Abu Dhabi National Oil Company (ADNOC) has taken the final investment decision (FID) for a new LNG export terminal in Al Ruwais, Abu Dhabi.

The state-backed oil and gas company has also awarded a $5.5bn (Dh20.2bn) engineering, procurement and construction (EPC) contract for the project.

During the executive committee meeting of the ADNOC board of directors, Crown Prince Sheikh Khaled bin Mohamed bin Zayed Al Nahyan endorsed the FID and EPC contract award for the Ruwais LNG project.

The contract has been granted to a consortium led by Technip Energies, with partners JGC Corporation and NMDC Energy.

Technip Energies CEO Arnaud Pieton said: “We are honoured to have been awarded by ADNOC the Ruwais LNG project, a pioneering initiative in the LNG sector. By powering electrified LNG trains with nuclear energy, this project sets a new standard for energy security and sustainability.

“By leveraging our low-carbon and electrified LNG leadership we will support ADNOC’s position as a reliable global natural gas supplier and commitment to decarbonisation.”

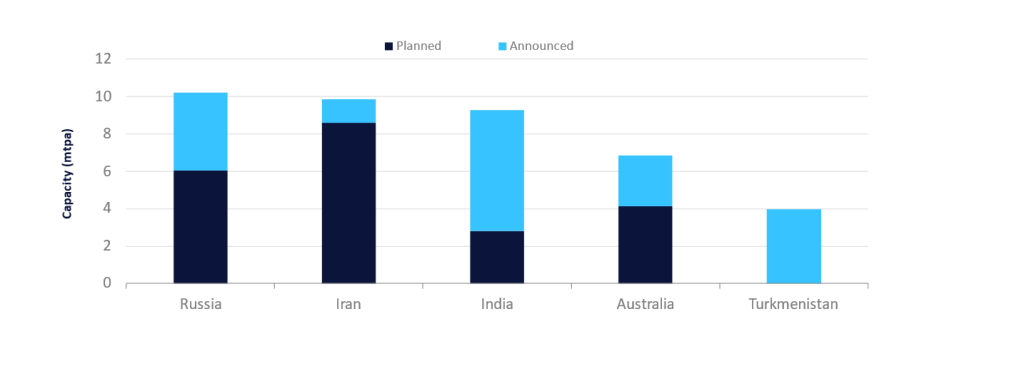

The Ruwais LNG project will feature two liquefaction trains with a combined capacity of 9.6 million tonnes per annum (mtpa), effectively more than doubling ADNOC's current LNG production to approximately 15mtpa.

Set to be the first LNG export terminal in the Middle East and North Africa (MENA) region powered by clean energy, the Ruwais facility is expected have low carbon intensity.

It will also leverage AI and advanced technologies to bolster safety, reduce emissions and improve operational efficiency.

As part of efforts to expand its global LNG footprint, ADNOC last month agreed to acquire a 10% equity stake in the Area 4 concession in Mozambique’s Rovuma basin from Galp.

This acquisition would provide ADNOC with a share of LNG production from a concession with a capacity exceeding 25mtpa, including the operational Coral South Floating LNG (FLNG) facility and the upcoming Coral North FLNG and Rovuma LNG onshore developments.

ADNOC's investment in Mozambique followed its purchase of an 11.7% stake in the Rio Grande LNG project in Brownsville, Texas, US, and the signing of an LNG offtake agreement.