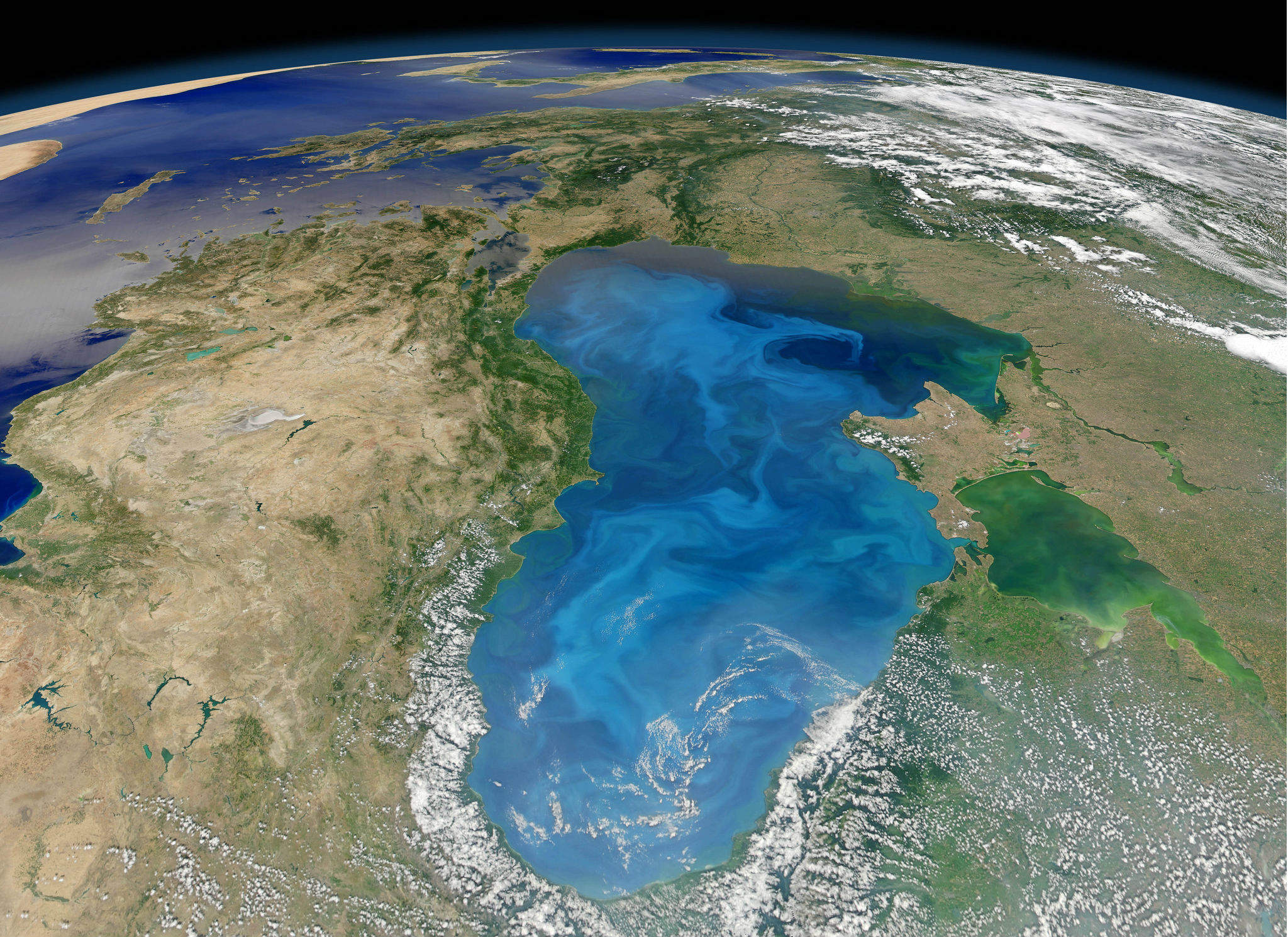

There is potential for oil and gas reserves in The Black Sea to be massive. Until recent years, countries showed little interest in the sea that sits between South East Europe and Western Asia, but due to a rapidly evolving energy landscape, diversification is moving to the top of the agenda.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The sea is surrounded by Romania, Bulgaria, Turkey, Ukraine, Georgia and Russia; all of which have started explorations in different regions. Turkey and Russia have previously supplied other surrounding countries with reasonably priced oil and gas, but technological advances mean that more countries have the opportunity to search for their own resources.

