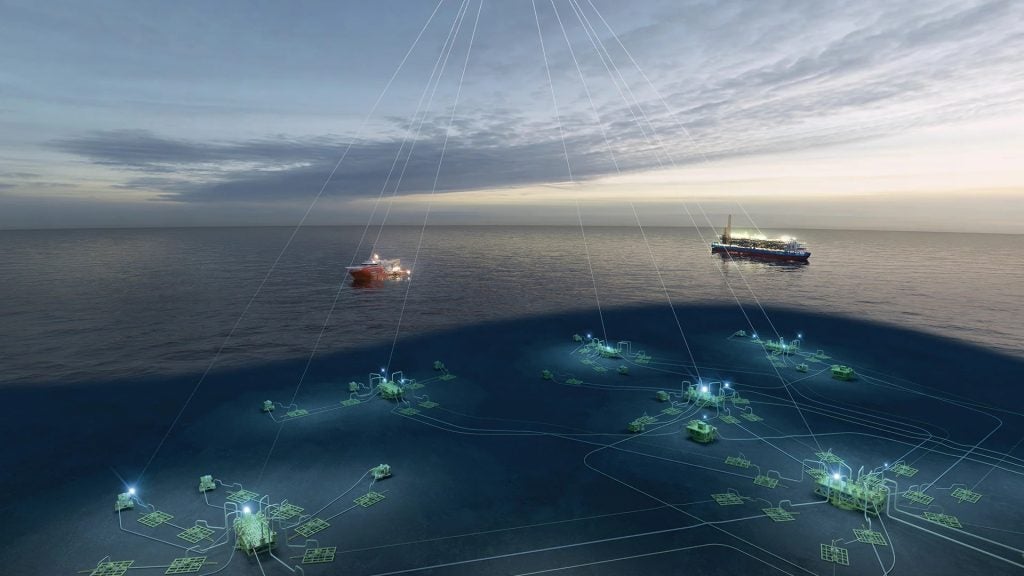

Oilfield services companies Aker Solutions, SLB (formerly Schlumberger) and Subsea7 have received approval from competition authorities for their proposed subsea joint venture (JV).

The JV, which was announced last August, will see the companies bring together their subsea businesses.

This includes deep reservoir domain and engineering design experience, field-proven subsea production and processing technology portfolios, manufacturing scale and capabilities, and a full range of life-of-field solutions.

In a statement, Aker said that all regulatory permissions and clearances, including those needed in Angola, Australia, Brazil, Mozambique, Norway, the UK, and the US, have been secured.

“The joint venture is planned as a milestone in subsea production economics, helping customers unlock reserves, reduce time to first oil, lower development costs and achieve decarbonisation goals,” Aker noted, adding that all the approvals and clearances obtained were unconditional.

The parties will now seek to fulfil the last-minute closing requirements to complete the process in the fourth quarter of 2023.

Upon completion, SLB will control a 70% stake in the JV, and Aker and Subsea 7 will own the remaining 20% and 10% stake, respectively.

Globally, the combined entity will employ around 9,000 people.

As per the terms of the initial agreement, at closing Aker will receive $306.5m (€279.4m) in shares from SLB, $306.5m in cash from Subsea 7 and a promissory note from the JV worth $87.5m.

At the time of the announcement of the JV, SLB CEO Olivier Le Peuch said: “As investment in the offshore market – particularly in deepwater – continues to increase, our customers will benefit from enhanced services that leverage digital and technological innovation to drive improved subsea asset performance while increasing energy efficiency and reducing CO₂ emissions.”