GlobalData’s latest report, ‘Global Methanol Capacity and Capital Expenditure Outlook, 2018 – IGP Methanol and NW Innovation Lead Global Capacity Additions’ states that the global methanol capacity is poised to see considerable growth over the next nine years, potentially increasing from 134.2 million tonnes per annum (mtpa) in 2017 to 243.1mtpa in 2026. Around 74 planned and announced plants are slated to come online in the next nine years, primarily in the Middle East and Asia.

Among regions, Asia leads with the largest capacity contribution globally, with a capacity of 96.3mtpa from 152 active plants by 2018. The main capacity contribution will be from an active plant, Zhongtian Hechuang Energy Company Ordos Methanol Plant, with a capacity of 3.6mtpa.

Among countries, China leads with the largest capacity contribution globally, with 81.5mtpa from 142 active plants, as of 2017, the main capacity contribution being from the above plant, Zhongtian Hechuang Energy Company Ordos Methanol Plant.

In terms of upcoming plants and the expansion of existing plants, among regions, the Middle East leads with the largest capacity additions, contributing 34.8mtpa from 23 planned and announced plants by 2025.

Among countries, Iran leads with the largest capacity additions, with a capacity of 30.4mtpa from 21 planned and announced plants by 2026.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobally, natural gas leads with the largest capacity, contributing a capacity of 71.7mtpa, as of 2017. It is followed by coal and naphtha, with a capacity of 61.4mtpa and 1.1mtpa, respectively. For the feedstock natural gas, the main capacity is from China, with a capacity of 8.7mtpa.

Methanex Corporation, China Coal Energy Company Limited, and China Petrochemical Corp are the top global producers of methanol, as of 2017. Methanex Corporation tops the list, with an estimated capacity contribution of 9.4mtpa from 11 plants globally. China Coal Energy Company Limited and China Petrochemical Corp follow with 3.7mtpa (three plants) and 3.6mtpa (nine plants), respectively.

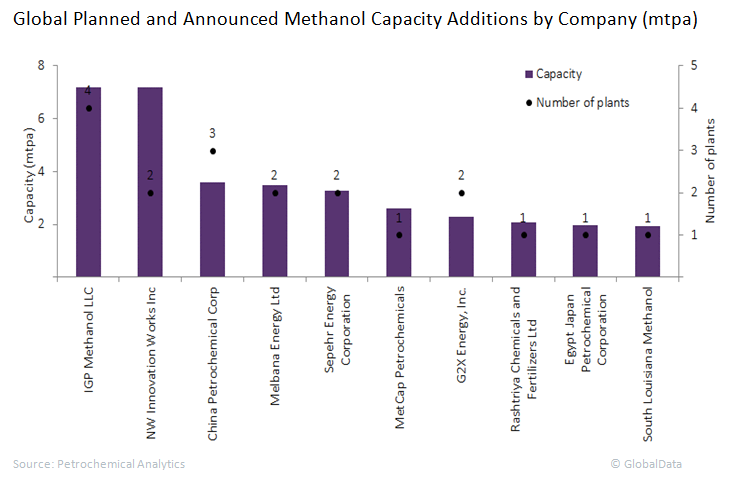

IGP Methanol LLC, NW Innovation Works Inc, and China Petrochemical Corp are the top three companies by planned and announced capacity additions globally over the next eight years, with capacities of 7.2mtpa, 7.2mtpa, and 3.6mtpa, respectively, in 2026.

Among regions, North America leads with estimated capital expenditure (capex) of $13.8 billion on 16 planned and announced methanol plants between 2018 and 2025. The main capex spending will be on NW Innovation Works St. Helens Methanol Plant, with $2.6 billion of capex spending.