The big players

Total, OMV, Repsol, Turkish Petroleum Company (TPAO), Shell and ExxonMobil are all interested in what lies under the Black Sea. TPAO estimates there are up to ten billion barrels of oil in the region, and the various companies are working on several projects in different sections which are divided into ‘blocks’.

Exploration in the sea had been limited and sporadic until 2012 when the huge Romanian well Domino-1 provided the largest discovery in the Black Sea to date; 84 billion cubic meters of gas, in the country’s block called Neptun.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSpurred on by this discovery, ExxonMobil teamed up with Austria’s OMV to join the exploration of Neptun. Together the companies built the Ocean Endeavour rig, which is drilling a well called Pelican South-1 wildcat in the hope of finding further hydrocarbon reserves. ExxonMobil is also planning to explore the smaller Teres block in the Bulgarian part of the sea, which so far hasn’t received much attention from companies.

Total, OMV and Repsol are expected to start drilling for oil and gas in Bulgaria’s biggest offshore block, Han Asparuh, between February and May 2016. Two exploration wells are planned that will reach depths of over 5,000m.

In January 2014, TPAO and Shell began a joint 300m drilling project 100km off the coast of Istanbul, and the seismic vessel set sail in March to search for oil reserves. Turkish Energy Minister Taner Yildiz said this would likely result in big discoveries of oil and gas.

"Our first priority is to improve and use national energy resources as much as possible," he said at a press conference. "Our neighbouring countries such as Bulgaria and Romania have found natural gas and oil resources in this region, so that’s why we’re hopeful for this exploration venture of TPAO and Shell."

Bulgaria has also collaborated with Shell on deep water exploration in the Black Sea. Ultimately, the country wants to reduce its reliance on imports from Russia, and Shell was the only bidder for the 7,000km2 SIlistar block, having pledged $21m in seismic surveys.

"This is a very serious success for us and one of the most important steps towards diversifying our gas supplies," said Bulgarian Energy Minister Temenuzhka Petkova.

Confidence despite oil uncertainty

The western part of the Black Sea is one of the most promising hydrocarbon bearing areas in South East Europe. As supplies from Russia are less reliable than previously, countries with assets in the Black Sea are taking advantage of better, modern technologies available to them, as well as greater interest from private investors.

However, making a few large discoveries isn’t enough for some especially in a low oil price environment, for instance, exploration in the Teres block was cancelled due to a lack of investor interest. Also, drilling scheduled to start in Bulgaria’s Khan Asparuh block in mid-2015 has been delayed by a year. With any deep water exploration, there is no certainty of a reward.

Many oil companies are coming up against challenges, particularly now that there is a worldwide incentive to reduce the use of fossil fuels. Rough market conditions such as oil price volatility have affected TPAO’s drilling plans, delaying around half of the 130 wells that had been planned for work this year.

Despite this Turkey and Shell remain confident of their long-term projects. TPAO alone has invested around $4bn in offshore oil exploration in the Black Sea and the allure from previous discoveries is enough to encourage some companies, even in the face of uncertainty about the future of oil.

Shell upstream Turkey director Joris Grimbergen expressed his confidence, saying that: "Oil price developments won’t stop Shell from exploring. We’ll start drilling…a year before that planned."

The likelihood is that there is much oil and gas to be retrieved from the Black Sea, and some companies are bolder than others at putting their money into exploring. With the world edging towards renewables, the energy landscape could change dramatically over the next ten years, and oil and gas may play a far smaller role in the future. Nevertheless, for the time being, there are still plenty of buyers for any oil that is discovered.