The US low-carbon hydrogen market, once buoyed by the Biden administration’s strong push for clean energy, now faces uncertainty as Donald Trump prepares to take office again.

Low-carbon hydrogen most commonly includes green hydrogen, emissions-free hydrogen made from the electrolysis of water using renewable electricity, and blue hydrogen produced from fossil fuels with reduced CO₂ emissions using carbon capture and storage (CCS).

The president-elect's vocal disapproval of clean energy initiatives raises concerns about the future of hydrogen, a sector that has benefitted significantly from federal support. However, these benefits having been heavily weighted towards hydrogen developers operating in Republican-led states, potentially offering a silver lining.

Hydrogen boom under Biden

The Biden Administration sparked a new era of optimism for the US low-carbon hydrogen market.

Landmark legislations such as the Infrastructure Investment and Jobs Act earmarked $9.5bn for low-carbon hydrogen development, while the Inflation Reduction Act (IRA) introduced the game-changing 45V tax credit, which awarded up to $3/kg of clean hydrogen produced.

These incentives were crucial in reducing levelised costs to make hydrogen projects more financially viable, positioning the US as “a key region for the global hydrogen market and something of a ‘land of carrots’ for prospective developers”, says Francesca Gregory, senior energy transition analyst at Power Technology’s parent company GlobalData.

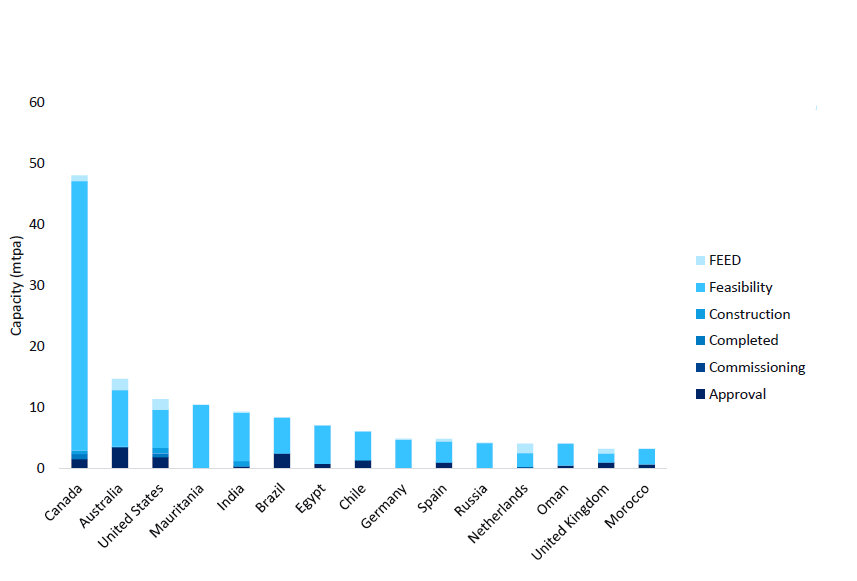

The US has grown its hydrogen production capacity rapidly thanks to such initiatives, now placing third as the largest hydrogen market, behind only Canada and Australia. According to GlobalData, the country currently holds 11.4 million tons per annum (mtpa) of active and upcoming hydrogen capacity, representing approximately 10% of the global capacity share.

However, while these numbers look promising, it is worth noting that feasibility and FEED (front end engineering design) stage projects account for 44% of the total capacity outlook. With a large portion of the projects still in their infancy, the market remains vulnerable to political shifts.

Uncertainty ahead for hydrogen funding

Although a complete disposal of the IRA seems unlikely, any efforts to water down the bill may also have significant implications for the US hydrogen industry.

A repeal or reduction of the 45V tax credit, for instance, could derail many hydrogen projects, with many developers having relied on the incentive to offset high production costs. Such a shift would affect confidence in the market, particularly for early-stage projects, which make up nearly half of the country’s hydrogen capacity outlook.

Gregory further explains that while Trump has not made specific criticisms of hydrogen, he has made clear his disdain for clean energy spending, undermining the Biden administration’s various funding packages for low-carbon technologies and frequently labelling such efforts as part of a “green scam”.

