GlobalData expects the major oil and gas producing countries in the Middle East will offer opportunities for investment in 2018. A key event will be the expiry of Abu Dhabi’s offshore ADMA concession in March, being divided into three separate concessions, namely Lower Zakum, Umm Shaif and Nasr, and Satah Al Razboot and Umm Lulu.

Bids were reportedly received for the new concessions in Q4 2017, with the new concessions expected to introduce a more conventional royalty/tax regime compared to the fixed-margin regime of the old concession. Abu Dhabi’s national oil company ADNOC awarded a 10% stake in the new Lower Zakum concession to a consortium of Indian companies on 10 February 2018 for a participation fee of $600m.

March will also see the opening of a new onshore and offshore bid round in another emirate, Ras Al Khaimah, which hopes to attract new investment into the upstream sector after the Saleh field ceased production in 2016.

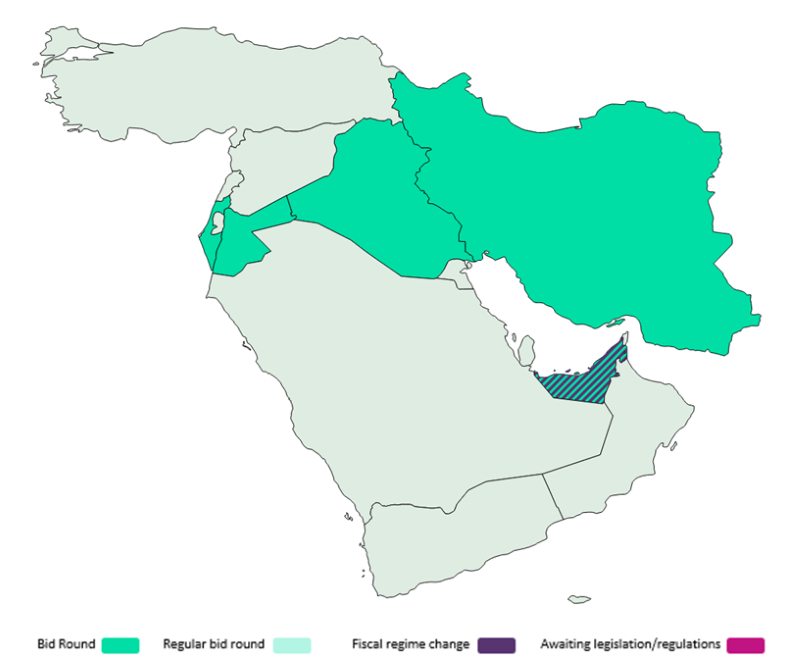

Iran’s efforts to attract investment in its upstream sector through the Iran Petroleum Contract continue, while Iraq has adopted a relatively flexible approach for its bid round closing in May, asking bidders to propose contract models. Israel is also planning a second offshore round to follow its round held in 2017.

Bid rounds, fiscal regime changes and pending legislation in 2018

Source: GlobalData Upstream Analytics