Oil production in the US has been booming, with crude oil exports alone increasing to 1.6 million barrels per day (bpd) so far in 2018. This is up dramatically from 2016, when the US exported less than 0.5 million bpd.

To maintain export growth, facilities are going to have to continue to grow quickly in size and scale to avoid reliance on smaller and cost-ineffective ships. This is particularly pressing given the rise in very large crude carriers (VLCCs). These colossal ships can be as big as 180,000 to 320,000 dead weight tonnes (DWT), and require a very deep berth.

In order to facilitate these offshore giants, and enable the US to continue to grow as an exporter, Texas Gulf Terminals, a subsidiary of Swiss commodities trading company Trafigura, has proposed the construction of an offshore mega-terminal. The terminal will sit approximately 12.7 nautical miles off the coast of Corpus Christi, Texas.

“Texas Gulf Terminals is building a new offshore Deepwater Port facility that will safely, efficiently, and cost-effectively export US crude oil at a time when new infrastructure is critically needed,” says Corey Prologo, director of Texas Gulf Terminals and director of Trafigura, North America. “Oil production in Texas is booming but producers are facing a major infrastructure bottleneck as they try to move oil to markets where it can be sold.”

Bigger really is better

The offshore terminal will lie off the coast of Texas, where there are water depths of approximately 93ft. This will allow mega-tankers to dock and load in just 48 hours.

