In 2018 Royal Dutch Shell plans to exit two mega-giant oil fields in Southern Iraq. The company received ministry approval in January to sell its 19.61% stake in the West Qurna-1 field to Itochu and plans to relinquish its entire 45% stake in the Majnoon field by the end of June this year.

Shell’s divestment of West Qurna-1 and exit from Majnoon, the only two oil assets it has in Iraq, aligns with the company’s $30bn divestment program. The company’s strategy aims to free up cash flow by reducing debt and dispose of projects with lower than average rates of return.

The decision to leave Majnoon is not surprising considering the field is estimated to have an internal rate of return (IRR) of 2.1%, significantly below southern Iraqi fields’ average of 19.3%.

Shell’s divestment in West Qurna-1 may have been harder to predict as the field boasts a healthier development IRR of 15.0%, however, the field requires a significant amount of capital expenditure. Over the past five years the field’s average annual capital expenditure has been estimated at $1.2bn per year. Divesting the field will further satisfy Shell’s objective to free up cash flow. Additionally, the divestment of these mega-projects has a profound effect on the share of crude oil in the company’s production and reserves mix, increasing the weighting of natural gas in line with a possible longer term objective. After the transactions takes place we estimate Shell’s remaining recoverable reserves to decrease from 26.2 billion boe (barrel of oil equivalent) to 25.8 billion boe.

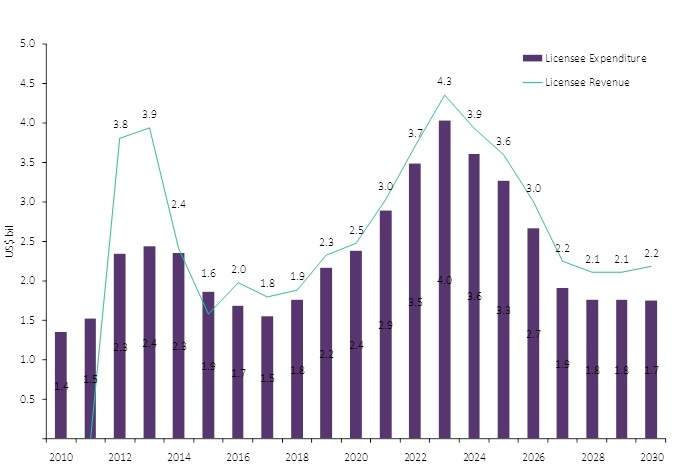

West Qurna-1 licensee expenditure Vs. licensee revenue

| Source: Upstream Analytics © GlobalData |