bp is looking to divest a 49% stake in its oil and gas pipeline network in the US Gulf of Mexico, reported Reuters, citing sources.

The stake put up for sale could fetch up to $1bn (£828.54m) for the UK-based oil and gas giant.

With the potential sale, bp hopes to meet its goal of reducing its debt and maintaining its dividend policy.

In the second quarter of 2023, bp increased its shareholder payout by 10% while its net debt was at $23.7bn.

According to the sources, the energy company has placed its stake in the pipeline assets in a new entity, which will be 51% owned by bp, while the remaining stake will be sold.

The pipelines company generated around $200m in 12-month earnings before interest, tax, depreciation and amortisation, they added.

The sources also stated that a deal is not certain.

bp, which holds a key position as the producer in the deep water off the US Gulf of Mexico, declined to comment on the news, reported the news agency.

Earlier this year, bp commenced production from the Argos offshore platform and hopes to increase production in the Gulf of Mexico to around 400,000 barrels of oil equivalent per day by the middle of this decade.

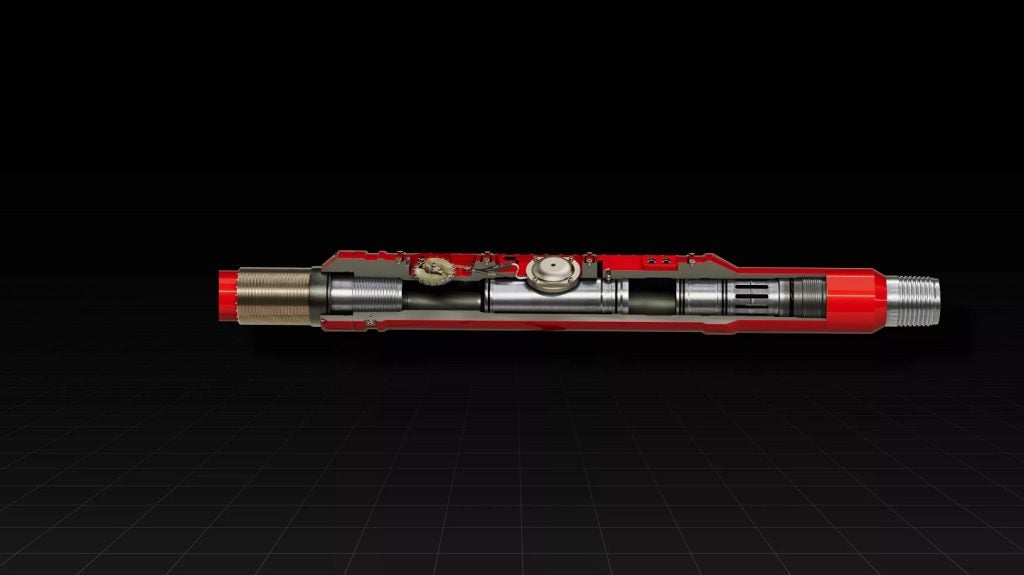

bp owns stakes in a number of pipelines in the US, including the 185km Cleopatra Gas Pipeline, the 143km Endymion Oil Pipeline and the 259.1km Mars Oil Pipeline.

The news comes as the company searches for a new CEO after Bernard Looney quit bp last month.

bp chief financial officer Murray Auchincloss replaced Looney on an interim basis.