fossil fuels was driven by these recent reversals in climate policy by BP and Shell in particular.

He said: “There is a significant misalignment between the long-term interests of our pension fund and continued investment in companies seeking short-term profit maximisation at the expense of the ambition needed to achieve the goals of the Paris agreement. Recent reversals of previous commitments, most notably by BP and Shell, has undermined confidence in the sector’s ability to transition.”