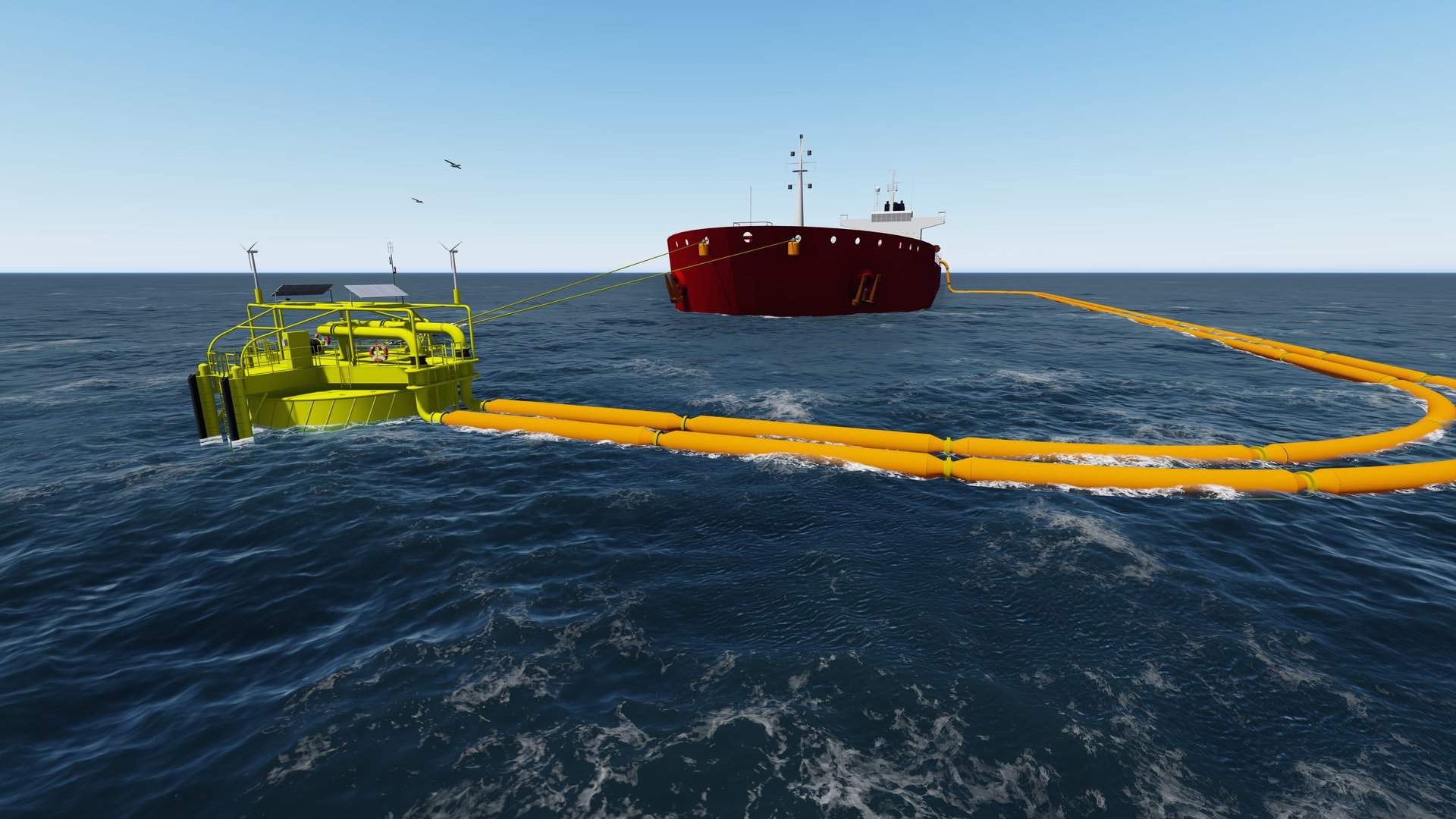

“Our Deepwater Port will use a single point mooring buoy system (SPM), which is a small buoy that is anchored offshore, to accommodate very large crude carriers (VLCCs) and other super tankers that cannot be fully loaded in US ports,” explains Prologo. “The buoy will be anchored out at sea and controlled from an onshore Control Center. Once our project is constructed, the Deepwater Port will ease infrastructure barriers to crude oil exports, grow the US economy, and support Texas jobs. Simply put, Texas oil needs a home, and we have part of the solution.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe project will use a similar system to the Louisiana Offshore Oil Port (LOOP), which is currently the only US port able to fully load a VLCC. However, LOOP is both an import and export facility, limiting its efficacy.

There are a number of benefits to using offshore deepwater ports as opposed to conventional inland ports such as the South Sabine Point and Southtex ports. “Currently, no US inland ports are capable of fully loading a VLCC, which is the most economical and efficient way of transporting crude around the world, carrying up to 2 million barrels per voyage,” says Prologo.

Once constructed, SPMs also have a lower risk of environmental damage. “Using SPMs eliminates unnecessary ship traffic in inland ports as well as the “double handling” of the same crude oil, reducing the opportunity for spills and emissions each time the crude oil is transferred,” says Prologo.

Past complaints causing new concerns

There are several challenges the project will need to overcome before this titan can become a reality. The Port of Corpus Christi, a nearby conduit for oil exports, has filed a letter asking to delay Texas Gulf Terminals’ application on the basis of a 12-year-old criminal case.

According to the Financial Times, the port’s lawyer Debra Tsuchiyama Baker wrote: “Because Texas Gulf Terminals has chosen to hide the identity or not provide required information for its other affiliates, there is no way to determine if they also have criminal convictions or have engaged in improper business practices.”

In 2006, Trafigura pleaded guilty to selling oil it falsely claimed came from the UN Oil-for-Food programme, a former scheme that allowed Iraq to sell oil in exchange for medicines, food and other humanitarian needs.

The Port of Corpus Christi has made millions of dollars from high-volume crude oil exports over the last few years. Should the Texas Gulf Terminal project go ahead, it is predicted that the port operator’s revenue could fall by 12%.

In order for Trafigura’s application to be approved, federal officials must be confident that the information provided by the company is accurate and meets all regulations. As part of this process, the United States Coast Guard, in cooperation with the Maritime Administration, is preparing an environmental impact statement. It is paramount that the project is found to meet all environmental regulations to begin construction within the delicate offshore ecosystem.

“Project construction would comply with all United States Army Corps of Engineers conditions and would incorporate Best Management Practices, including re-establishing pre-construction contours and restoring permanent vegetation to any impacted areas,” says Prologo. “We are committed to working closely with the appropriate agencies to minimise our environmental impact.”

Importance for the US

Despite challenges, the huge opportunity the port presents means it will likely go ahead.

“Our project is part of the solution to help resolve the infrastructure bottleneck that is currently preventing the optimal flow of US oil exports from Texas,” says Prologo. “As US crude oil production surges, oil exports have also grown, and are projected to reach 4.8 million bpd by 2022. Without new investment, today’s US export infrastructure will be unable to accommodate this volume, which will restrict production and slow economic growth.”

Expansion is clearly needed for the US to fully take advantage of the seemingly unquenchable demand of predominantly Asian nations for crude oil. A number of other companies and ports are also looking into alterations and additional projects that would be able to facilitate VLCC, including Enterprise Products Partners, Occidental Petroleum’s Corpus Christi facility and Jupiter.

“Once constructed, our project will handle only about 10% of the expected growth in US oil production,” says Prologo. “We need to be talking about how to get that other 90% that is projected to come online in the coming years out to market, whether that means additional offshore facilities, port upgrades, or all of the above.”

As US oil continues to boom, VLCCs will be needed to reduce costs and speed up exports, but until projects like Texas Gulf Terminals’ Offshore Deepwater Port comes online, progress is likely to be slow.