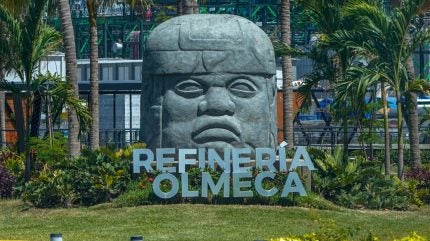

Pemex’s Olmeca oil refinery is unlikely to produce commercial quantities of fuels by the end of this year, despite the project being a showpiece development for current Mexican President Andrés Manuel López Obrador.

The newest facility for Petróleos Mexicanos, the Mexican state-owned petroleum company, has already suffered a series of delays, and a doubling of construction costs, as the country moves towards energy independence.

According to Reuters, citing unnamed sources familiar with operations, it would now not be impossible for the refinery to meet previously stated targets, namely reaching full production capacity in the coming weeks.

Reuters stated that neither Pemex nor the president’s office responded to requests for comment.

The sources said several engineers were working on individual parts of the refinery, which still need to be fully linked and integrated.

In fact, this last step was described as a months-long complex and agonising process, according to one of the sources.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnother source said that operationally “the refinery is fine so far, but the problem is the expectations that have been created”.

Another source said that even if all goes to plan, the first of two production lines would be ready between October and November, at the earliest.

The cost of the refinery is now estimated at close to $17bn (308.18bn pesos).

President Obrador inaugurated the 340,000-barrel-per-day (bpd) refinery in July 2022, stating at the time that it was a crucial step towards Mexico’s energy independence. When fully operational, it will increase the country’s refining capacity by almost 20%.

Mexico’s total oil and gas production was 1.9 million barrels of oil equivalent per day in 2023, according to figures from Offshore Technology’s parent company GlobalData.

The country remains the second-largest oil and gas producer in Latin America, although the hydrocarbons share of the economy has been decreasing as the country diversifies its export portfolio and struggles with the competitiveness of its crude petroleum exports.

In May 2024, Reuters reported that Pemex had started sending 16,300bpd of crude oil to the refinery in Obrador’s home state, Tabasco, which is less than 5% of its total capacity.

Obrador will be replaced by Claudia Sheinbaum in October after she was elected president in early June.

Pemex was also recently reportedly to be in talks with Mexican business investor Carlos Slim’s companies regarding the revival of the country’s first deep-water natural gas field, the Lakach field, which has been shelved twice previously.

Located 90km from the Gulf port of Veracruz, the field is estimated to hold 900 billion cubic feet of gas.

Pemex is looking to develop the offshore field through a service contract model, where partners finance projects upfront.