Russia said on Thursday that the US is unlikely to agree to a proposal from Ukraine to slash the current $60 price cap on Russian oil to $30 per barrel.

Moscow said such a move would muddy global energy markets and damage the US economy, slamming the idea as “beyond all bounds” of reality.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In an interview published on the Foreign Ministry website, Russian Foreign Minister Sergei Lavrov called a $30 price cap “outrageous”. He said: “I read the other day that Ukraine has been trying to convince Washington to halve the price cap for Russian oil, to $30 per barrel. This is outrageous, not to mention the fact that the idea of a price cap contradicts market rules and reflects a desire to dictate conditions.”

He added: “The US is unlikely to yield to Ukraine’s demand, if only because this would harm the Americans themselves and provoke undesirable reactions in the oil market. I hope the United States has at least some national pride left and will not dance to [Ukrainian President] Zelensky’s tune.”

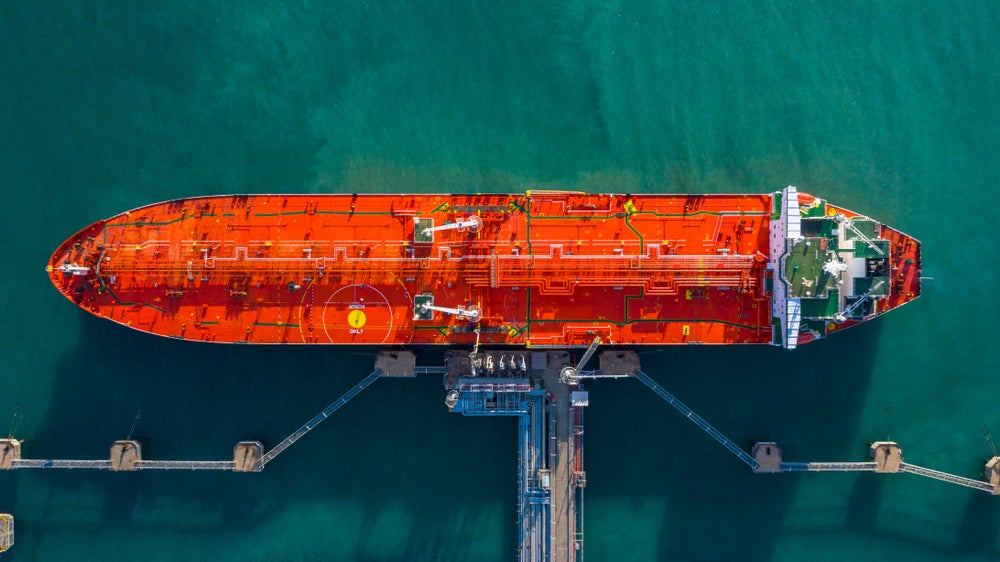

The US imposed the $60 per barrel price cap on seaborne oil at the end of 2022 to limit Moscow’s income from oil and oil products following Russian President Vladimir Putin’s full-scale invasion of Ukraine.

The cap allows Russia to export oil to third-party countries using EU and G7 tankers and financial institutions only if it is sold for $60 per barrel or less, which falls far under market prices. At 18:20 GMT, Brent crude prices were around $85 per barrel.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBefore the cap was officially set, Zelensky asked for a limit of $40 or lower, but the $60 has been maintained despite fluctuations in the oil market and calls from some other countries to lower the cap to further limit Russia’s revenue.

In December last year, the US tightened rules relating to enforcement of the price cap in an effort to make circumventing the sanctions more difficult. Dozens of shipping companies have now faced sanctions for trading above the $60 cap.