ExxonMobil long-term strategy continues to be dependent on the future hydrocarbon demand after taking huge impairments in the US and international upstream assets, summing up to approximately $19bn, as the company performs a revision on the outlook on crude oil and natural gas demand. To address the increase in emissions and pressure from investors, ExxonMobil took a bigger stance and emphasised their plan to expand their carbon capture capacity.

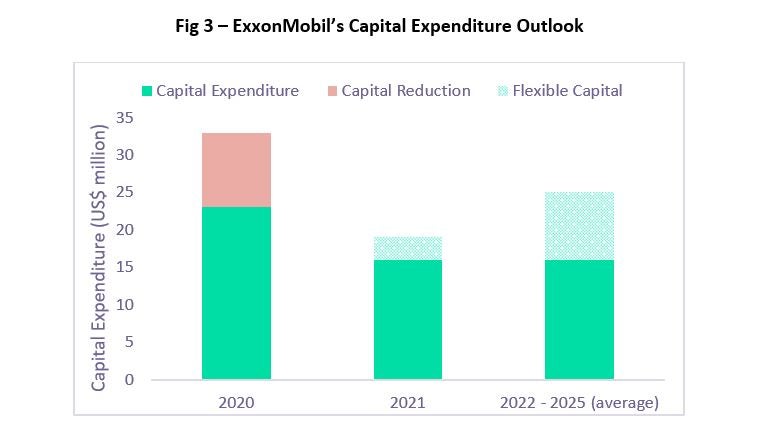

ExxonMobil has created a new business unit, Low Carbon Solutions, to focus on new Carbon Capture and Sequestration (CCS) opportunities to scale up the company’s initiative with partnerships discussed globally. The company is currently advancing up to 20 new plans with planned capital of $3bn through 2025. In 2019, carbon capture capacity in the US is standing at only 25 mtpa, which is merely 0.33% compared to up to 7500 mtpa emitted, which will require a great deal of effort to ramp up for future sustainability. The company reported that CCS is critical and cost-efficient to mitigate emission but is currently not on track to meet IEA Clean Energy Progress, capturing only 6% of the 114 million tonnes of carbon emitted in 2019.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

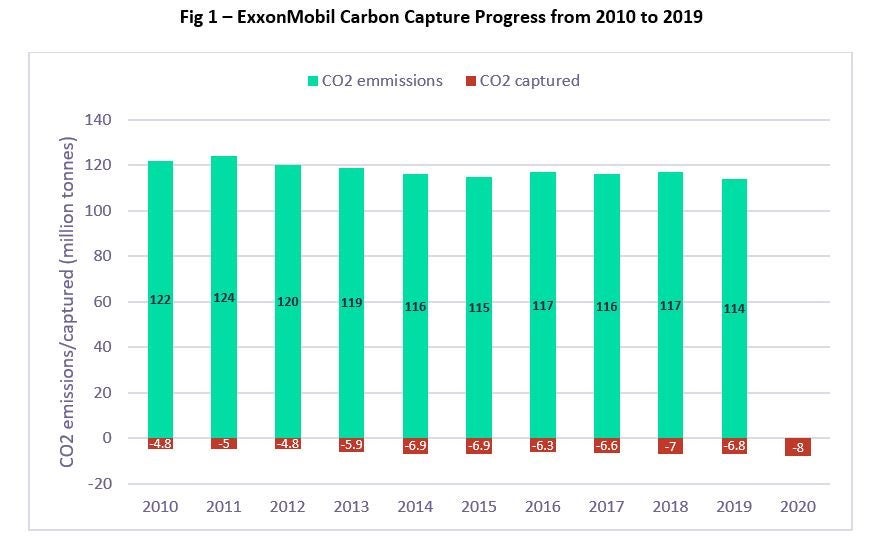

As part of tackling Scope 1 emissions, ExxonMobil plans to reduce greenhouse gas intensity through carbon capture, reduction in methane intensity and flaring. ExxonMobil has an elaborate plan to reduce greenhouse gas intensity by 15% to 20% reduction in its upstream operations. The reductions will be supported by a 40% to 50% reduction in methane intensity and a 35% to 45% reduction in flaring intensity. The company also plans to eliminate routine flaring by 2030 in upstream operations as defined by the World Bank. However, ExxonMobil is also working towards reducing Scope 2 and Scope 3 emissions through investment in biofuels. The company currently has two partnerships, one with purchasing renewable for upstream operations and another for algae biofuels for trucks, currently still in the R&D stage.

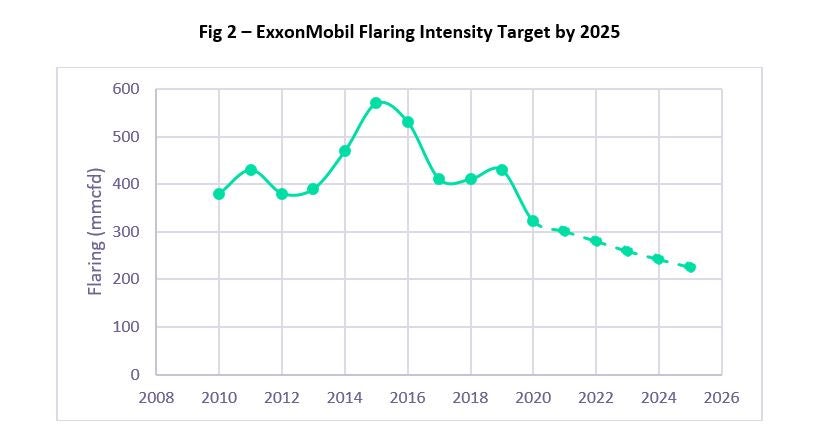

ExxonMobil exceeded expectations in Permian development in 2020 and will continue the trend into 2021. They have reported 20% drilling rate improvements and 25% reduction in well cost from 2019. This efficiency will help ExxonMobil retain the long-term value and economic viability of Permian unconventional to sustain even though the oil price is not favourable in the future. Therefore, ExxonMobil capital allocation will be focused on high-value investments such as Guyana, Brazil, and the Permian Basin. The capital expenditure will be adjusted depending on whether the oil price stays above $55 per barrel.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData