Fear runs deep in Houston. In an average year, offshore industry conferences would draw oil industrialists from across the world to the city. Events such as CERAWeek or the Offshore Technology Conference would bring a powerful network to the home of the US oil industry. However, 2020 was not an average year and Houston lost a lucrative revenue stream.

Local heavyweights such as Occidental or Marathon now fear the pledges of the new president. In his campaign, Joe Biden said he would stop oil leasing on land and sea owned by the government.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Federal land covers 28% of the US’ total land area and its Outer Continental Shelf in the Gulf of Mexico. Federal land covers most of Utah and Wyoming, including access to large reserves of shale gas. While Texas’ large reserves would remain generally unaffected by drilling restrictions, its massive Permian Basin crosses into New Mexico. Here, restrictions on government land would impede extraction for one of the country’s largest reserves.

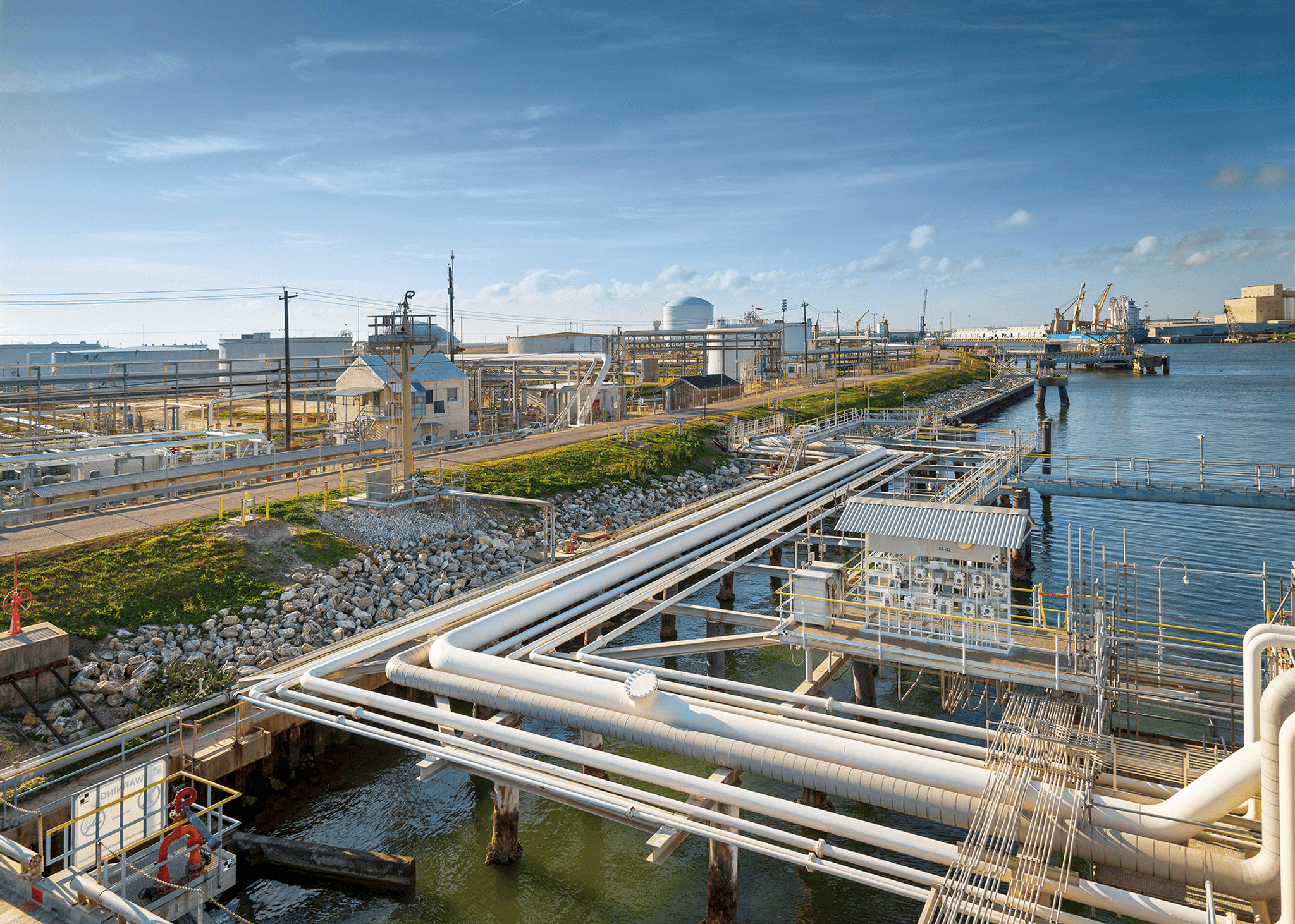

Houston lies 50 miles from the Gulf of Mexico, where operators make 15% of US oil and gas. A ban on extraction in federal waters would see the industry slowly wane from existence without new projects. Given its importance to residents, Houston’s newspaper has tracked local fears for its bedrock industry.

Houston reflects on fears for Gulf of Mexico oil and gas

“Future of offshore drilling in the Gulf hangs on Biden’s leasing pledge”, reads a Houston Chronicle headline from November. Trump aimed to paint Biden as anti-oil during the presidential race, leading another Chronicle reporter to wonder: “Did oil doom Biden in Texas?”.

