The world’s tenth-largest oil and gas company has become despised. Western democracies and their allies have committed to disrupting, isolating, and bringing down Russia and its largest state-owned enterprise, Gazprom. Without exaggeration, investors cannot abandon the company fast enough.

Before the invasion, Russia’s aggressive negotiations in Eastern Europe caused Baltic states to criticise the country. In Moldova, Gazprom offered the government cheaper gas if they weakened ties with the EU in October 2021. In an ominous move, in August 2021, Gazprom cut Ukraine out of a transit deal delivering gas to Hungary.

There is no implication that directors of Gazprom played any direct role in the Russian leader’s decision to invade Ukraine. However, Russia’s political system rewards successful businesspeople with significant political power. Beside this, the company’s essential role in state finances has made it an obvious target for Western leaders looking to impose financial sanctions.

The damage so far

In oil and gas, public image comes in different shades of bad. The perception of riches coming from bribery, corruption, pollution, and climate change denial has permanently stained the industry. Polling company Yougov has said that at any time, one in four British adults would describe the industry as “not ethical at all”.

But even within oil and gas, Gazprom has never enjoyed the same level of public favour enjoyed by Total, ExxonMobil, or Chevron in Western countries. Having an increasingly dictatorial state as a majority owner has not helped the situation. Democracies do begrudging deals with Gazprom, but now even that seems tasteless. The war in Ukraine has quickly shifted public opinion against continuing these deals, leaving Gazprom in the cold.

The UK has closed its debt and equity markets to the company. Shell and BP, headquartered within the country, have started exiting joint equity deals with the company. Equinor has made similar moves, as Norway removes Russian investments in the country. The EU and US has sanctioned multiple individuals linked with Gazprom and, to a lesser extent, Rosneft. On a wider level, sanctions against Russian banks, including Gazprombank itself, will hurt the economic environment where Gazprom trades.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe alternatives for Gazprom, and how it could save face

This view is not universally shared. Europe, North America, most of Oceania, parts of South America and Africa, and smaller democracies in East Asia have denounced the attack on Ukraine. However, this leaves the world’s two most populous countries, India and China, ready to trade with Gazprom.

Many expect that, with gas flows to Europe falling, Gazprom will deal with China. According to Russian state media, pipeline exports to China tripled in 2021. Not long before the invasion, the two countries agreed a 30-year gas supply deal. On 1 March, Gazprom signed contracts for design and surveying work for the new Soyuz Vostok pipeline.

In the near term, infrastructure between the two countries remains relatively limited. Russia cannot divert European gas flows into Asia in the same volume. Increasing gas sales to other countries would require significant shipping capabilities, which poses its own problems with terminalling, liquefaction facilities, and waters made unnavigable by sanctions against Russian ships.

These do not rule out a new gas trade across east and south-east Asia, but do not make creating that trade any easier. Although the trading ties between the two countries have grown, China still keeps a wary political distance from Russia. Following the invasion, several nations in Africa, Asia, and Oceania have done the same.

Gazprom beyond oil and gas

Beyond the physical and economic fronts, war has come online. Russia has declared war on open, truthful information by suppressing free press and social media within the country. This free press rarely reports on the fronts of cyber warfare, which remain difficult to quantify. However, some real consequences of online fights have become apparent.

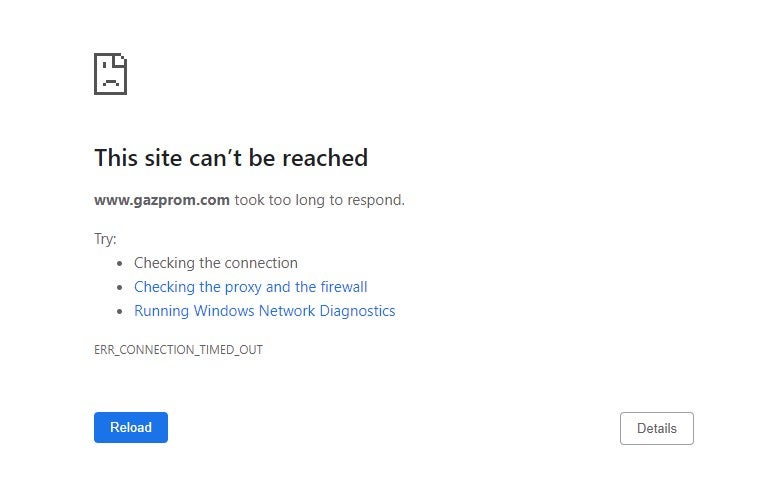

Hackers from Ukraine, as well as allied nations, have declared open season on Gazprom’s cyber infrastructure. Ukraine’s “IT Army”, a volunteer body instructed by the country’s government, has declared Gazprom one of its main targets. The group has joined others in attacking Gazprom websites, initiating distributed denial of service (DDoS) attacks against them.

