Norwegian oil and gas multinational Equinor, along with partners Var Energi and Petoro, have concluded that a downscaled ship-to-ship oil transfer terminal for the Johan Castberg field development offshore Norway would be too costly.

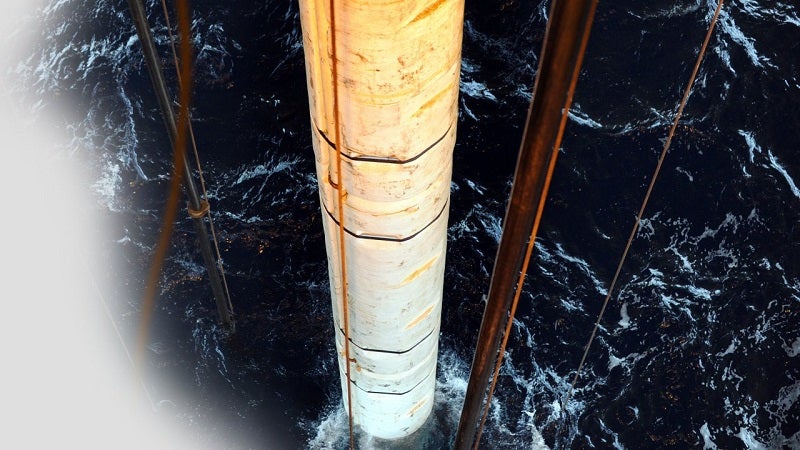

The Johan Castberg field development is located in production licence PL 532, 100km northwest of the Snøhvit field in the Barents Sea.

The project consists of three oil fields on the licence – Johan Castberg, Havis and Drivis – which are expected to produce around 200,000 barrels of oil equivalent per day (boepd) over an estimated operational life of 30 years when production starts in 2022.

Equinor is the operator of the licence with an operating interest of 50%, while Var Energi and Petoro have 30% and 20% interest respectively.

A study of ship-to-ship oil transfer from the Barents Sea by a quay in Finnmark county was initiated in March 2018. The study was based on estimates that indicated a much higher resource basis for the Johan Castberg area, but further exploration did not prove these expected resources.

Equinor executive vice president for technology, projects and drilling Anders Opedal said: “In a demanding period for the industry we have managed to develop Johan Castberg into a profitable project.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWe have, however, not been able to develop a profitable export solution for the Johan Castberg oil involving a terminal at Veidnes. The partners are therefore discontinuing their studies of ship-to-ship oil transfer for Johan Castberg in Finnmark.”

According to Equinor, the financial loss before tax for ship-to-ship oil transfer would have been around $400m (NOK 3.6bn) compared with exporting directly to the market, or NOK 2.8bn in a large-volume scenario. The 2014 oil price drop and uncertainty about phasing in future Barents Sea volumes also contributed to the decision to abandon the oil terminal project.

With the study concluded, the oil export from Johan Castberg will now go directly to the market, as described in previous plans for development and operation (PDO).

Opedal said: “It is important to the licence partners that the petroleum activity helps create local spinoffs. We have indeed left no stone unturned to find economically viable solutions for a terminal, however, we have not found the basis for pursuing the project.

“We will still continue the work of securing local spinoffs and jobs from the field both in the development and operating phases.”