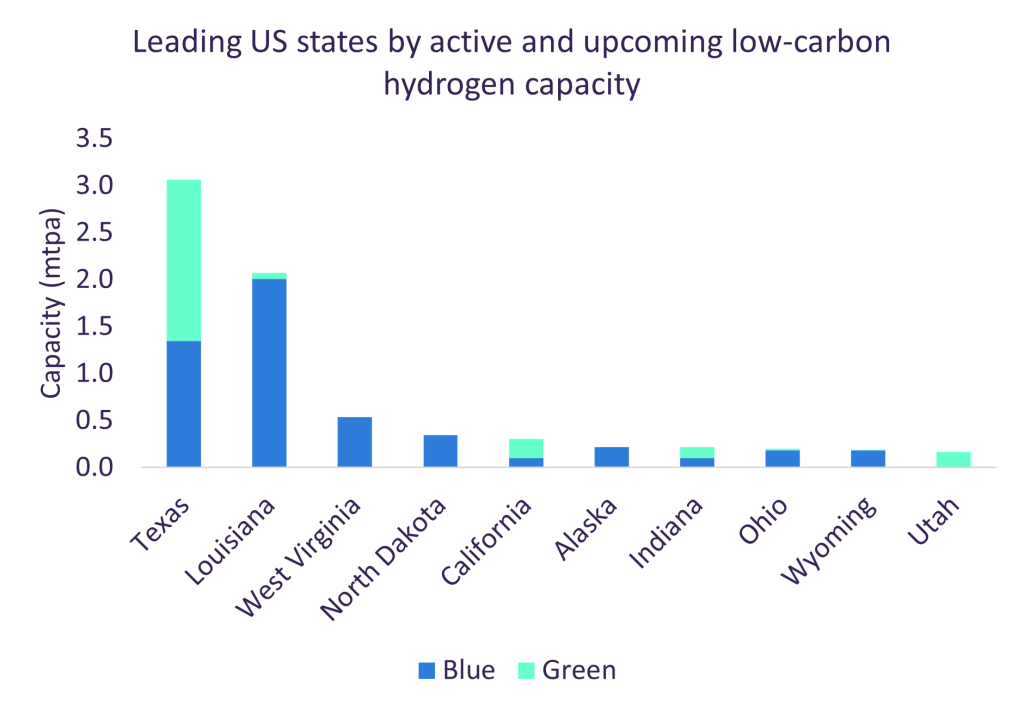

Trump's disapproval of renewable energy in particular is alarming, given its role in producing green hydrogen. His return to the White House raises the likelihood of a rollback of funding for renewable projects, which in turn could alter the economics of developing green hydrogen, which is currently expected to reach 3mtpa of capacity by 2030.

Red states could provide a lifeline

Despite these concerns, a complete repeal of hydrogen funding remains unlikely. As early as March 2024, the American Petroleum Institute, a major Republican party donor, signalled the difficulty of wheeling back tax credits offered to hydrogen and CCS in a Trump victory scenario due to their popularity in Republican-led states.

Indeed, both the highest levels of project activity and most active development of hydrogen production capacity are taking place in Republican strongholds such as Texas, Louisiana and West Virginia – regions that stand to benefit significantly from continued federal incentives. Texas alone is home to 45 hydrogen projects, more than any state.

In addition, Trump’s support for CCS – albeit in the context of supporting further oil and gas activities – indicates that the prospects for blue hydrogen are not as dire as that of green hydrogen.

As Trump’s policies take shape, the US hydrogen industry will undoubtedly face challenges, but the widespread hydrogen development in Republican-led states, coupled with the potential for legal challenges to any attempts to scale back, suggests that support for hydrogen could remain intact.

However, if the US is to maintain its position as a leader in the industry on the global stage, support at current levels may not be enough. For one, the US only has a road map for its hydrogen sector, whereas other regions such as Canada, Australia and the EU have more concrete strategies in place to develop their respective markets.

To avoid lagging further behind, it is critical that the US not only resumes but strengthens its support for industry. With strong state and federal-level backing, hydrogen could still carve out a future in the US, even under a Trump presidency.