Growing global demand for energy and petrochemicals, coupled with ongoing energy security concerns, could prompt rising demand for oil into 2030, despite the rapid deployment of green energy, according to a GlobalData response to the IEA’s recent Oil 2024 report.

The IEA found that oil markets face challenges as medium-term structural shifts are expected to cause excess supply in six years’ time, with green and energy-saving technologies helping to gradually slow the pace of oil demand growth.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

It added that weaker macroeconomic expectations and unprecedented investment in alternatives will also push current oil users towards greener technology.

However, GlobalData analysts pointed out that overall energy demand continues to grow, and if carbon capture, utilisation and storage technology becomes more cost-effective, it could lessen the trade-off between oil production and climate goals.

In fact, oil and gas companies are still bearish about the widespread adoption of clean energy alternatives across various sectors.

Energy security

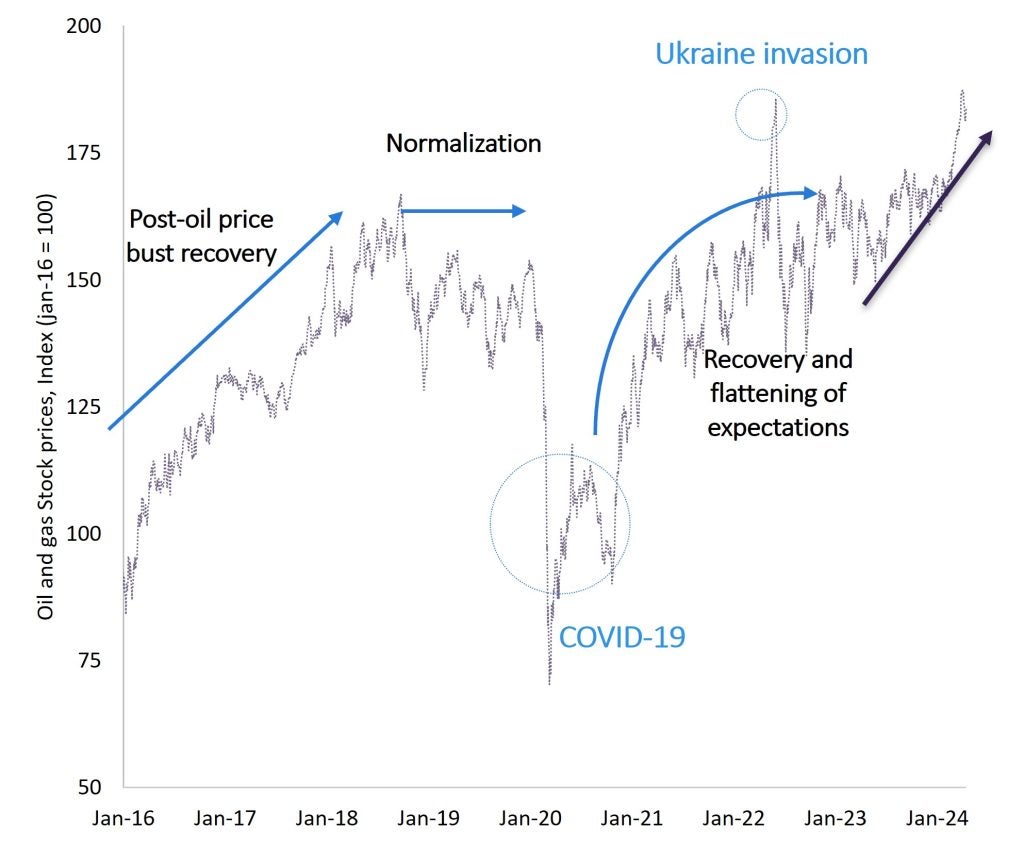

The analysts also pointed out that the oil market is highly dynamic, with forecasts often influenced by short to medium-term dynamics that may not persist in the long run.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor example, 20 years ago, the primary concern was oil supply limitations rather than demand. This is why forecasts are updated annually, as unexpected events and trends can significantly impact projections.

The analysts also emphasise that energy security concerns will prevent many nations from completely phasing out oil, as it remains a readily available source of energy.

The IEA also suggested that over the next few years supply and demand growth will mostly come from natural gas liquids and condensate. The energy body also argued that, along with declining demand for gasoline, refineries will have to adapt to these market changes.

Regional variations

GlobalData’s forecast aligns with the IEA’s expectation that demand growth between now and 2030 will be driven primarily by petrochemical demand in China, as well as oil being used as an energy source in India.

Developed economies, in contrast, are expected to experience lower demand by the end of the decade.

However, GlobalData forecasts indicate that Mexico’s demand increase will closely match the decline seen in Canada and the US, keeping overall North American demand relatively stable.

GlobalData Oil and Gas Stock Price Index

This forecast is set to hold in particular in the event of a Republican victory in the upcoming US election, said the analysts, and given Mexican President-Elect Claudia Sheinbaum’s energy independency approach.

Demand in Africa, Latin America and the Middle East is also expected to grow, but these regions will contribute only marginally to overall global demand.

