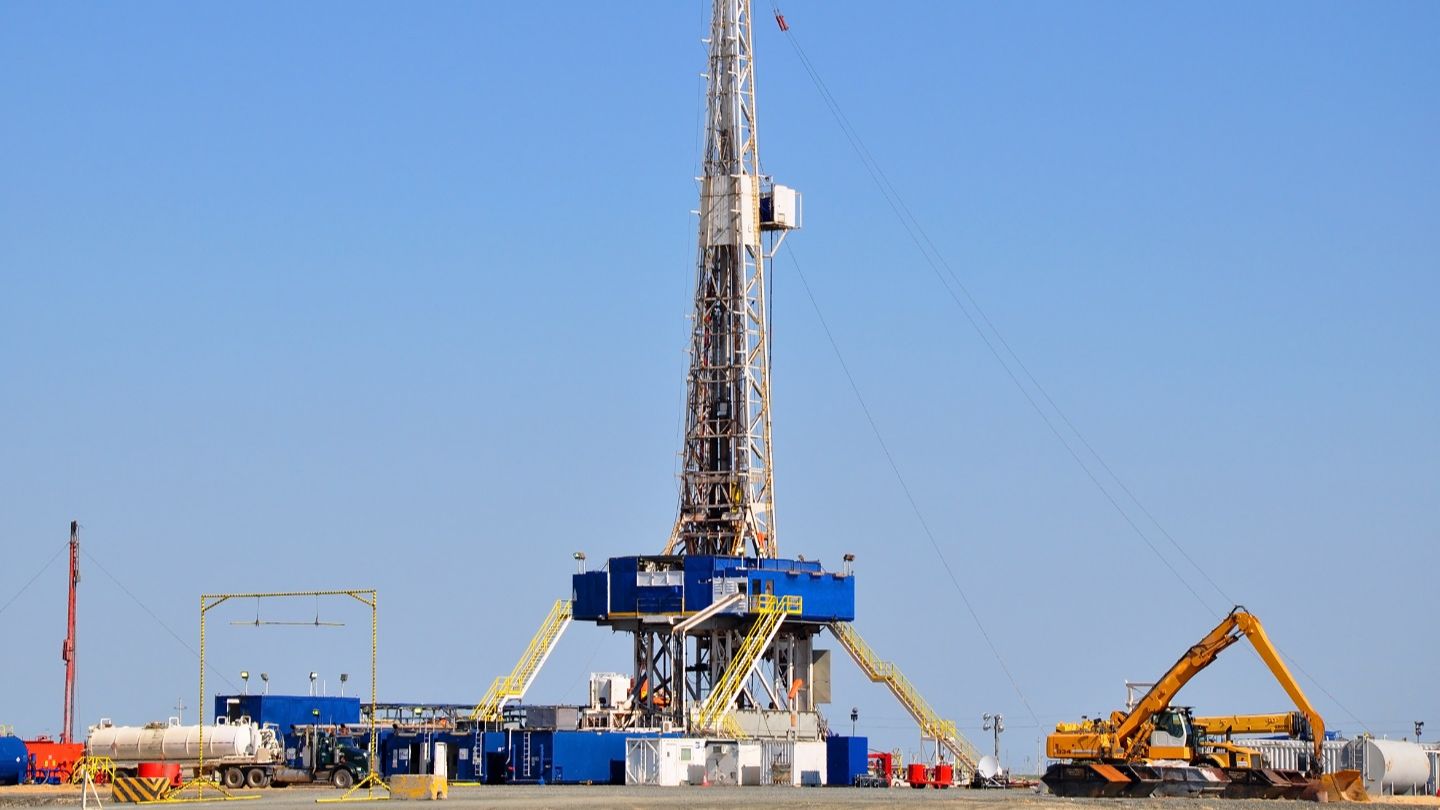

ADES International, an oil and gas drilling services provider, is set to move forward with its plan to list its shares on the Tadawul exchange in Riyadh, ZAWYA reported.

The company, which is supported by the Saudi sovereign wealth fund PIF, will free float 30% of its shares including a mix of existing and newly issued shares for the initial public offering (IPO). This amounts to 338.7 million shares.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The final offer price is expected to be announced on 18 next month after a book-building process.

ADES Investments, the Public Investment Fund (PIF) and Zamil Group Investment are the shareholders, who will sell their shares in the IPO.

This IPO is expected to rake in more than $1bn, Reuters reported last November.

The company was listed on the London Stock Exchange in 2017. PIF and Zamil Group Investment partnered with ADES Investments, to take the company private in 2021, when it was valued at $516m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe company secured approval from the Capital Market Authority, Saudi Arabia’s market regulator, for the listing, in June this year.

Reuters quoted ADES chairman Ayman Abbas as saying: “Since inception, ADES has grown from a local driller operating predominantly in North Africa to one of the largest drilling operators in the Middle East and North Africa region with a fleet of 85 rigs and operations spanning seven countries.”

He continued: “Our IPO will support us in continuing to deliver growth and cement our position as the leader in the jack-up drilling market in Saudi Arabia and globally.”

ADES’ main clients include Saudi Aramco, Kuwait Oil along with BP and Eni.