During the election, the Chronicle carried the words of the largest US oil trade association, the American Petroleum Institute (API). Once the election’s winner became clear, the API sent its customary congratulations to the President-elect.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWithin this, president and CEO Mike Sommers wrote: “We will also be watching closely to ensure that the incoming administration keeps President-elect Biden’s campaign promises to the energy workforce and protects the millions of jobs supported by our industry in states like New Mexico, Ohio, Pennsylvania, and across the country.”

Industry representatives say “tax revenue and millions of jobs” hang on leasing pledge

One week before Biden’s inauguration, Sommers gave a keynote speech on the state of the industry in 2021. He emphasised oil’s role in creating chemicals to fight Covid-19, and the effect the virus has had on the industry. At times, he emphasised how oil and gas form an “essential” part of the energy transition and how the API’s approach to Biden will emphasise its ability to keep power costs down.

However, Sommers made his view clear: “From afar, it’s easy to call for bans on leasing or fracking. But up close, the reality is that fracking is safe, a marvel of technology, critical to this nation’s energy security and a lifeline to local economies, governments, and schools. Take all that away, and millions in local tax revenue and millions of jobs, go right with it.”

In the last four years, oil and gas companies have benefitted from Donald Trump’s anti-regulation stance. Trump removed checks on safety measures, limited states from object to projects, and removed methane emissions reporting regulations.

On the last of these, the industry had mixed reactions. While some smaller operators welcomed the lifting of “burdensome” regulations, giants such as BP and ExxonMobil objected. ExxonMobil upstream senior vice president Bart Cahir said in a blog post: “In our view, the move misses the mark, especially since the Environmental Protection Agency will no longer take action on existing sources.”

But could Biden’s reforms save the industry from itself?

Biden could be exactly what ExxonMobil needs. In October, the Chronicle carried the headline “Biden would be good for oil prices”, citing Goldman Sachs. Elsewhere, analysts have looked at Exxon’s poor performance over the last four years, and suggest “Since Trump was a disaster for ExxonMobil stock, Biden could do better”.

Finding similar articles is not difficult, and neither is finding oil reserves in the US. Trump’s deregulation has allowed oil supplies to increase further while the market suffers with oversupply. Lower production could raise prices, allowing Gulf of Mexico fields to become more profitable.

Even the idea of lower supply levels may spur on the markets, as Trump has given producers the ability to circumvent new laws. In the last few months, companies have bought up large amounts of offshore licenses, giving them some flexibility regardless of new legislation.

Senior energy analyst for S&P Global Platts Sami Yahya told the Houston Chronicle: “One of the main likely drivers behind the slightly better-than-expected performance of November’s lease auction is the looming regulatory uncertainty that will come with a change of a US administration.”

On the other side of the world, OPEC has reached the same conclusions around oil prices, agreeing a net production cut in 2021. In doing so, they have laid the foundations for the US to capitalise from rolling back its most expensive fields. Because of its short project lifespan, this would likely come from onshore shale gas, leaving the Gulf of Mexico in a better position.

Analysis by Rystad Energy expects large oversupply in the first quarter of 2021, followed by undersupply from May, as economic activity increases. It also warns: “A change of administration in the US could mean that Iran’s supply comes back faster than we anticipate in our current base case. This could be either because Biden’s team decides to remove sanctions altogether, or because countries like China or India feel confident enough that the new administration will turn a blind eye to the existing sanctions and ramp up imports from Iran.”

This further increase in production would drive down oil prices, just when they seem to be recovering from last year.

Can Biden still act to change oil and gas in the Gulf of Mexico?

Even with Biden’s party controlling all branches of government, political commentators have said he will probably not be able to affect radical change. Some elected Democrats have already voiced their concern about Biden’s energy policies, such as those representing the coal-reliant state of West Virginia. The president’s narrow majority means these lawmakers could cause Biden to weaken his policies for them to gain approval.

Doug Getten, energy partner in the Houston office of global law firm Paul Hastings, says: “I think it is less likely that you’d see comprehensive legislation related to the Gulf of Mexico specifically or even federal lands more broadly.

“The more likely result is that you see a slowdown in permitting or leasing of federal lands. Further, you could see the Bureau of Ocean Energy Management returning to Obama-era policies, requiring more plugging and abandoning, making it more difficult to operate in the Gulf.”

What will remain of Biden’s pledged oil and gas reforms?

As part of his changes for oil and gas, Biden would reverse Trump’s methane deregulation with an executive order. Alongside this, the Democrats have advocated for “strong federal standards and targeted support for repairing and replacing aging distribution systems”.

Given moderate industry support for this, it seems likely to gain support in both political parties. However, measures such as removing oil subsidies could prove more difficult to pass. Obama attempted to pass similar legislation with a stronger majority, but his effort came in vain.

Without the support of the branches of government, Biden would likely rely on executive orders and rule changes in government agencies. These are generally weaker and more easily undone by future leaders. Getten continues: “In the end, I’d be more concerned about executive action than legislative. Democratic congresspeople from Texas, Louisiana, or Mississippi would resist legislation with a negative impact on the Gulf.

“I think Biden will, at a minimum, tighten regulations related to greenhouse gas emissions that were rolled back under the Trump administration. I don’t think this means we will see a ban on hydraulic fractioning, at least early on in the administration.

“However, I think, and the oil and gas industry has made it clear in securities filings, that they agree that permitting will slow down.”