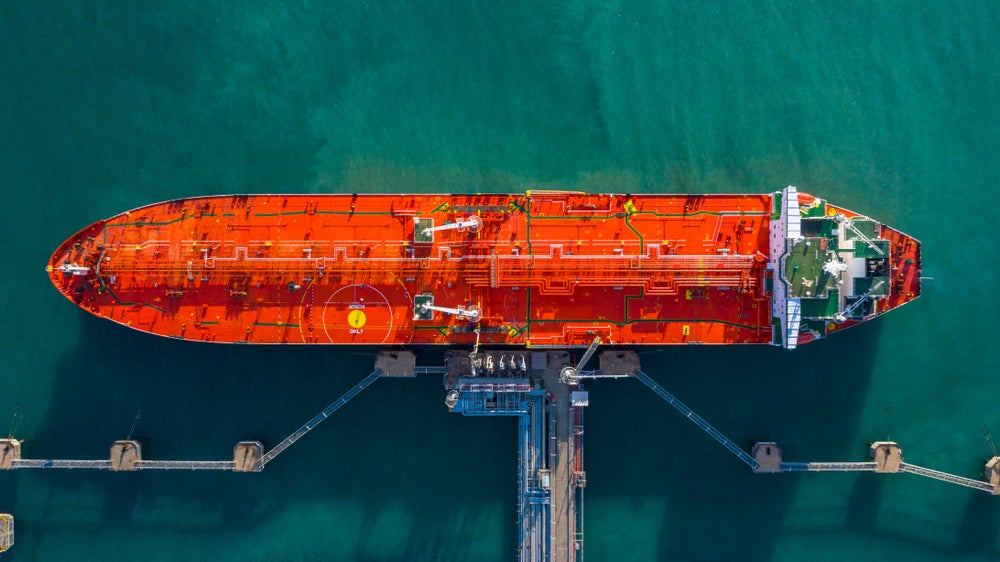

Three tankers carrying Sokol crude oil, previously stranded at sea after Western sanctions made shipping Russian oil more difficult, are now on the move again towards China and India, data from Kpler and the London Stock Exchange Group (LSEG) showed on Monday.

The backlog of tankers carrying Russian Sokol oil has become one of the biggest disruptions to Moscow’s oil trade since sanctions from the West, imposed after Russia’s invasion of Ukraine in 2022, came into force.

According to Reuters, more than ten million barrels of Sokol have been floating in seaborne storage over the past three months.

Payment complications and the impact of price caps from the West have slowed trade for Russian shipping companies and their vessels carrying the oil.

At the end of November last year, three major Greek shipping companies announced their exit from the Russian oil trade in a bid to avoid sanctions. Prior to this, all three companies – Minerva Marine, Thenamaris and TMS Tankers – were actively moving Russian crude and oil products from Europe to the rest of the world.

In January, shipping data showed that India’s exports of Russian crude fell for a second consecutive month in January to their lowest levels in a year. US sanctions caused several tankers that were meant to deliver Sokol crude to India to be diverted, with no shipments of the crude reaching the subcontinent last month.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNow, three vessels – NS Century, NS Commander and Nellis – which have been sitting in the sea since November, have begun moving again. NS Century and Nellis are carrying a combined 2.2 million barrels of Sokol to Chinese ports, according to data analytics company Kpler.

Both tankers will be subject to US sanctions, which have recently been tightened, for breaching the $60 per barrel price cap.

“China might be the solution to [Russia’s] problem [regarding Sokol sales] as at least two tankers that have been idling since November started moving towards Chinese territorial waters,” Viktor Katona, head of crude analysis at Kpler, told Reuters.

Some 7.5 million barrels of Sokol remained stuck at sea as of Monday, according to Kpler, down from more than ten million barrels two weeks earlier.