At a glance, the global oil and gas industry could be considered healthy, at least from a production standpoint. Global crude oil output has jumped from just over 3 billion tons in 1990 to 4 billion tons in 2011, and has not fallen below this benchmark since. Demand for oil has never been higher, especially in countries such as China, which saw oil demand increase by 360,000 barrels per day in 2016 alone, the daily average consumption of the Philippines, and this is a trend that is set to continue.

There is also an environmental argument to the continued heightened demand for natural gas, with many countries switching from coal-powered operations to natural gas due to the relatively limited environmental impact. As a result, observers such as SP Global and the International Energy Association have dubbed this period the “golden age of gas,” with no sign of a slowdown in global demand or production.

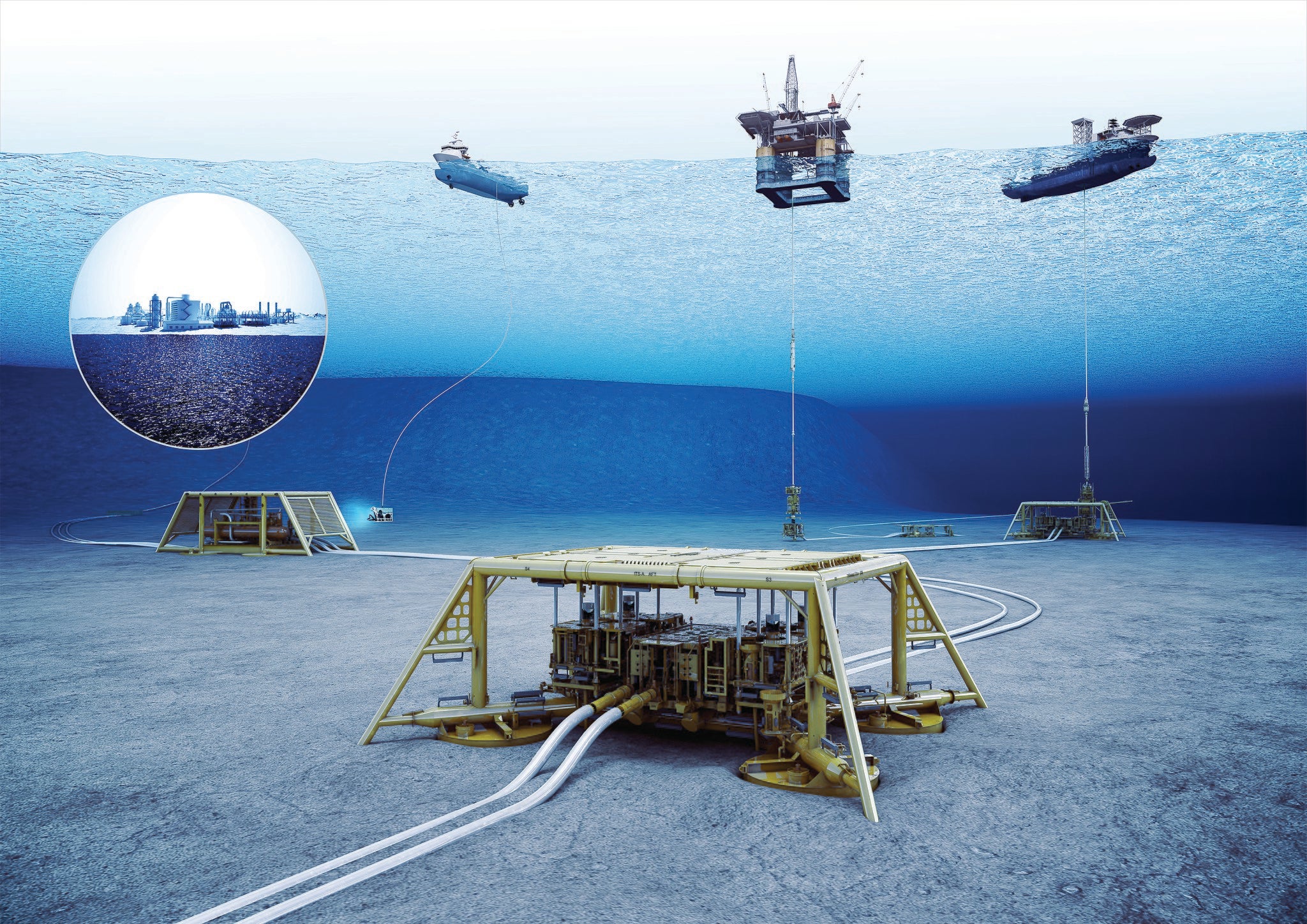

Yet these two industries face a significant challenge, and one from within their sectors. The subsea industry, represented by companies who produce the hardware and infrastructure that enables many of these oil and gas operations to function, is being increasingly put off by what some consider to be an overly demanding oil and gas sector, one that is pushing for greater production at a lower cost, to such an extent that it could be considered financially untenable.

Indeed, as the world shifts towards a cleaner energy mix, there are plenty of new opportunities for the subsea sector. The National Subsea Research Institute found that offshore wind expenditure is expected to reach around $276bn, while food from the world’s oceans could be worth an additional $1tn, two emerging industries that the subsea sector has the experience and expertise to make a splash in, and raising the prospect of the subsea and oil and gas sectors drifting apart in the future.

