Global liquefied natural gas (LNG) regasification capacity is expected to grow by 66%, potentially increasing from 49.6 trillion cubic feet (tcf) in 2022 to 82.2 tcf in 2027.

Among regions, Asia continues to lead globally, in terms of new build and expansion regasification capacity growth, contributing around 70% of the total global capacity additions. The region is expected to add a capacity of 22.7tcf from 2023 to 2027. Europe and the Middle East follow with capacity additions of 6.6 tcf and 896 billion cubic feet (bcf), respectively.

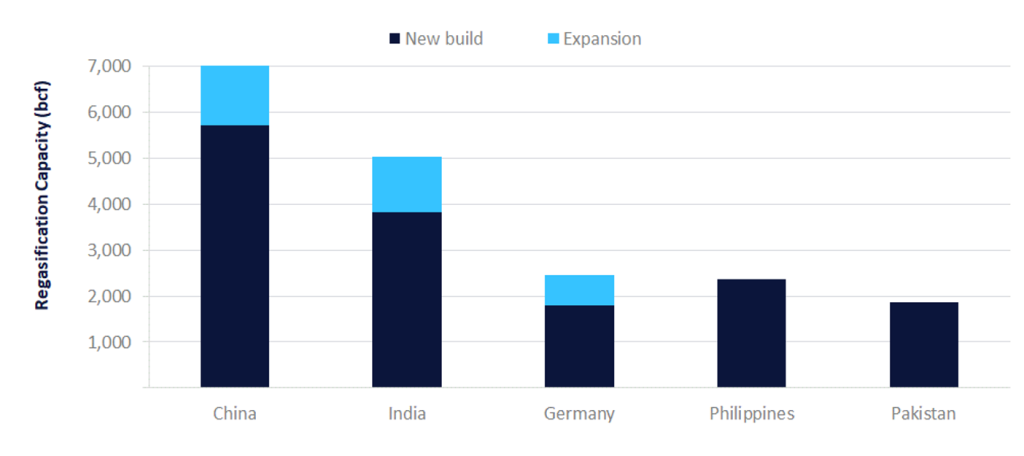

Among countries, China leads globally with 7.8tcf of new build and expansion regasification capacity additions by 2027. India and Germany follow with 5.0tcf and 2.5tcf, respectively.

Global new build and expansion LNG regasification capacity by key countries, 2023–2027 (bcf)*

Among planned and announced terminals expected to start operations by 2027, Tangshan II and Zhoushan II, both in China, lead globally with the highest LNG regasification capacity of 584bcf for each of the terminals. Seomkum in South Korea and Matarbari II in Bangladesh, follow with regasification capacities of 565bcf and 548bcf, respectively.

Further details on capacity additions and capex spending in the LNG regasification segment for the period 2023 to 2027 can be found in GlobalData’s new report, 'LNG Regasification Terminals Capacity and Capital Expenditure (CapEx) Forecast by Region, Key Countries, Companies and Projects (New Build, Expansion, Planned and Announced), 2023-2027'.