In the deepwater Gulf of Mexico (GoM), the existing pipeline and platform infrastructure have made tie-back opportunities a preferred way to optimise cost and commercialise discoveries.

An average daily production of 0.66 million barrels of oil equivalent (boe) is expected to be added to the US oil supply by 2023, from 30 upcoming projects, of which 23 are developed as tie-backs, with over US$67.4 billion of total capital expenditures (capex) spent.

Tie-back developments require on average a development capex per barrel (bbl) of US$9.64 compared to US$14.76 on average for other type of developments and their payback is quicker.

Tie-back developments have always been development options in the GoM for fields that were uneconomical with a standalone platform. Fields that are developed as tie-backs are smaller in scale than those developed with other facility types, have lower recoverable reserves, most of them below 100 million bbl and are mainly located in the proximity of the processing platform (less than 20 miles).

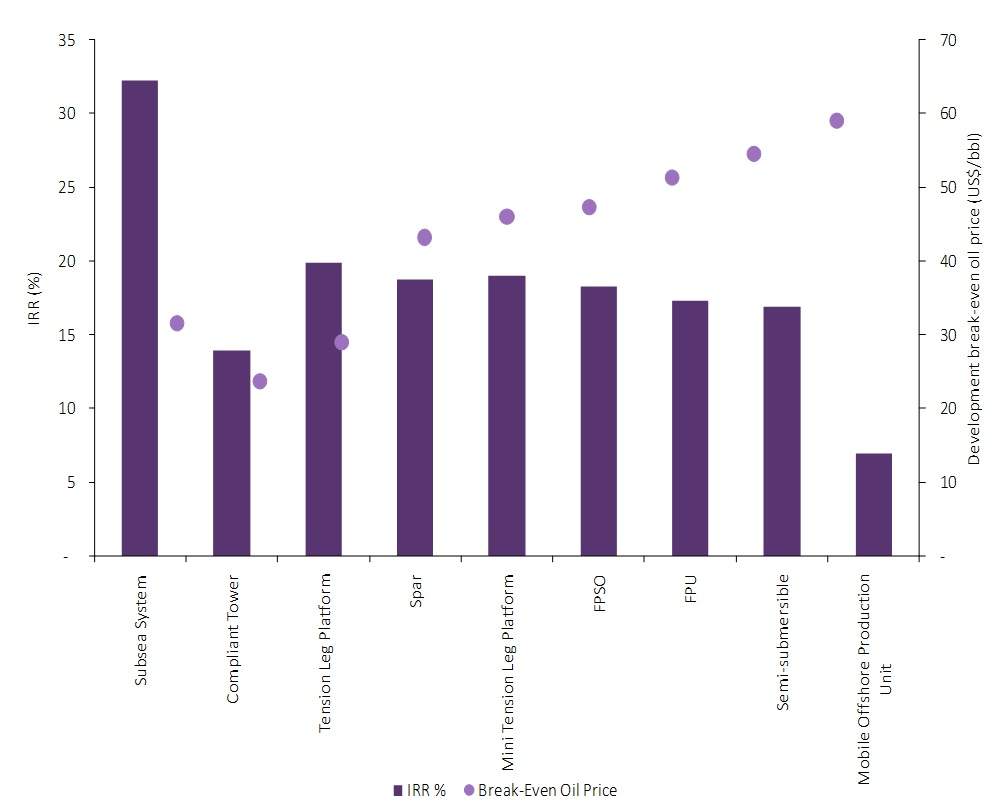

IRR and breakeven oil price by facility type

| Source: Upstream Analytics © GlobalData |

The current trend in GoM is in developing fields with smaller reserves. This is also supported by the fact that fewer fields with larger reserves are being discovered. As a result the trend of using subsea system as preferred development method for small reservoirs will continue. Moreover, as fields are entering mature stages in the GoM more processing capacity becomes available and even when platform upgrades are needed to tie-back a field, this is usually less expensive than the cost of building a new platform.

For more insight and data, visit the GlobalData Report Store – Offshore Technology is part of GlobalData Plc.