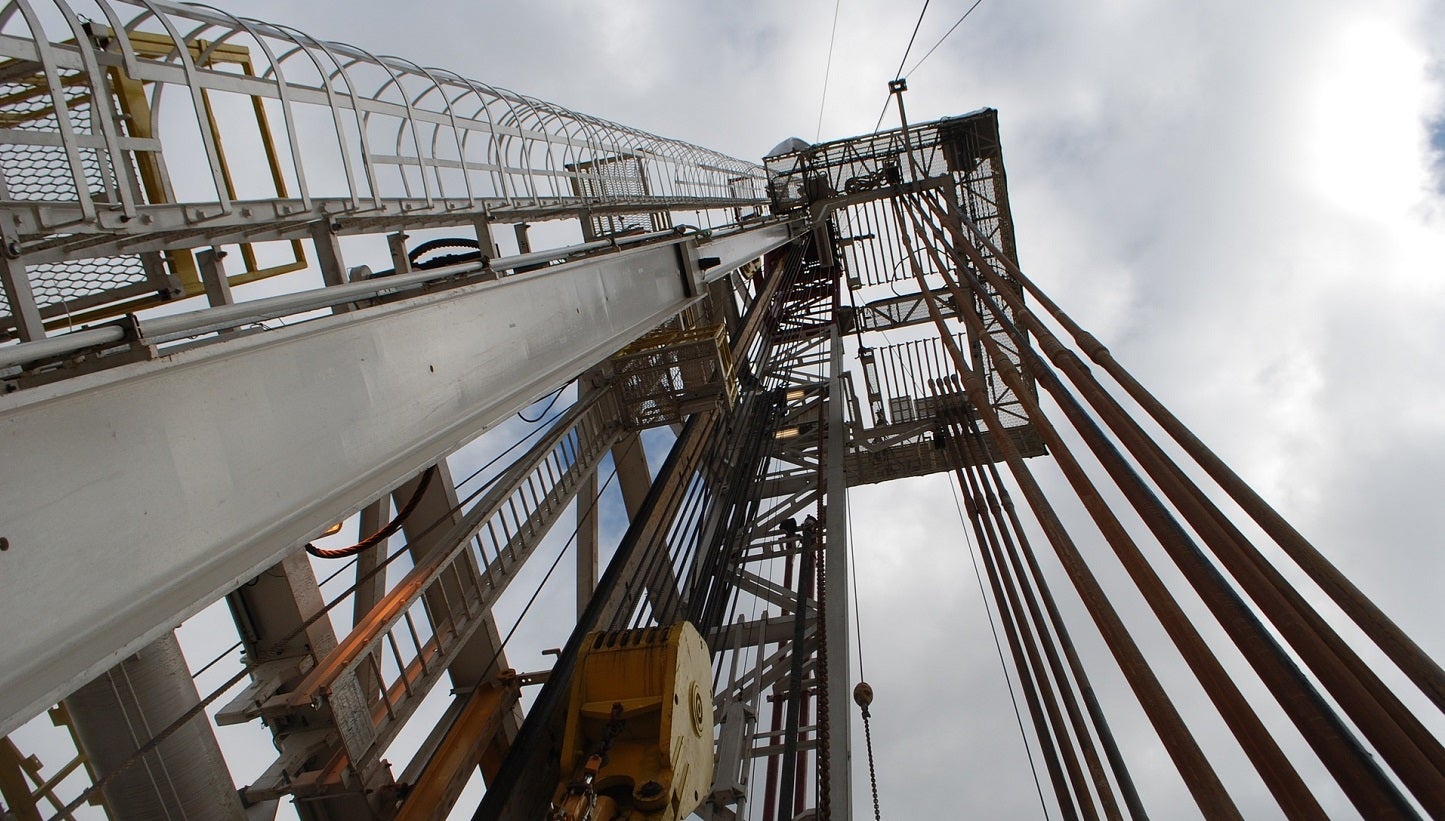

Riley Exploration Permian has agreed to acquire oil and gas assets from Pecos Oil & Gas (Pecos), an affiliate of Cibolo Energy Partners, in an all-cash deal worth $330m.

Under the deal, Riley Exploration will acquire 11,700 total contiguous net acres in Eddy County, New Mexico, US.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

These assets currently have production rates of 7.2 million barrels of oil equivalent per day (boepd) and 4.2 million barrels of oil per day (bopd).

Riley Exploration plans to fund the acquisition through a combination of borrowings under its revolving credit facility and the proceeds from the issuance of new senior unsecured notes.

Subject to customary terms and conditions, including purchase price closing adjustments, the transaction is planned to close early in the second quarter of this year.

Riley Permian CEO and chairman Bobby Riley said: “Our team has been highly selective in reviewing acquisition opportunities, and this is a deal that fits our criteria, as it brings over 100 high quality drilling locations and provides immediate accretion to relevant financial metrics.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“This is an under-developed asset with extensive development potential, allowing for value creation potential through the drillbit.

“Our enhanced scale will improve our cost structure, will facilitate normalising development cadence, and may lead to oilfield service cost savings. Overall, we believe this transaction positions our company to continue delivering strong financial performance and shareholder returns.”

Truist Securities is acting as the financial advisor while Kirkland & Ellis, and Holland & Knight are acting as legal advisors to Riley Permian for the transaction.