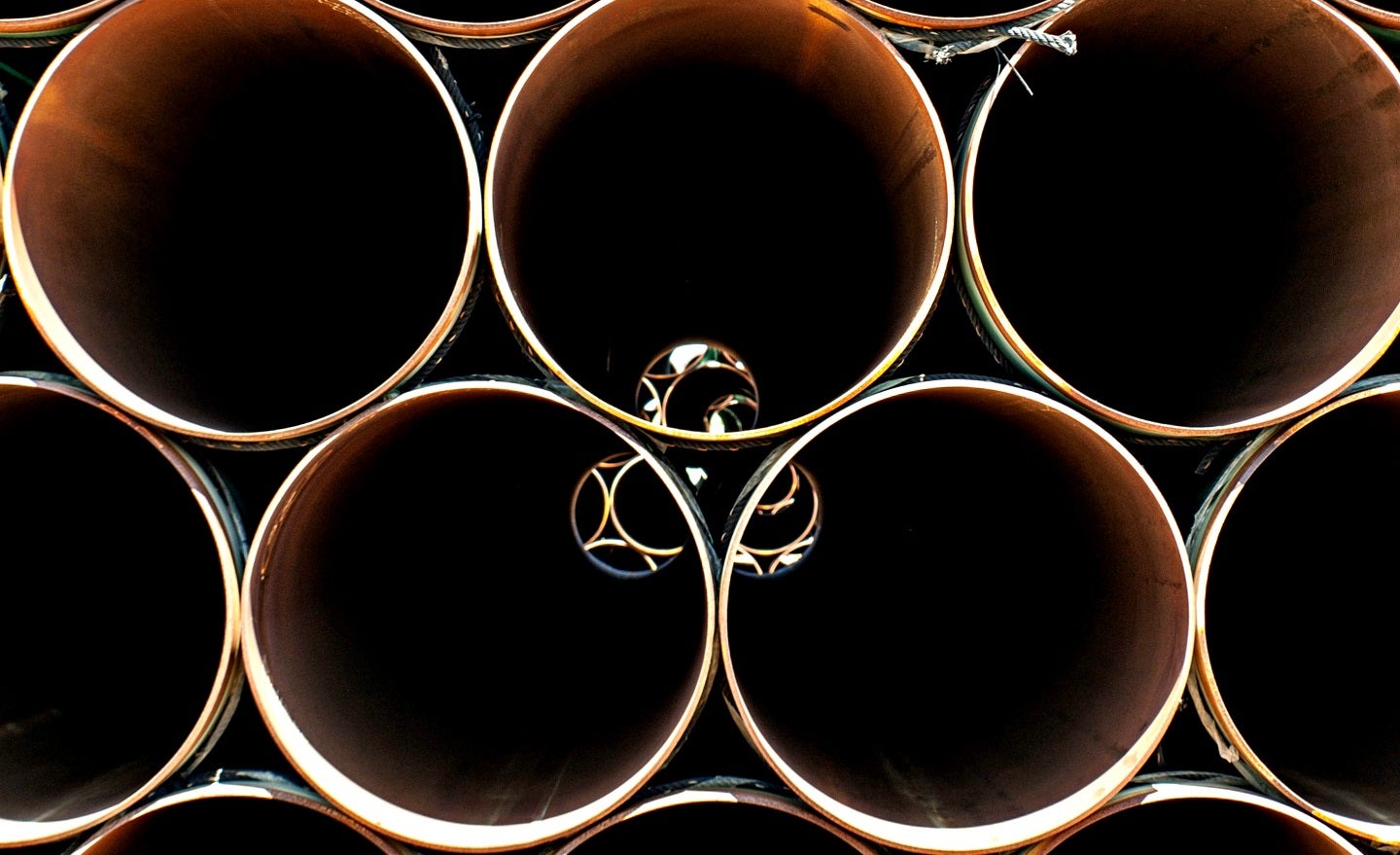

The board of North American pipeline company TC Energy has approved its plan to split into two separate energy infrastructure companies by spinning off its Liquids Pipelines business.

The spinoff will result in creation of two entities – TC Energy and Liquids Pipelines Company (LPC).

Bevin Wirzba, who is currently TC Canadian natural gas and liquids pipelines executive vice-president, will become CEO of LPC.

The decision to spilt into two independent, investment-grade, publicly listed companies follows the completion of a two-year strategic review and will help reduce debt.

The company said in a statement: “The spinoff will unlock shareholder value by providing both companies with the flexibility to pursue their own growth objectives through disciplined capital allocation, enhancing efficiencies and driving operational excellence.”

TC Energy will focus on natural gas infrastructure spanning 93,700km, as well as nuclear, pumped hydro energy storage and new energy opportunities.

Headquartered in Calgary, Canada, with an office in Houston, Texas, LPC will be a critical infrastructure company with highly strategic assets.

It will focus on enhancing the value of its asset base including 4,900km of existing crude oil pipelines. The assets also include the critical Keystone pipeline system.

In a press statement, TC Energy said: “As a low-risk business with 96% investment-grade customers and 88 per cent of comparable EBITDA contracted, the Liquids Pipelines Company retains the TC Energy premium value proposition, and expands upon it with the flexibility to focus on its competitive advantages.”

The spinoff is due to be completed in the second half of 2024 on a tax-free basis.