Internal stress and external pressure

Behind this concern amongst the subsea industry is the challenges that have faced the oil and gas sector more broadly, and undermine the broad strokes of progress made over the last few decades. The 2014 oil price crash, which saw the price of Brent crude collapse from $115 per barrel in June 2014 to $49 per barrel six months later, not only shook global oil and gas markets, but encouraged new innovation in the sector, such as the process of fracking, both of which threaten the existing relationship between oil and gas majors and the subsea industry.

“With the low number of subsea Christmas tree orders, a key barometer of the health of the industry, it’s clear that 2020 will be one of the worst in our history,” said Neil Gordon, chief executive of Subsea UK.

These “Christmas trees”, structures comprising valves and pipes that enable operators to test, service, and regulate the flow of produced oil, are an integral part of the subsea industry, and a downturn in sales volume is concerning, at least in the short term.

“However, indications from Rystad point to an increase in Christmas tree orders in 2021 and towards a relatively quick recovery towards the end of next year,” said Gordon. “But there will be the inevitable lag as projects filter through, leading to a contracting of the supply chain. A weakened supply chain is the biggest, and potentially most long term, threat we face.”

This threat to the oil and gas supply chain could be considered an internal one, insofar as it involves established players in the oil and gas industry, and the relationships and transactions between them. However, Gordon noted that external pressure in the form of the Covid-19 pandemic has added an additional set of unique challenges for the sector.

“Having only just started to recover from one of the most protracted downturns, Covid-19 and the subsequent collapse of oil and gas prices presented a double whammy for subsea companies,” he said. “With future prospects drying up almost overnight, opportunity and visibility have all but evaporated.

“This, coupled with the uncertainty around how to operate under the lockdown restrictions, has been one of the biggest challenges facing companies. The uncertainty around operating in a global pandemic will lessen as companies are getting over the initial shock and learning how to best manage their operations within the new norm.”

Challenges to the status quo

These pressures have strained the relationship between oil and gas majors and the subsea industry, introducing further instability and uncertainty to the sector. Gordon noted that the companies, in both industries, that can best adapt their operational and communicative processes will stand to do well.

“Those subsea companies who have been able to articulate how they add value and demonstrate how they can work co-operatively to increase efficiencies with long-term savings are best-placed to weather this storm,” he said. “There have been examples of best practice where customers and suppliers have worked collaboratively on driving efficiencies and considering value rather than cost, and understanding of the need to protect margins to ensure suppliers remain in business.”

However, he also said that there had been “some savage cost-cutting and some poor behaviour in how this is communicated,” suggesting that some actors in the sector have struggled to adapt to this rapidly changing industry. Stuart Payne, supply chain director at the UK’s Oil and Gas Authority, the government body charged with regulating the sector, claimed that some oil and gas companies had demanded suppliers cut rates by up to 40% overnight, a move which would have made many of these suppliers’ businesses financially untenable.

The result of these fractured relationships could be that the subsea industry moves away from oil and gas, at least to a small extent, and at least in the long term.

“While oil and gas is still the largest market for the subsea industry, diversification into other areas of underwater engineering is more important than ever,” said Gordon. “Offshore renewables now account for almost 25% of all subsea revenues.

“The subsea industry essentially comprises everything beneath the water line and represents a massive opportunity from offshore floating wind to hydrogen and CCUS [carbon capture, usage, and storage], defence, marine science, and aquaculture.”

The clean energy transition

This desire to diversify also reflects the subsea industry’s growing role in a clean energy transition, as they are one of many actors eager to minimise their environmental impacts. Gordon noted, however, that this transition would be most effective if it was achieved gradually.

“The energy transition is what it actually says, a ‘transition’ which means it is a period of change from one state to another,” he explained. “A strong oil and gas sector is therefore going to sustain and support the green recovery and this needs a number of initiatives to stimulate activity around projects in the short-term that will create supply chain demand and opportunity.

“The industry doesn’t want hand-outs, it wants to trade its way out of this downturn.”

This idea of aligning environmental protection with economic gain could prove to be an integral part of the future of the subsea industry. Gordon noted that extracting food, as opposed to oil, from the world’s oceans, could be a potential avenue for the subsea industry, as it looks to maintain its balance sheet while diversifying its activities.

“With an increasing amount of our food and energy coming from our oceans, this ‘blue economy’, estimated to be worth $1tn, represents significant opportunities for investment with substantial and sustainable returns,” he explained. “We need to work together in a sensitive way to manage this resource economically and responsibly, ensuring the future health of our oceans.”

In a similar vein, Ørsted has long been held up as the example to follow of an oil and gas company embracing clean energy, and more recent analysis has suggested that the renewable energy sector could be both environmentally sound, and highly profitable, for the industry. At the Subsea Expo held in Aberdeen in February, Wood Mackenzie analyst Mhairidh Evans noted that subsea investment in offshore wind could double over the next five years, with much of the annual $49.2bn investment in the sector coming from Europe.

New technological challenges in the offshore wind sector more broadly could also present opportunities for the subsea sector, which boasts leading experience and infrastructure to overcome these challenges. Figures from GlobalData show that offshore wind farms are being installed at lower depths – from an average depth of 30m below the surface of the water in 2018 to 33m a year later – presenting new technological and logistical challenges for the offshore clean energy sector.

However, the oil and gas industry looks set to remain the subsea sector’s biggest partner, at least in the short term, as the subsea industry delivers this gradual clean energy transition.

“Oil and gas remains the largest market for the subsea industry,” said Gordon. “There is significant potential in oil and gas for many years to come. Indeed, oil and gas is the key enabler in moving the dial in terms of the energy transition.

“As a society and an industry, we are much more aware of the value of our oceans and the need to protect them.”