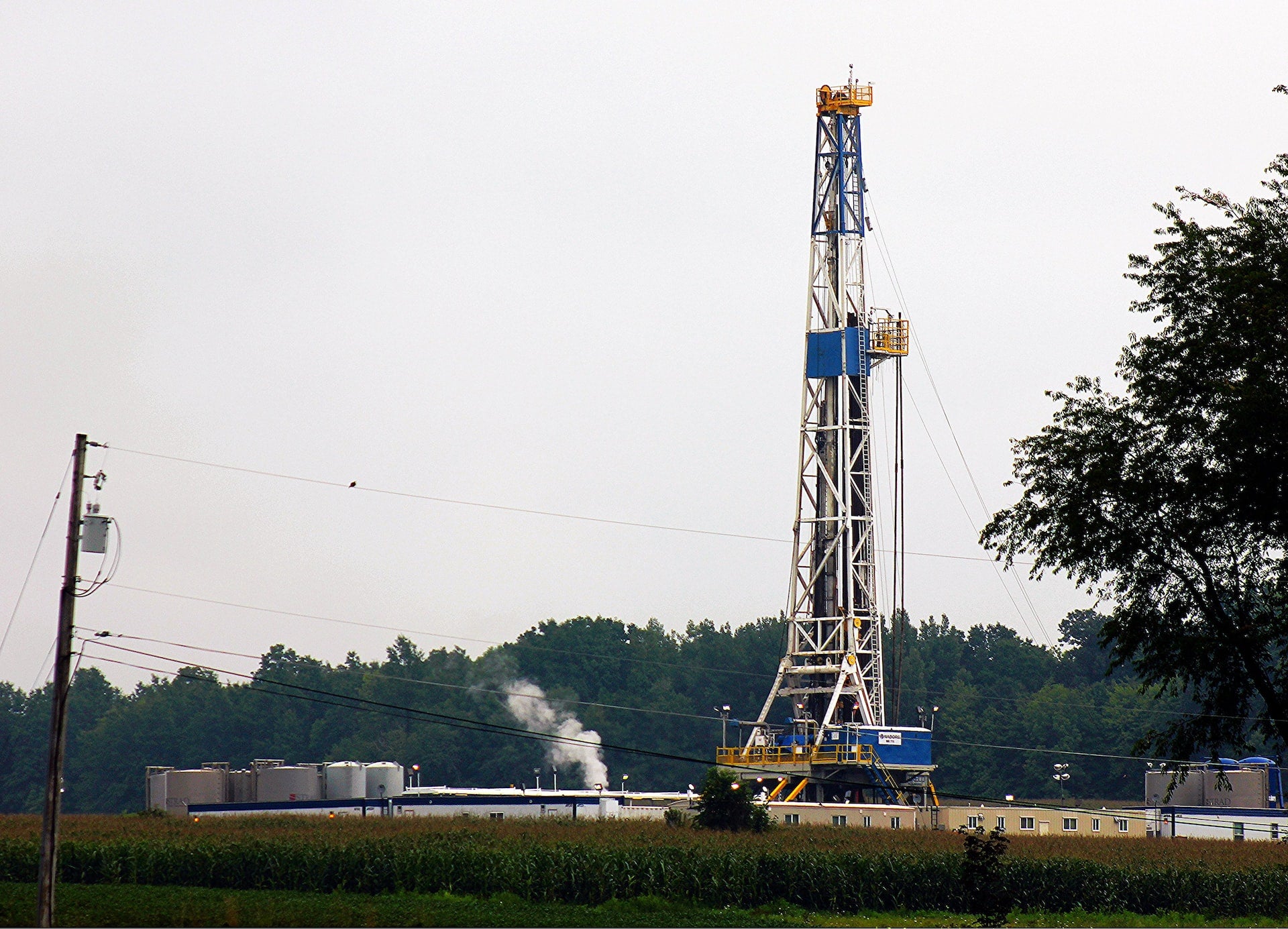

Crestwood Equity Partners has agreed to sell its Marcellus Shale gas gathering and compression assets to US-based Antero Midstream in a deal valued at $205m in cash.

The assets covered under the sale include 72 miles of dry gas gathering pipelines and nine compressor stations, with a compression capacity of approximately 700 million cubic feet per day.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The sale forms part of Crestwood’s long-term growth strategy to offload non-core assets to become a leading midstream operator in the Williston, Delaware, and Power River basins.

Proceeds from the sale will be used by Crestwood to enhance its financial flexibility by reducing debt and undertaking opportunistic common unit repurchases.

Crestwood founder, chairman, and CEO Robert Phillips said: “Over the past 18 months, Crestwood has strategically enhanced its asset portfolio to build competitive scale in its core basins, and as we focus on optimising and integrating the Oasis Midstream, Sendero Midstream, and CPJV acquisitions, today’s announcement highlights our confidence in the portfolio achieving our long-term leverage ratio target of sub 3.5x in 2023 and demonstrates our commitment to generating accretive unitholder returns and solidifying our financial flexibility for the future.”

Antero Midstream expects the acquisition to add nearly 425 undeveloped drilling locations, as well as increase its compression capacity by 20% and its gathering pipeline mileage by 15%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAntero Midstream chairman and CEO Paul Rady the acquisition will provide the firm with significant synergies that not only boost economics, but also lead to immediate free cash flow accretion.

Rady added: “The acquisition is consistent with Antero Midstream’s strategy of investing in infrastructure in the Marcellus, the lowest cost shale play, for high visibility customers, particularly Antero Resources.

“Importantly, the assets include underutilised gathering and compression capacity for capital efficient development from both Antero Resources and other third parties.”

Subject to customary regulatory approvals, the transaction is planned to close in the fourth quarter of 2022.