The UK and US have tightened rules relating to the enforcement of a price cap placed on Russian oil by the G7 in an effort to make circumventing the sanctions more difficult for Moscow.

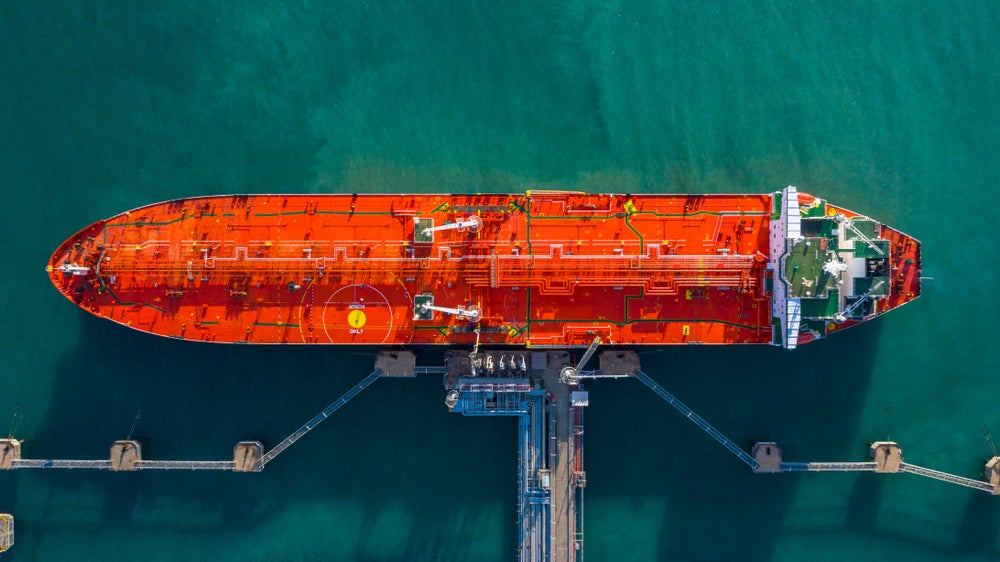

The price cap of $60 per barrel for seaborne Russian oil, which allows Russia to export oil to third-party countries using EU and G7 tankers and financial institutions only if it is sold for $60 per barrel or less, was initially imposed last December as western allies moved to limit Russian profits from its energy products amid its ongoing invasion of Ukraine.

New rules published on Wednesday 20 December 2023, by the US Treasury will require companies involved in shipping Russian crude to prepare fresh documentation to show explicitly that each oil transportation journey has complied with the price cap. Previously, vague reassurances by companies that the cap would be obeyed have been generally accepted.

Similar enforcement rules are being written up by other member nations of the ‘price cap coalition’, which comprises G7 nations, the EU, and Australia, the Treasury said.

“Today’s designations demonstrate our commitment to upholding the principles of the price cap policy, which advance the goals of supporting stable energy markets while reducing Russian revenues to fund its war against Ukraine,” said Deputy Secretary of the Treasury Wally Adeyemo.

“Participants in the maritime transport of Russian oil, especially Tier 1 actors like traders, must adhere to the compliance guidelines agreed upon by the Price Cap Coalition or face the consequences,” he added.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUnder the new rules, oil sold at a price that includes other western services, such as insurance and transportation, insurers and other service providers will be given the authority to demand a break-down of cost information to ensure price caps are being maintained.

Price cap coalition member nations hope that the tightened regulations will limit “under-the-radar” traders from circumventing the price cap by charging low prices per barrel for crude oil and then making up the difference above and beyond the cap by overinflating fees for additional services.

Russia has been largely managing to avoid profit losses from the sanctions by building a ‘shadow fleet’ of oil tankers that are not linked to price cap coalition members and therefore have no obligation to abide by the regulations.

Stricter enforcement comes after the Treasury said in August that the cap was working to reduce Russian revenue. US Acting Assistant Secretary for Economic Policy Eric Van Nostrand said at the time he was “confident that the price cap is achieving its twin goals of restricting Russian revenues while helping stabilise energy markets” despite ongoing market volatility.

October saw the first sanctions announced by the Treasury against two companies that had bought Russian crude above the price cap. The latest update includes further sanctions on more companies that have been dishonest with their trade practices.