While measuring the effectiveness of the group remains difficult, Gazprom’s website has frequently fallen offline since the invasion. The IT Army has asked its members about their ability to perform more intrusive cyberattacks beyond DDoS-ing, but no evidence of these has yet surfaced.

On the other hand, decentralised hacking collective Anonymous has taken credit for attacking Gazprom, as well as websites of its subsidiaries. While Gazprom made its name in oil and gas, the company holds extensive investments in many industries, including media and banking. Gazprom Media and Gazprombank have also become specific targets for hackers, ironically exposing the company to greater risk via diversification.

These brands have become toxic in Western countries. International sports federations have ejected Russian sportspeople, representatives, and sponsors following the invasion. Football teams that receive millions from Russian sponsors now refuse to compete while wearing Gazprom branding. Despite a history of corruption allegations, European football body UEFA now considers association with Gazprom to be damaging to its brand. Even gambling publications have written about the potential risks of Gazprom sponsorship.

Market fallout from Ukraine invasion continues

Between 16 February, one week before the invasion, and stock market close on the day following the overnight invasion, Gazprom stocks lost 38% of their value. This ignores a much sharper peak during the day, that caused a pause in trading.

But this dramatic figure hides the reality: Gazprom does not need good PR to continue doing a good trade.

In an oil market note on 3 March, Rystad Energy CEO Jarand Rystad said: “We expect that Russian oil exports will plunge by one million barrels per day from the indirect impact of sanctions and voluntary actions by companies.

“Saudi Arabia and the UAE have spare capacity to replace these supplies but may not act immediately. Strategic reserves of 60 million barrels will be released by the US and the OECD through the year, while US production levels will only manage to respond meaningfully towards the end of the year. The net impact is that oil prices are likely to continue to climb – potentially beyond $130 per barrel.”

However, the key point came in a later note on gas flows by senior analyst Kaushal Ramesh: “Global consumers are shunning Russian gas and LNG, pushing prices higher as short-term energy security and reliability take precedence over energy transition priorities. […] Fundamental drivers have by now taken a back seat in driving prices.

“Despite the rising anti-Russian gas sentiment, day on day flows from Russia are largely unchanged.”

In fact, as oil prices rise, Europe has paid much more to Russia for its petrochemicla connection.

Business as usual?

In the free world, public relations matter, and share prices reflect that. In Russia, the only appearance that matters is that presented to Vladimir Putin, regardless of underlying results. Anything else is unnecessary, and Gazprom knows this.

At time of writing, Europe remains hooked on Russian gas, and Russia deeply requires any payment it receives. Analysts remain uncertain whether Europe will kick the habit, or whether Russia will pre-empt the move by cutting Europe off. Regardless, this possibility has pushed up prices while the gas still flows. Western investors expect tough times for Gazprom, based on the company’s bad public image, but until gas flows stop, the company will remain cherished by the Russian state.

Since the price crash following the initial invasion, shares in Gazprom on the Moscow exchange have risen from RUB130 to RUB228. But even this cannot answer the ultimate question of the scale of damage to Gazprom. Since 28 February, Russia’s central bank has closed its stock exchange, preventing share prices from reflecting recent events. The bank has said the market will remain closed until at least 8 March.

Stock markets would usually allow investors to roughly gauge interest in a company. This simply does not apply to Gazprom. The company does not play by the same rules as companies outside Russia, and as a keystone in the Russian state, it has no reason to.

Meanwhile in Europe, the debate over Russian gas continues. While cutting out Russian gas immediately and entirely remains possible, the public and private costs make the choice unappealing. Instead, nations are looking at different levels of Russian gas rejection, while politicians calculate the economic cost of political will.

Unless European governments or Gazprom take drastic action, both will continue to profit, or at least mitigate costs, from international trade, regardless of whatever immorality the trade has. In this way, Gazprom sees business as usual.