The analysts also added that the trend of increasing non-OPEC production has been evident since the US shale oil boom. Recent developments, such as Brazil’s determined effort to play a major role in the crude oil market, and the emergence of Guyana, will continue to drive this trend.

As production becomes more fragmented, the burden on OPEC+ to restrain production to keep prices up will become increasingly futile, said the analysts. The risk of producers failing to anticipate or coordinate to prevent oversupply is real, so an oversupply scenario should not be completely disregarded.

Prices and market dynamics

In terms of prices, a low oil price scenario would force non-competitive players to bear losses, narrow their markets or exit the market altogether, said the analysts.

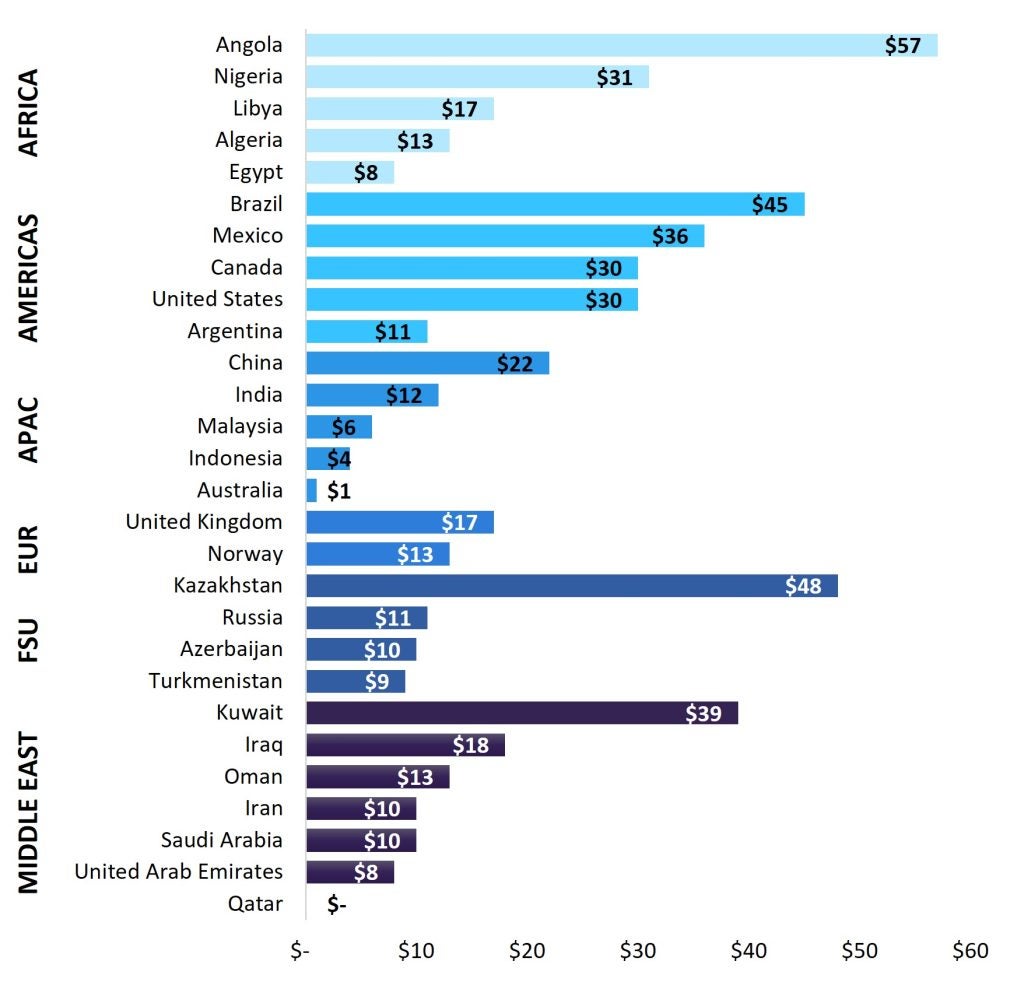

Industry experts agree that the $60 per barrel (bbl) benchmark is a critical breaking point for many countries with a large share of fields having near or higher breakeven oil prices.

According to GlobalData’s fields database, breakeven oil prices vary significantly, with many producers in the Americas and other non-OPEC members having average breakeven prices of more than $20–30/bbl higher than Qatar, the world’s most competitive producer.

Breakeven oil price relative to Qatar

Since OPEC+ members generally have the lowest marginal costs per barrel, a low-price scenario would particularly impact countries such as Brazil, Mexico and Argentina.

These countries have a significant share of production dominated by national oil companies that contribute substantially to fiscal revenues, forcing them to decide how much loss to bear and which fields to prioritise.

Similarly, argued the GlobalData analysts, countries such as the US and Canada would face tough decisions: either increase imports from the Middle East and OPEC+ countries, risking energy security, or find fiscal ways and means to make their industries competitive.

Overall, a low-price scenario would be less detrimental for OPEC+ countries, potentially allowing them to regain market share and eventually stabilise prices again, they concluded.